Trade Manager Panel

$49.00 NZD

- Fast, Easy, Trade Setup With Entry/Stop/Target/Trailing/Break Even/Straddle Strategies

- No More Lot Size Guessing – Auto Calculation Of Trade Volume Based Off $ or Acc %

- Automatic Order Type Detection Based On Your Entry Price Relative To Current Market Price

- New “Risk Reward” Style Trade Setup Box. Click & Drag Risk/Reward Boxes & Open Trade When Done!

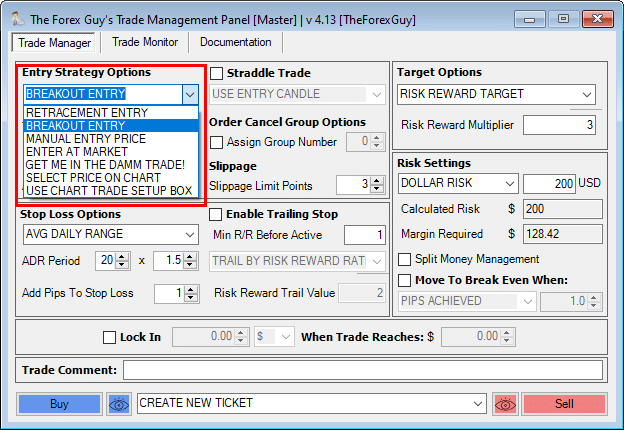

- Common Used Entry & Stop loss Calculators – Candle Retrace %, Candle High/Low, ATR value etc.

- Advanced Trailing Stops, Move to Break Even Options & Lock In Profit Management Options

- Straddle Trading Options to Open Positions In Opposition Direction Recovery Strategies

- Easy Order Cancels Order (OCO) & Order Cancels Group (OCG) System

- Only Need 1 Trade Manager Open To Manage All Your Trades From Multiple Symbols

- Trade Settings Recovery If Computer Crashes / Power Out Scenario – Some Users Were Saved Costs of VPN Because of This.

- Risk Protection Checks (For Fat Finger Accidental Extra 0’s)

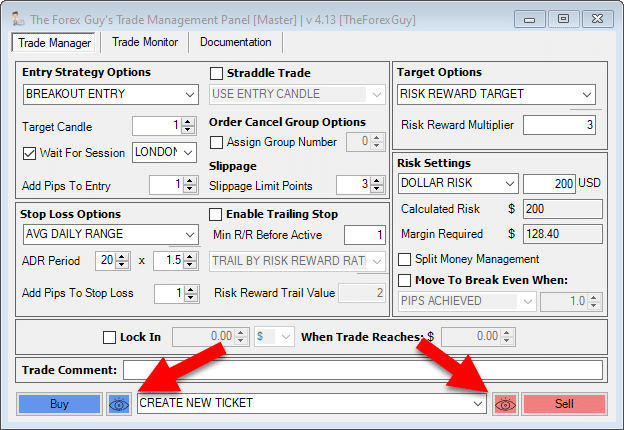

- Simple Press Buy/Sell Buttons – Setup Your Trade Params, Press Buy/Sell or Open Trade & The Panel Does the Rest

- Compatible with MT4 & MT5 (Some Options/Strategies Not Compatible With FIFO MT5 Accounts)

- No Computer/Account Limit Restriction (as long as it is for your use only*)

Let Me Introduce You To The Best Trade Manager Panel You’ve Ever Seen For MT5 & MT4

The trade panel will become your new trading best friend, as it has mine.

Over the years I’ve continued to improve, and add requested features to it. Once you use the trade panel, you will wonder how you ever traded without it!

Setup a new trade super fast and easy with my trade panel. Use the new risk reward style trading box to layout your trade on the chart.

Press the open trade button and trade manager will do all the tedious number crunching for you and get your trade placed faster than any human could!

