Today we will be taking a look at the Average True Range indicator (ATR) and discuss why traders use it and why we’ve decided to keep it off the charts.

What is the Average True Range?

The idea behind average true range indicator has some merit to it. It generally comes bundled free with all the standard charting packages and a lot of professionals are using it as a tool to measure volatility.

Originally it was created for the commodities market, which is subjected to much more volatile movements than Forex. Due to this increased volatility the commodities market often experiences large gaps between the close-open prices.

Indicator formulas that only took into consideration the High-Low range of a candle would not be accurate enough for these markets.

What does it do?

The Average True Range indicator was developed by J. Welles Wilder and the formula he used for calculating the Average True Range figures took into account the gaps in the market that most indicators ignored.

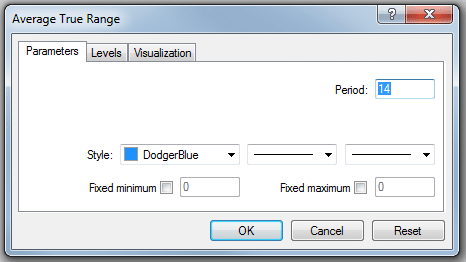

The main input requirement from the trader is the ‘period’, the default is 14. The period determines how many candles are used in the calculation to output the Average True Range figure.

The Average True Range will apply three calculations to each candle, then compare the results and select the greatest output. This first step determines the candle’s ‘true range’. The same technique is applied the amount of candles set by the trader via the ‘period’ input.

After all the ‘true range’ calculations are made, the Average True Range will grab all those figures and apply basic average math to output the ‘Average True Range’.

The Average True Range Autopsy

So let’s see what lies under the layers of this indicator.

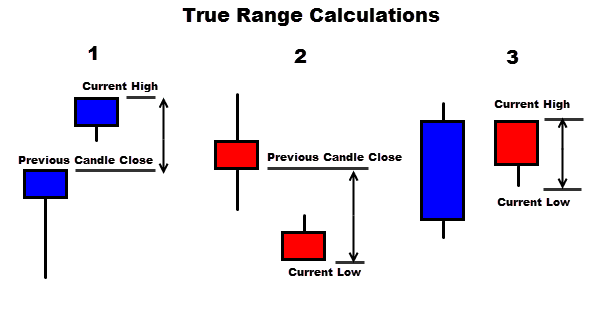

We mentioned that the Average True Range first applies 3 calculations to each candle to determine the ‘true range’. There are the 3 formulas used in this step.

- 1. Current High – Previous Candle Close

- 2. Current Low – Previous Candle Close

- 3. Current High – Current low

All the outputs of these formulas are in ‘absolute values’ which means that negative numbers are just treated as positive numbers.

The condensed formula looks like this…

TRUE RANGE = max[(high-low), abs(high- prev close), abs(low – prev close)]

Once all these calculations are made, the greatest output is used as the ‘true range’, then all the true range values are averaged out to produce the ‘Average True Range’.

How it’s used?

The Average True Range indicator is mainly used for measuring volatility in the markets. The idea behind it is the more the market moves; the larger the candle ranges the higher the output from the Average True Range.

It definitely makes sense and I can understand why traders are interested in using this indicator, but rarely do traders use it as a standalone tool in their trading system.

Most of the time, traders couple the Average True Range with other indicators to create a trading strategy, which is not uncommon amongst indicator traders.

Why we don’t like it

We don’t like this indicator because of the age old problem with most indicators, it lags!

Because the Average True Range has ‘average’ math applied to its output formula, it is slow to react with market changes.

You will find that people promoting the use of indicators generally ‘cherry pick’ trades from the forex historical data where the conditions lined up absolutely perfectly to produce a decent trade but don’t mention the other 90% of trade signals the indicator produced that failed.

