In this chapter we will be talking about the best Forex signals. We use individual candlestick price action signals that can really give any Forex trader an edge they need to succeed in their trading.

We’ve covered patterns like the double top and head and shoulders. Although they are great for helping us forecast price movements.

When used in isolation they do take a long time to play out and require large stop losses to trade correctly.

This is not practical enough for generating realistic returns in a reasonable time period. We really need hone in more on the market movements and target the best Forex signals.

This is where the candlestick signals come in.

A candlestick is the graphical representation of the High, Low, Open & Close price during that candles open period. Using these four points of data we can tell a great detail of what happened during the candle’s session.

We use this “visualized data” to anticipate where price may most likely be moving much more quickly.

There are many candlestick formations out there. Some of them are just made up of one particular single candlestick structure, others can be made up from combinations of two or even three candles. The best forex signals are generally comprised of one or two candlesticks.

We like to keep things simple and effective here at The Forex Guy. We use only the best Forex signals built on candlestick setups that have proven to produce the best results in everyday trading.

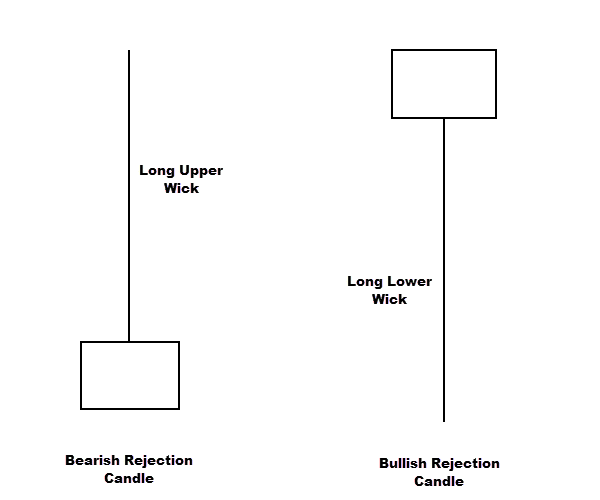

The Rejection Candle

The Rejection Candle formation is easy to identify because it has a large wick that protrudes from end of the body.

The body of the candle is located at one end of the candles range and is usually small. The large wick on the Rejection Candle demonstrates to traders that price ‘rejected’ a specific area on the chart.

Long lower wicks communicate bullish rejection and suggest price will most likely move higher. Long upper wicks tell the trader that bearish rejection has taken place and is the tip off for potential downward movement.