Let Me Show You How Easy my Trade Manager is to Use…

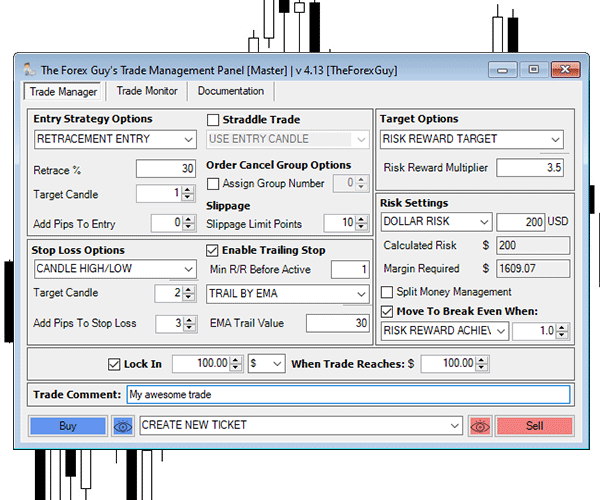

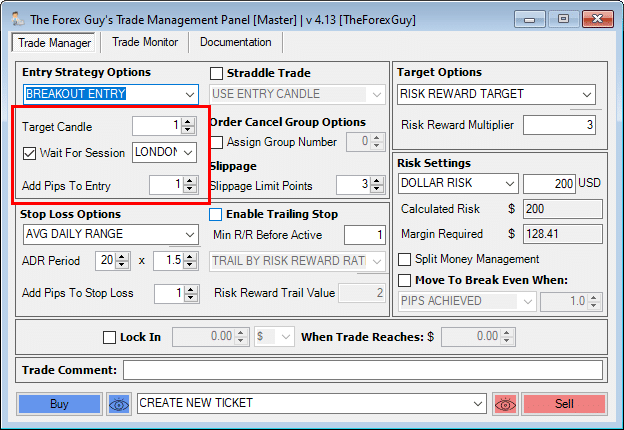

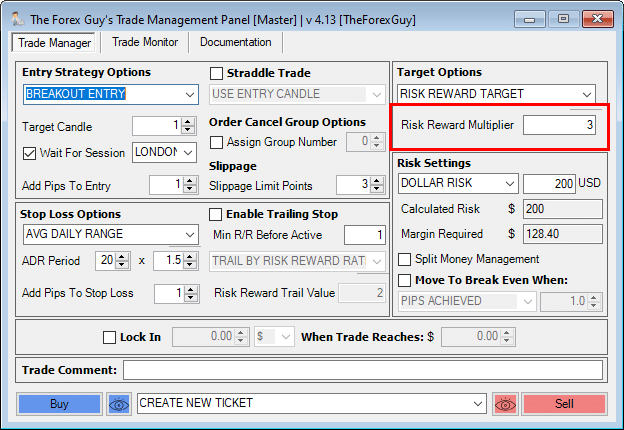

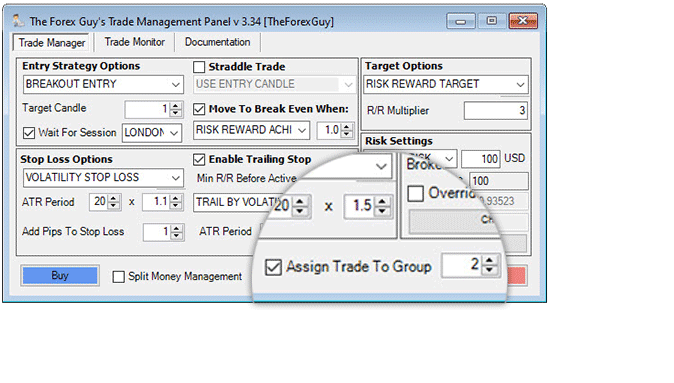

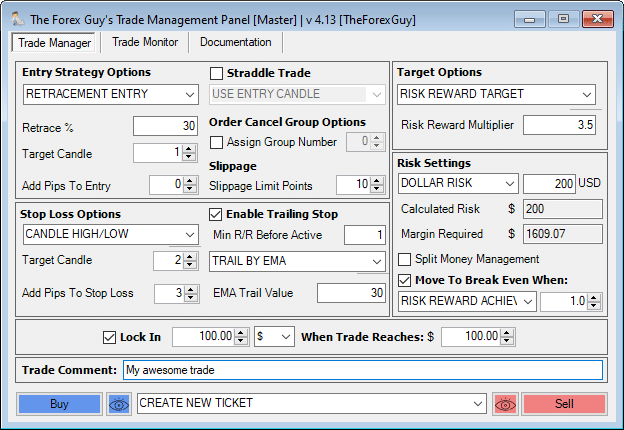

Step 1: Select Your Entry Method & Configure Entry Method Settings

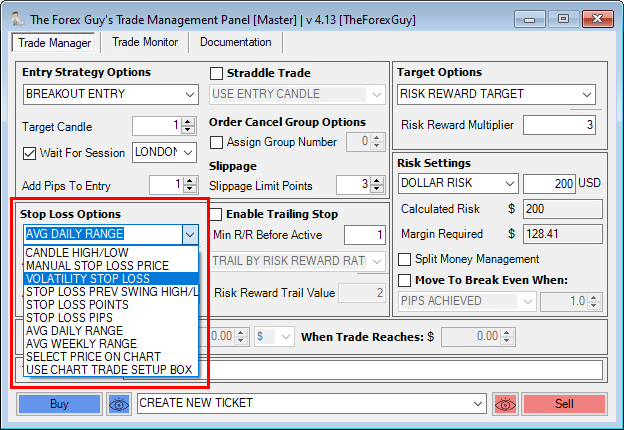

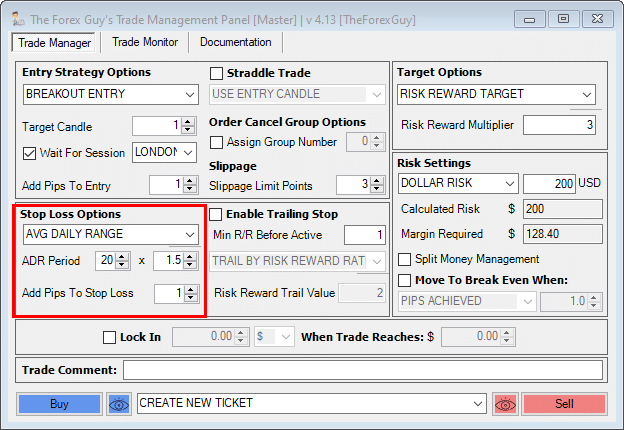