Let’s have a look at the Average True Range in action on recent charts…

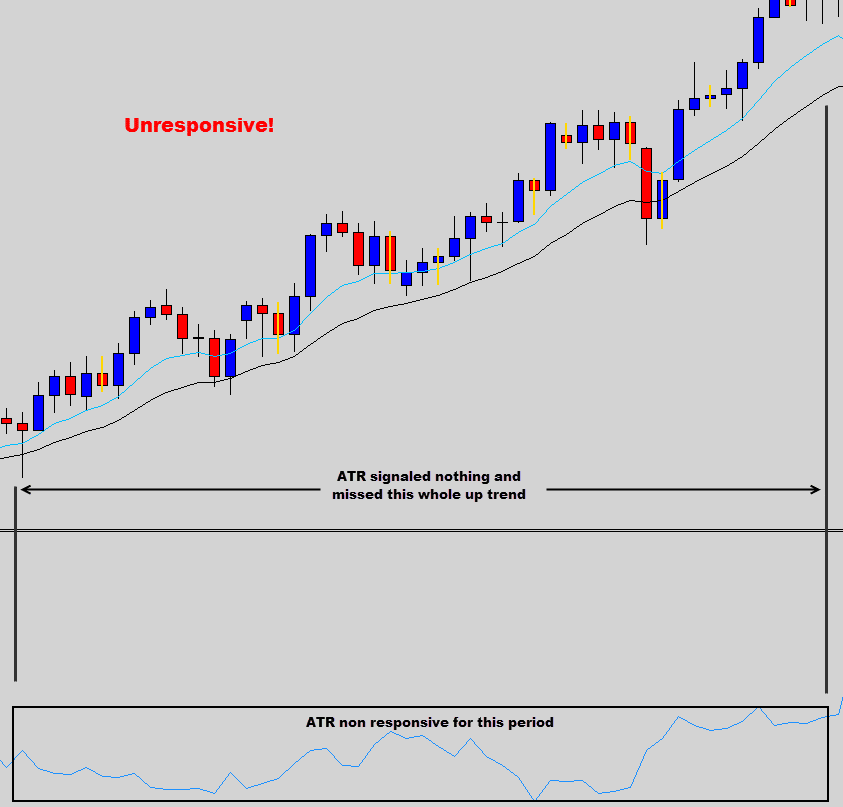

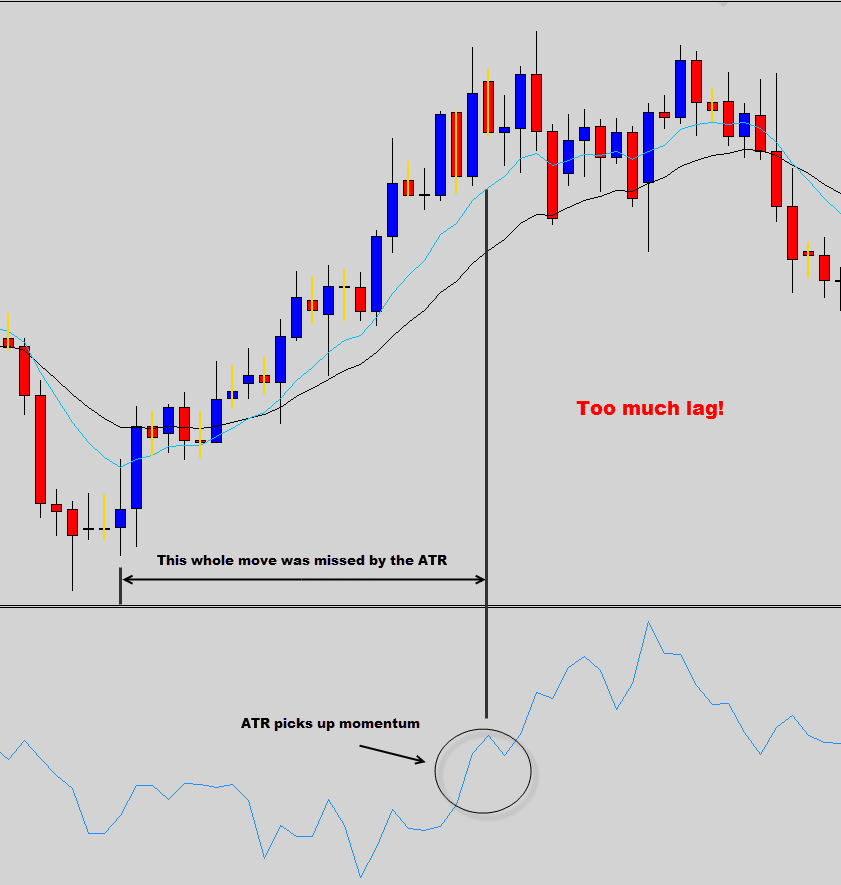

In the example above, the Average True Range indicator remained unresponsive during this entire uptrend. If we were relying on the Average True Range to provide