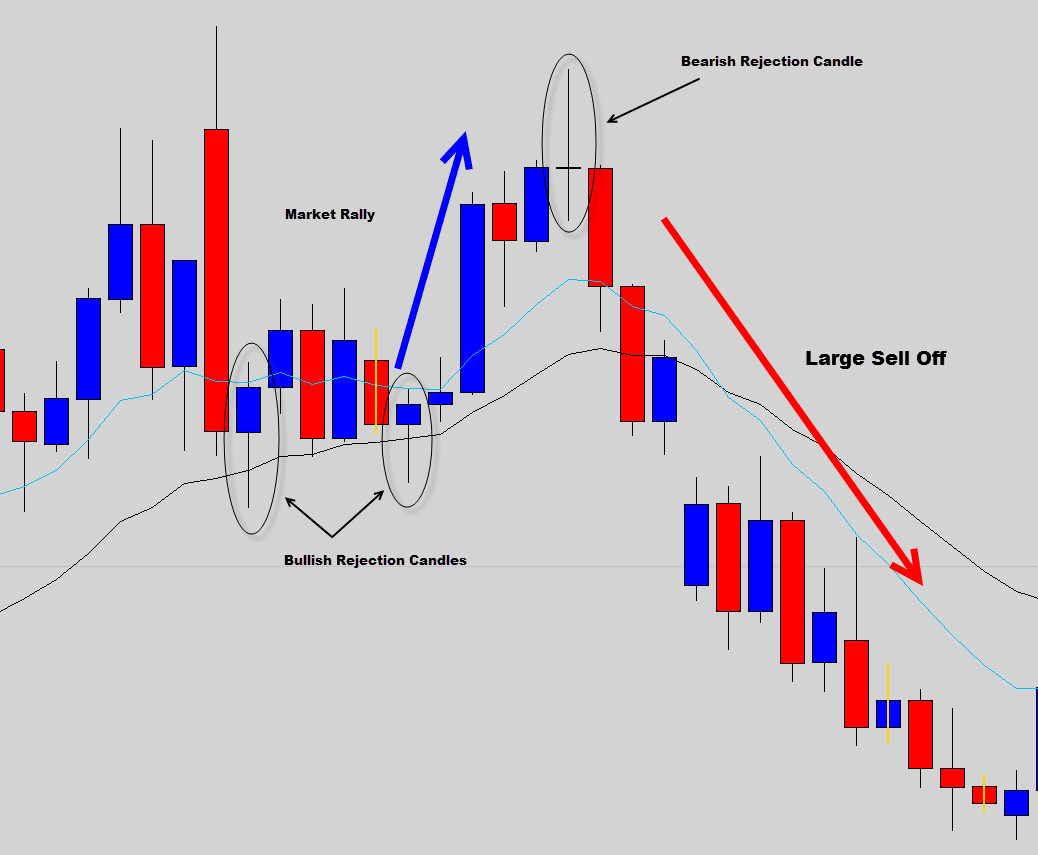

See how the rejection candles can tip off the trader to upcoming market movements.

The rejection candle is the most common and one of the most lucrative trading signals in price action trading.