Step 2: Select Your Stop Loss Calculation Method & Configure Settings

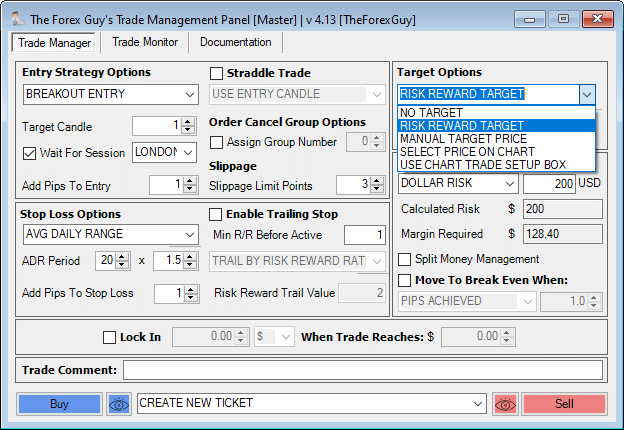

Step 3: (Optional) Select A Target Price Calculation Method & Configure Settings

One of the most welcome of all the features, is the ability to setup the trade so it only risks a certain amount of capital you specify. If you only want to risk $100 on a trade, the panel will do the calculations to get the closest lot size possible for a $100 risk.