us with the best trade signals, we would have missed out on this entire move.

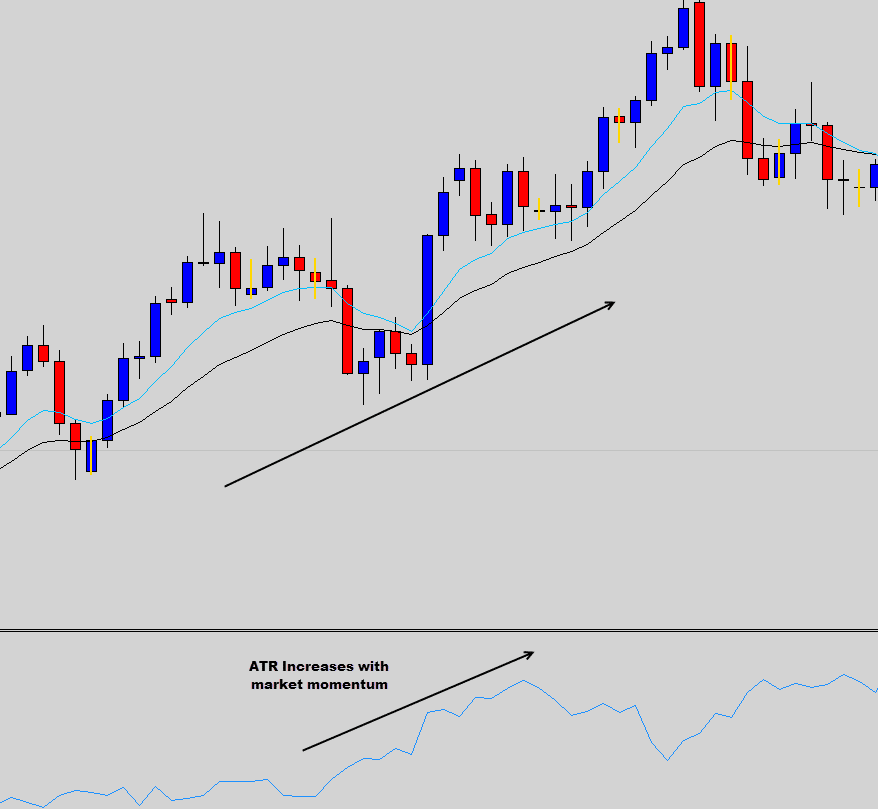

In this example the Average True Range started to produce some increased activity right at the top of the entire up move. So basically the Average True Range signalled up in right at the top.