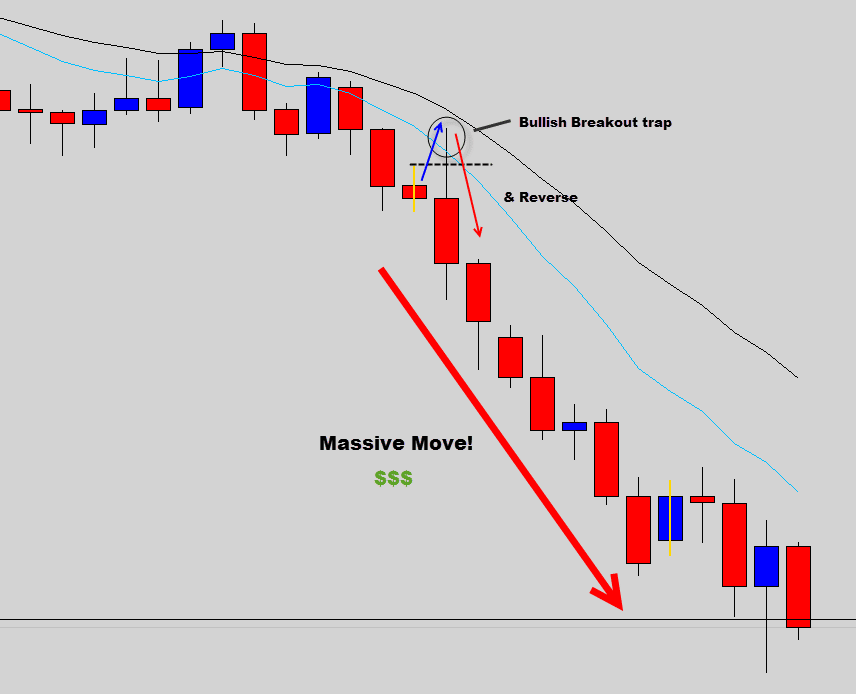

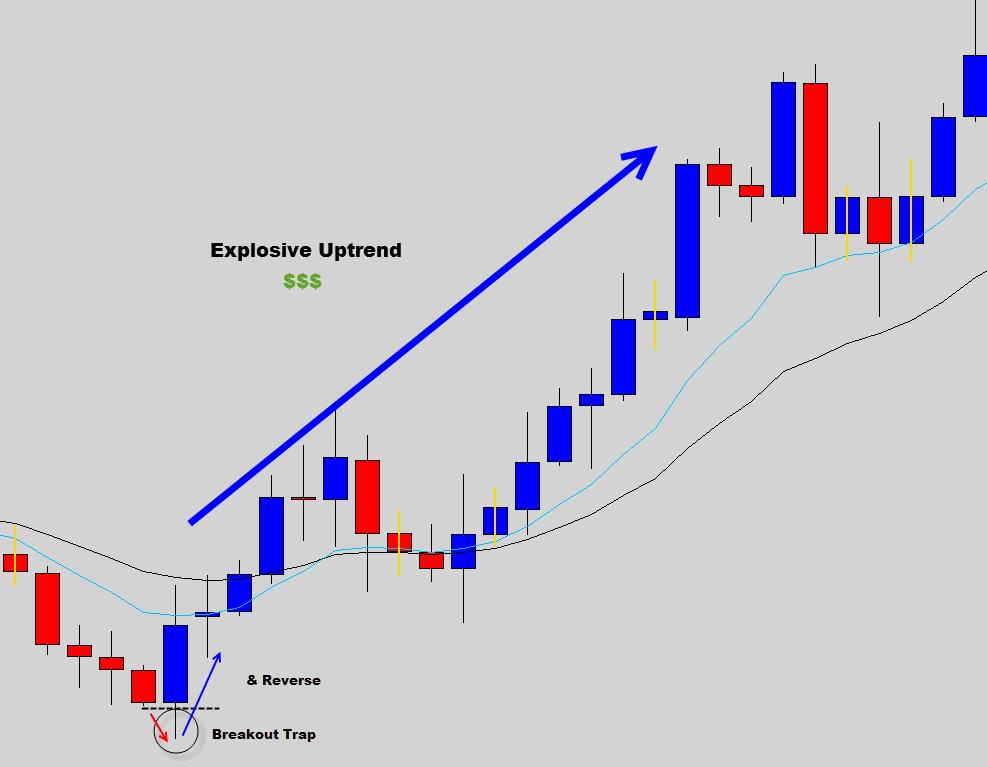

The Breakout Trap & Reverse Trade Trigger

This is one of my favorite setups, and one of the best Forex signals used with price action trading.

Breakouts occur when price breaches some sort of containment. Some breakout events produce very explosive moves, but you’ve got to know the correct time to trade these breakouts because not all of them actually work out the way you would expect them two.

There are critical areas where breakout traps are highly prone to occur. Most unsuspecting traders will blindly trade the initial breakouts from these high risk areas on the chart.

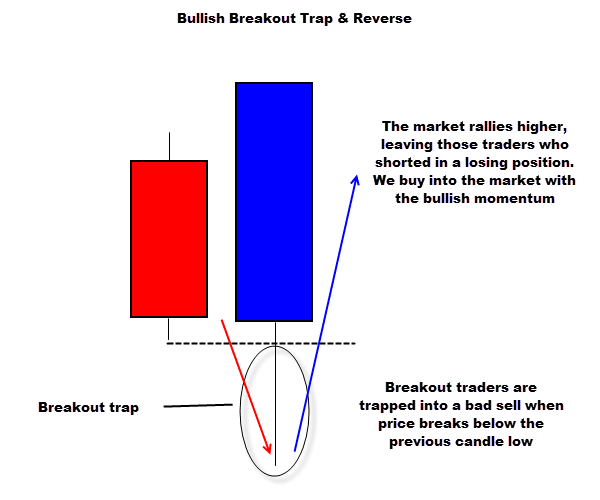

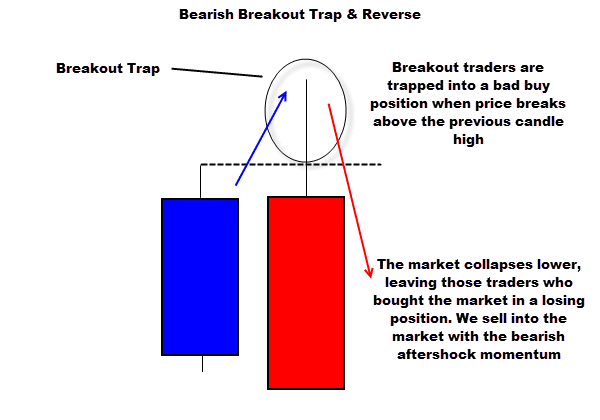

A breakout trap occurs when a price breaks out of the high risk containment area and triggers breakout traders to jump into the breakout movement.

All of a sudden the market collapses back in on itself ‘trapping’ those unsuspecting traders into a false move.

The Breakout trap & Reverse trade is taking the opposite move of the initial breakout, entering into a trade with the true market momentum.

The anatomy of the Breakout Trap & Reverse trade is made up of a two candle combination, where the second candle is the actual trade trigger.

This is the only price action setup that we trade ‘live’, which means we don’t need to wait for the trigger candle to close before a valid signal is produced.

The Breakout Trap & Reverse trade can produce explosive long term movements.