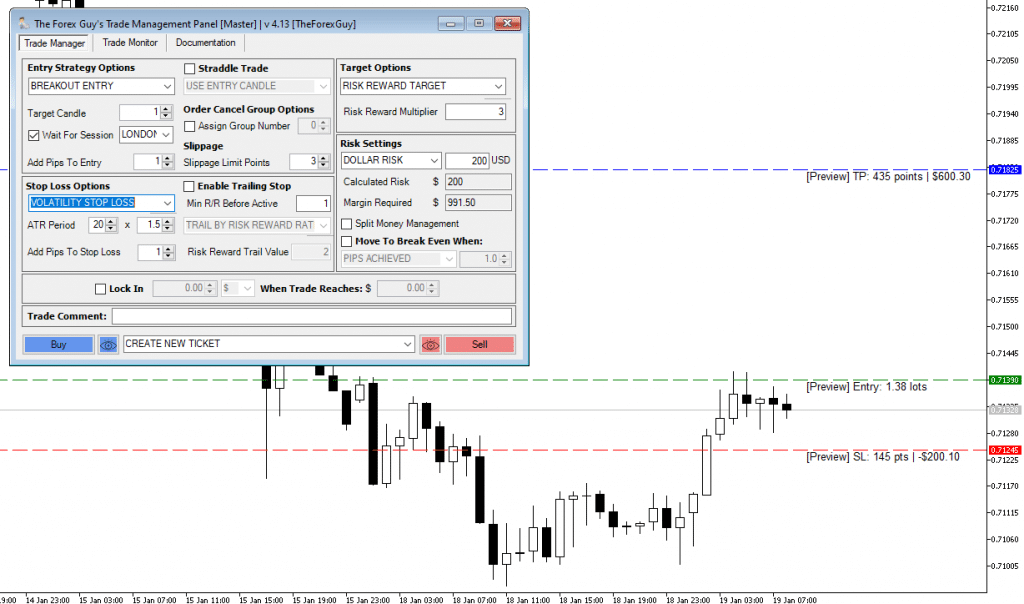

Step 4: (Optional) Preview Your Trade Before Placement

Use the trade preview buttons to output a preview of how your trade will be applied.

This can be very useful to make sure you haven’t made any mistakes or accidently selected a wrong setting.

Once you select to preview a buy or sell, you will get preview levels like this…

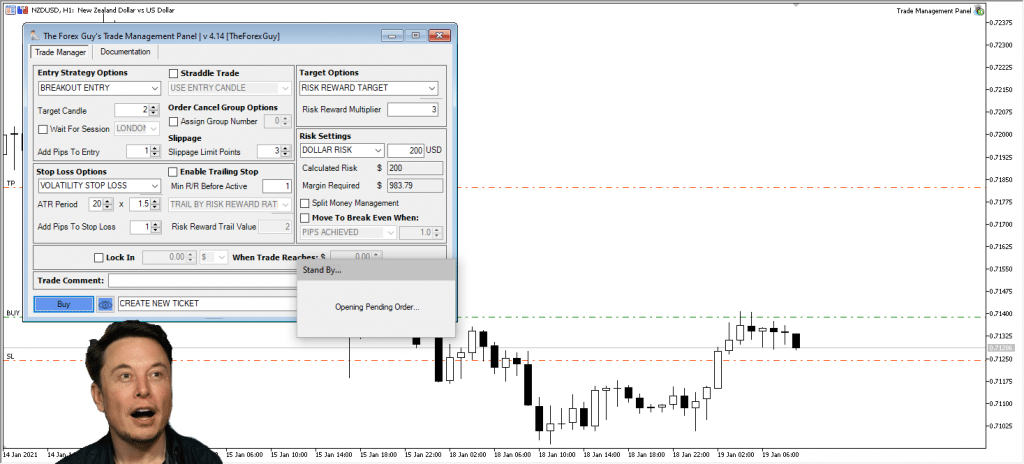

Step 5: Simply Press Buy Or Sell To Execute Your Trade

…And the Panel Will do All the Number Crunching for Lot Sizes, Order Types & Prices For You… Fast