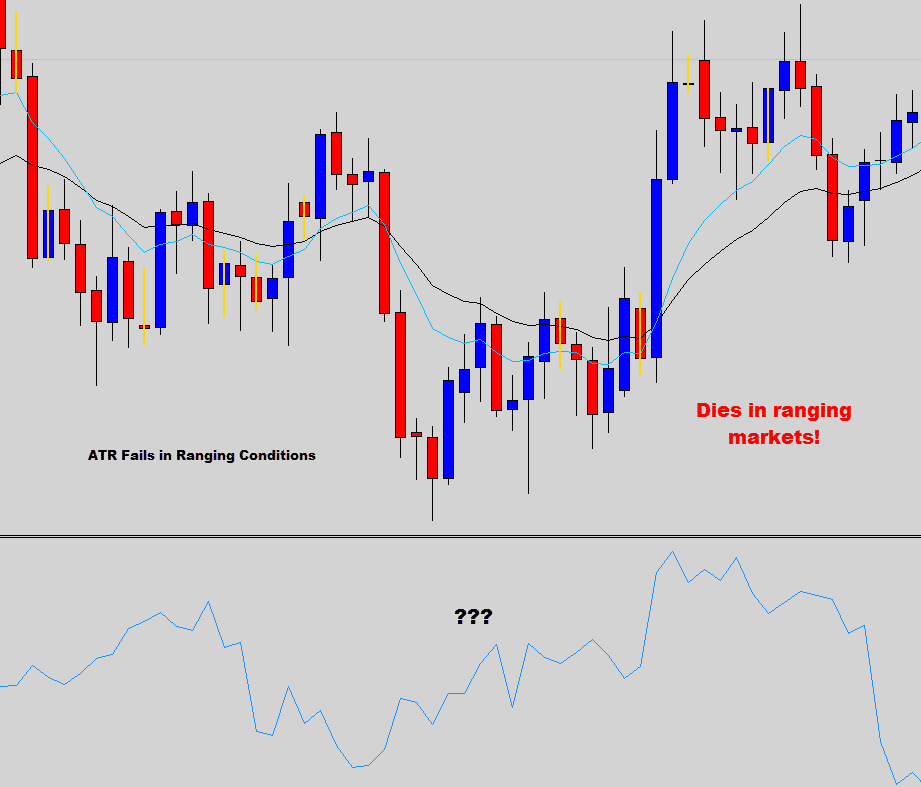

The last example demonstrates how useless Average True Range is in ranging or choppy conditions, using the Average True Range in your trading plan would produce many false signals.

As you can see the Average True Range is slow to react and only starts signaling traders into a moving market after half the move is already over. Sometimes the trader is signaled into the move after the entire move has taken place and you can forget ranging conditions.

This is unreliable, if you had a million dollar trading account would you really take this indicator’s data seriously and risk your money on its performance.

Maybe once upon a time this indicator worked when the market dynamics where smoother and more stable, but today’s markets are no place for simple average based indicators.

The price action way

What we need to understand is that the price chart itself is the supplier of the information that the Average True Range is using to calculate its output. It applies formulas using price action data to provide you with historic data with the attempt predict the future of price movements.

The point I am trying to make is why use the data on the chart, filter it down and then use that second hand information to make trading decisions from. Get serious about your trading, cut out the middleman and start trading directly from the charts themselves.

