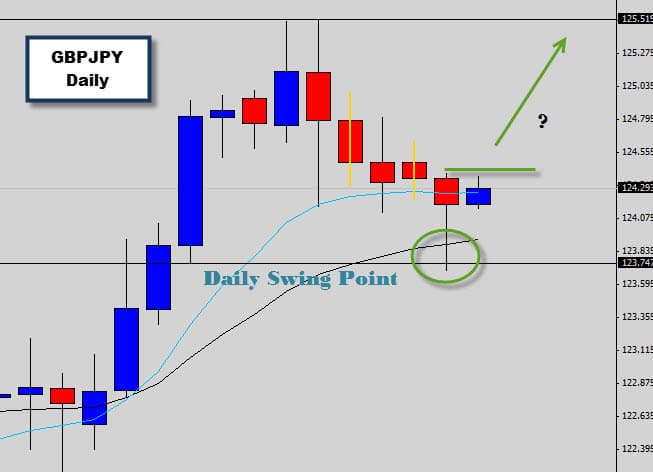

We talked about this GBPJPY Bullish Rejection Candle setup that formed on the daily chart last week

This trade had a rough start but the signal did eventually follow through with bullish price action momentum. Price Action traders who follow the Price Action Protocol could have used the advanced entry techniques and returned a potential of 600% on initial investment on this trade.

We did say to watch the overhead resistance, as you can see it has stopped the trade dead in its tracks forming a large daily bearish candle. If you haven’t taken profit on this trade you should re evaluate the situation and consider if the trade is worth holding any longer.

Sometimes opposing price action signals can be used for exit signals, this bearish rejection candle that has formed from the resistance level is signalling to us that moves into higher prices above the resistance level are not supported by the market. From here the market will most likely continue to sell off.

Previous Post On This Setup

Today we are looking at the GBPJPY chart. The situation is looking bullish after last session’s New York close on our daily chart. The last session produced a Bullish Rejection candle which communicates to us that moves into lower prices were not favoured by the market.

The bullish rejection is driven up from a key support level in this market creating an almost perfect setup to go long. It would’ve been nice to see the candle close higher than it’s open but still an awesome setup that still has enough credibility to pull the trigger on.

The Price Action Protocol tells us this is a hot spot for buying on the chart at the moment because the market not only rejected a support level, it rejected the trend mean value as well. When these two factors line up together we generally see some powerful price movements.

If price breaks the signal candle high then its likely that price with take the next step higher. We’ve just got to be vigilant here and watch the price action at the overhead resistance , it may cause us some problems. It would be a good place to set a trade target.