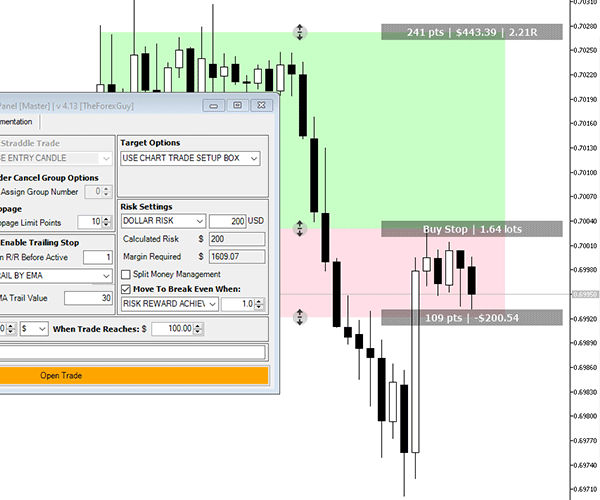

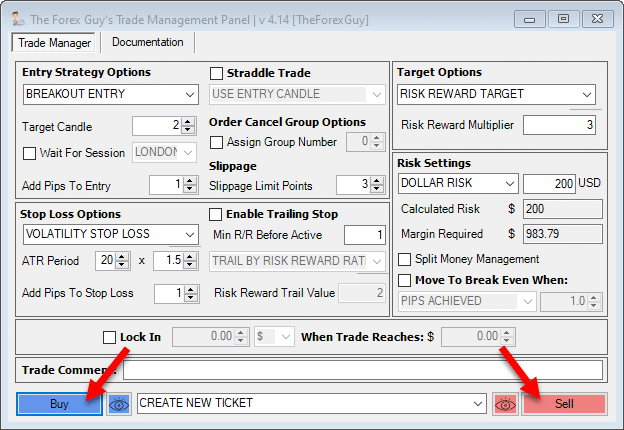

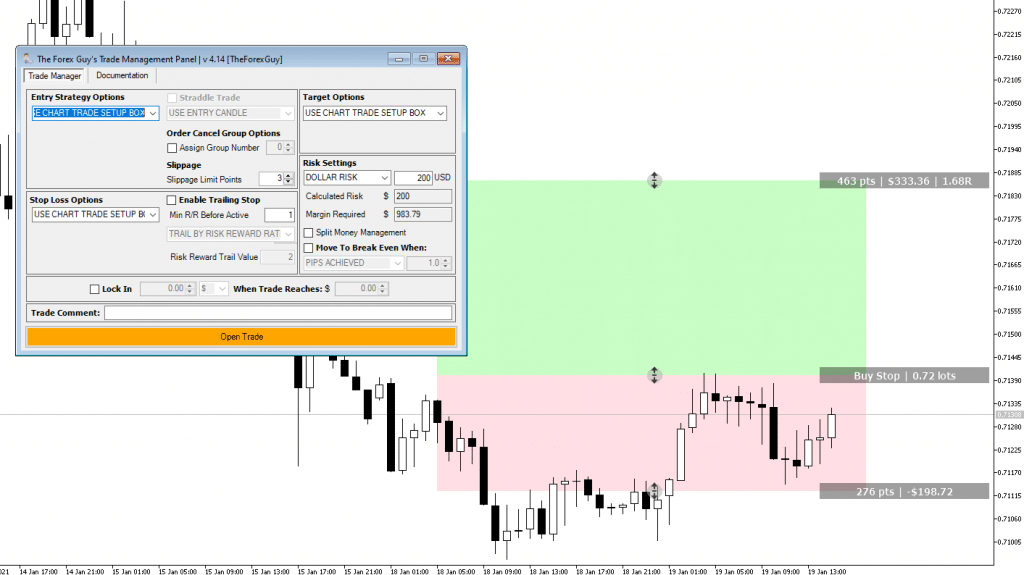

Or Use The Easy Risk Reward Style Trade Setup Box

The trade setup box give you a visual risk / reward approach to setting up the trade on the chart.

It’s quick, easy and gives you convenient info to help set up the geometry and trade parameters the way you want.

Just move the boxes up and down until everything is arranged the way you like, then simply hit the “open trade” button the panel – and boom your trade is placed.

Here Are Some Advanced Trade Management Features

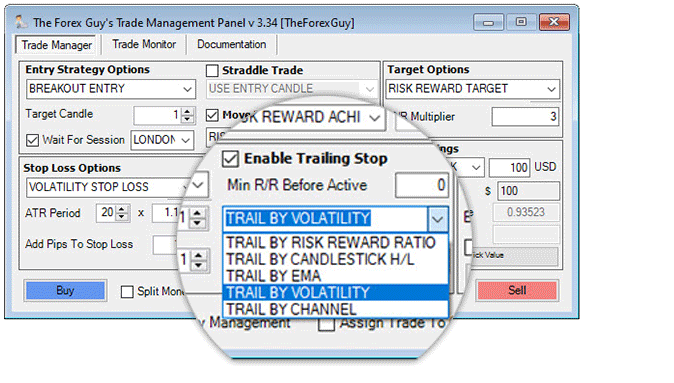

Advanced Trailing Stop Loss Options You’ve Always Wanted

The standard MT4/MT5 built-in trailing stop options are very basic. Usually we want trailing stops that are much more dynamic in nature which fit our strategy the best.

That’s why I’ve provided a good list of trailing stop engines to choose from in the Trade panel. Adding a trailing stop to your trade setup is optional.

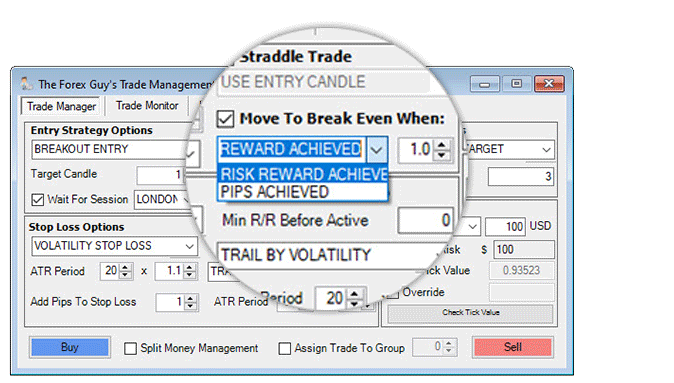

Automated “Move to Break Even” Stop Loss Options

Trader’s love to lock in profit, and a move to break even feature was highly requested in the initial design.