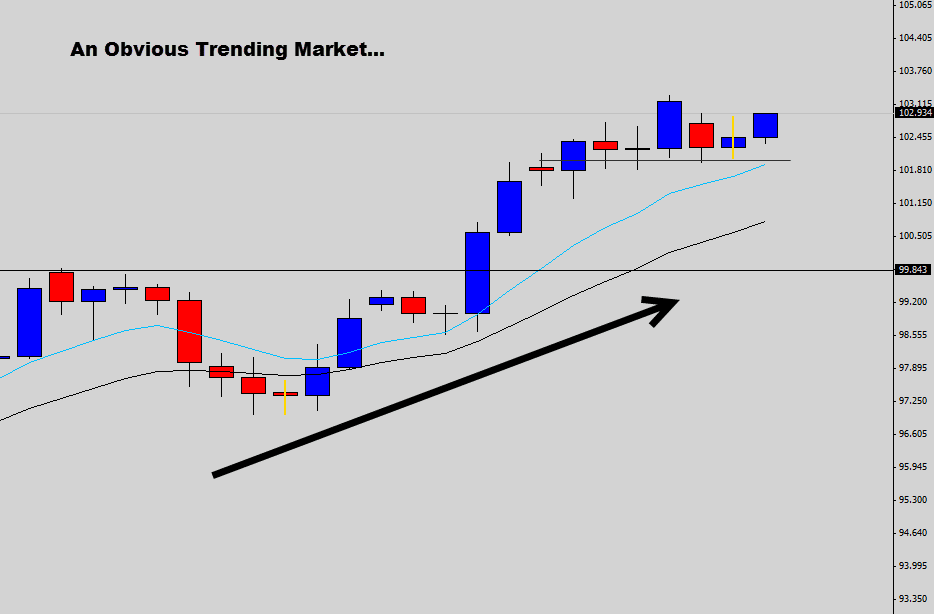

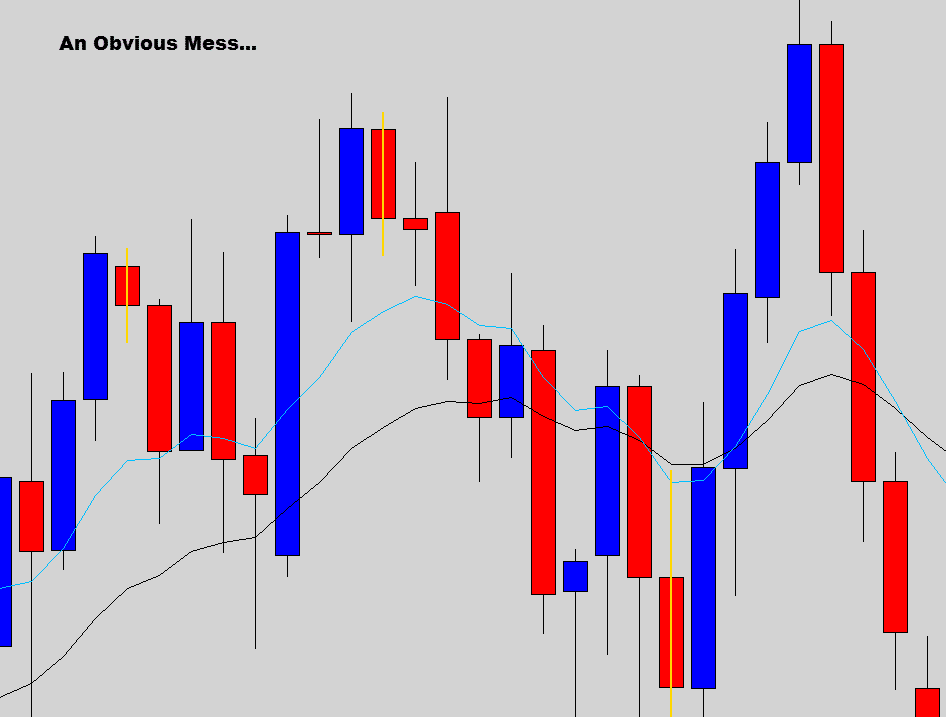

Price action trading uses the chart to find an entry point. We don’t need an indicator to tell us how volatile the market has been. You’ve got eyes for that, one quick glance at a price chart and you will be able to determine if the market is whipping around like crazy or trending nicely.

In less than a second it’s obvious that this market is in a clear uptrend…

And this market is obviously not outputting ideal trading conditions…

This is why the Average True Range indicator needs a proper funeral. It provides lagging data that is unrealistic to work with. Why use the Average True Range indicator when the chart is telling us in real time what we need to know with no lag and much more clarity?

It’s now time to bury the Average True Range and let it rest in peace. If you really want to get serious about your trading and get the edge you need to succeed, then it’s time to learn how to read price action like a real professional.

Inside our Price Action Protocol Trading Course, you will learn how to spot ideal trading conditions using the only one indicator that really counts, and that’s your eyes!

Amir

thanks a lot! my trading career totally change since I found this website!