I implemented 2 “move to break even” triggers:

Note: You can have a break even stop trigger and a trailing stop setup at the same time – they work independently of each other

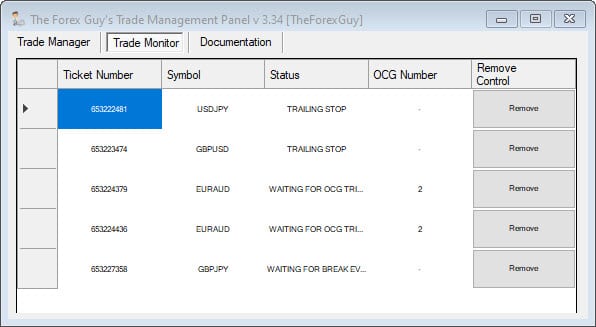

OCO (Order Cancels Order) Functionality + An Improved Version

A popular technique known in the stock market is an “order cancels order” type of order rule-set (OCO).

You send in 2 pending orders and when one is triggered – the other is automatically canceled.

This type of functionality is missing from MT4/MT5, so the panel has a really easy OCO implementation for you to use.

You simply assign your trades with a group number – once one of the trades triggers in the group, all the other pending orders are canceled.

This is better than the standard OCO setup, because it allows you to put multiple trades in a group, which I call “order cancels group”

Example #1 – Retracement or Breakout

You can set two pending orders on EURUSD with a breakout style entry and the other with an enter on retracement style order. Once one of those are triggered, the other order is removed automatically.

Example #2 – Straddle Type Breakout OCO

Imagine you want to take a breakout but don’t know which direction the market will go. You can set a pending buy and sell at opposite ends of a candle or market structure. Once a breakout occurs in one direction, the other is removed. This is popular with news traders.

Example #3 – Correlated Pairs & Signals Setup

An good example for where multiple pending orders in the same group is applicable is when you need to setup trades on highly correlated pairs – for instance: GBPUSD, GBPJPY, GBPAUD.

You see a price action signal on all 3 of those markets, but only want to be triggered into ONE of them. You Set up all your pending orders on all 3 of those markets with the same group number so it becomes a “whatever symbol triggers first wins” – as soon as one is triggered, the rest are removed.

Even if two pendings are accidentally triggered at the same time due to a volatility spike, the panel will close the unwanted secondary opened trade to enforce you are only left with one position as intended.

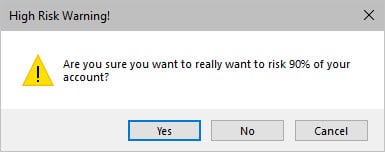

Risk Protection To Stop Those Silly & Costly Input Mistakes Other Tools Might Let Pass Through

Just in case you make a silly mistake – like want to risk $90 on a trade, but still have the account percentage method selected ( the panel thinks you want to risk 90% of your account on a trade ), built in are risk protection safety checks to prevent those potential disasters.

You will be prompted with a ‘risk safety check’ like the one shown below…

There are numerous checks like this when it comes to lot sizing and trade risk. Sometimes the panel can’t get a lot size close enough to the risk you want, and you will get prompts for risk adjustments so you’re always in control

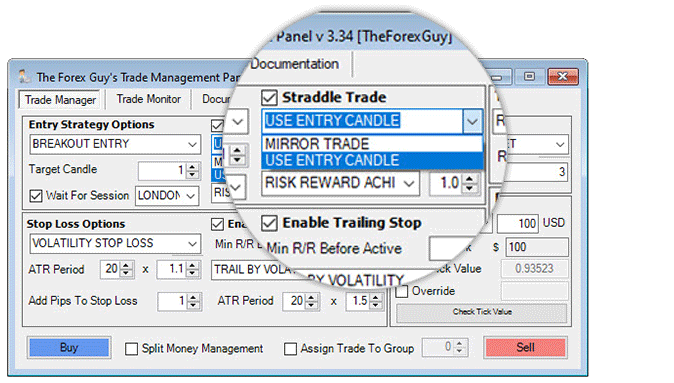

Straddle Trading Strategies For Advanced Traders

A straddle trade is a technique where a buy and a sell order are setup at the same time to catch which ever way the market breaks out first.

The straddle strategy options is more niche than the OCO type of setup and is for advanced traders. The total trade risk is divided up into both straddle positions.

When one straddle order is executed, the other is not canceled. It is not removed until the other straddle position reaches a pre-determined profit target

This caters for the scenario such as this: Your buy order is triggered but the sell order is left open. The bullish move fakes out and the market reverses and now triggers your sell order.

If you risked $500, you would be -$250 from the buy order stop out, and the sell trade will be running with $250 risk. It is setup so the panel factored in worse case scenario where all trades fail, you lose close to what you set for your trade risk only.

There are two templates for setting up straddle trades…

Note: Straddle trading cannot be done on an MT5 FIFO account (commonly what MT5 US traders are stuck with).

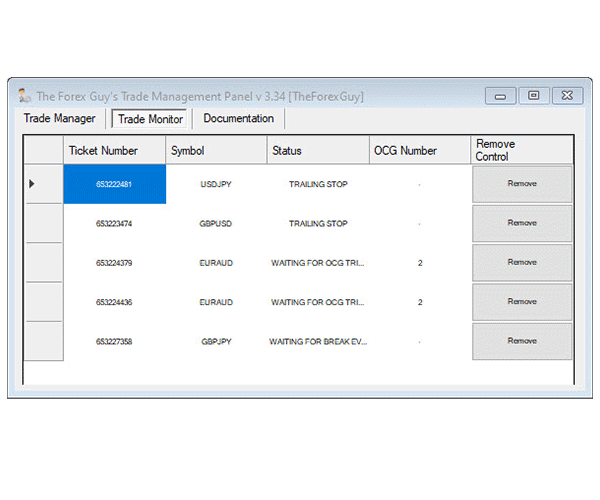

All Active Trades Are Managed From One Panel – Regardless of Symbol

Commonly with other tools, you need to keep a separate instance loaded on every pair that you’re trading with it.

This was something I addressed quickly in the initial design of my panel. I only wanted ONE panel to do all the work.

The first panel loaded becomes the “master panel” and it collects all the orders from every other panel open.

So it doesn’t matter if you have trades running on AUDJPY, GBPUSD, USDCHF, GOLD & S&P500… the master panel will manage all of those orders for you.

This saves you from having a very cluttered, cumbersome workspace, with trade managers loaded all over the place.

It also help reduce load on VPS systems with minimal resources

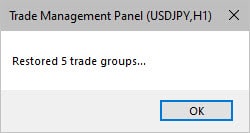

Automatic Trade Recovery From Power Outs or Computer Crashes

(For Some Users – This Can Eliminate the Need For VPNs)

Imagine your toaster shorts out, trips a circuit breaker in your house and your computer loses power!

This is a very important consideration because a lot of tools out there have no recovery system. You got to the trouble of setting up your trades and if there is an “incident” where the panel closes, you might lose all your functionality (like trailing stop management).

The trade panel keeps a record of what it was doing, so if for any reason your panel is closed – it can recover and resume what it was doing on reload.

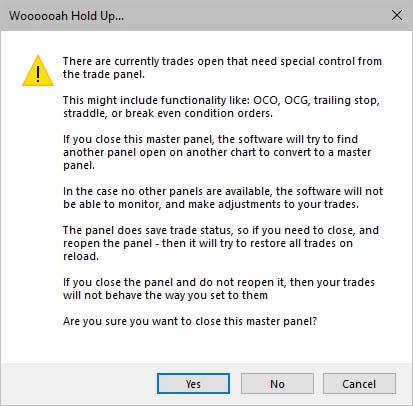

Warnings Will Show When Trying Closing A Master Panel That Is Managing Trades

Another fail safe added in for your protection, just for those accidental clicks.

If you try close a panel which is “busy” managing or monitoring trades, this warning will prevent you from closing it off.

On-going Improvement & Updates

This is a heavily used tool in my trading community (I am a heavy user myself).

A Trade Management Panel made by a trader, for traders.

Because I am continuously developing my trade library to accommodate more strategy testing, the panel is occasionally updated with extra options/features/improvements.

Any bugs that are reported are worked on quickly and if MT5 changes we update the panel to keep it working.

I hope this overview gives you an idea of what my Trade Panel can do!