This is one of the reasons they are one of the best Forex signals. Check out these real chart examples…

The explosive, rapid profit potential of this trade setup is the reason why it’s my favorite and best Forex signals included in our price action trading system.

This trade setup is a revised version of our ‘Outside Candle’ trade setup.

The Outside candle trade sehttps://www.theforexguy.com/price-action-signals/outside-candle/tup is the closed candle version of the Breakout Trap & Reverse signal. This means with Outside Candles that we don’t have a signal until the actual candle has closed.

The problem here is we can miss out on a decent chunk of the move. By improving the signal parameters and trading it live, we can nail much better entry prices and improve our overall trade reward potential.

Breakout Catalysts

Despite what we’ve just talked about there are actually price action signals that we can use to enter real market breakouts that are at low risk of becoming bull or bear traps.

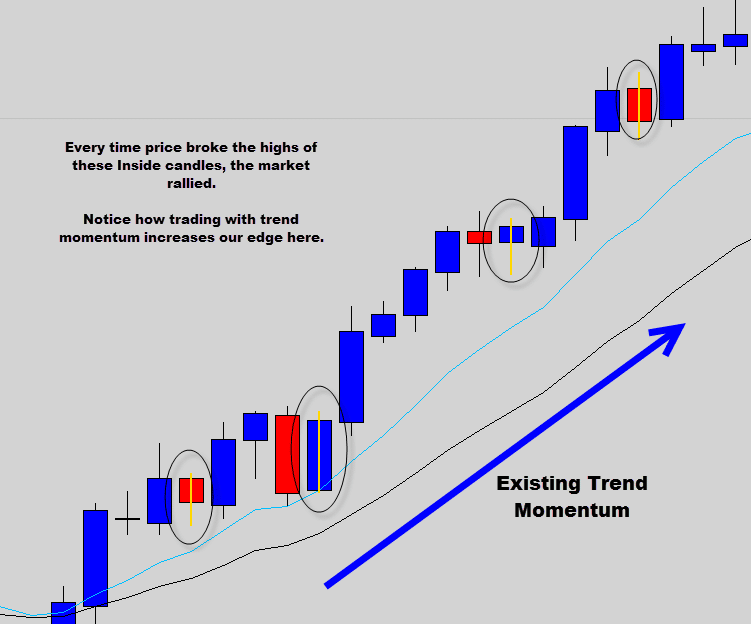

We utilize two candlestick formations for this, the Inside Candle and the Indecision Candle. These are the best Forex signals for breakout trading.

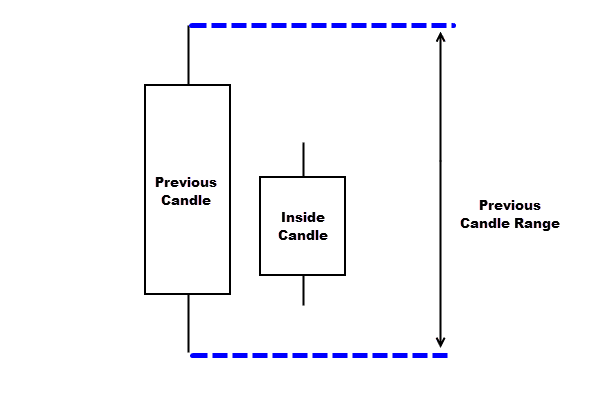

The Inside Candle

The Inside Candle is a 2 candle formation where the second candle’s high – low range completely fits within the previous candles high – low range.

This particular setup shows during the Inside Candle period, the market churned away in consolidation and didn’t really go anywhere.

This price grinding and churning action that creates an Inside Candle is generally an accumulation period of market trade orders, or created due to low trading volume during quite times in the markets e.g. public holidays.

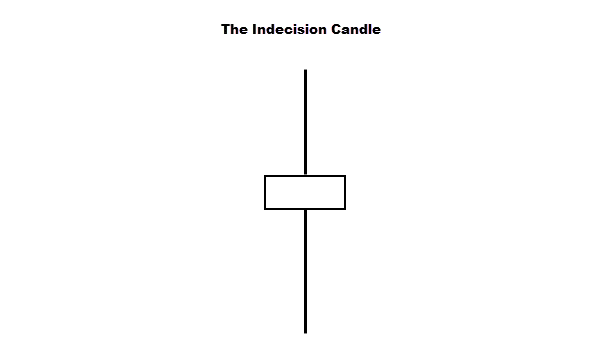

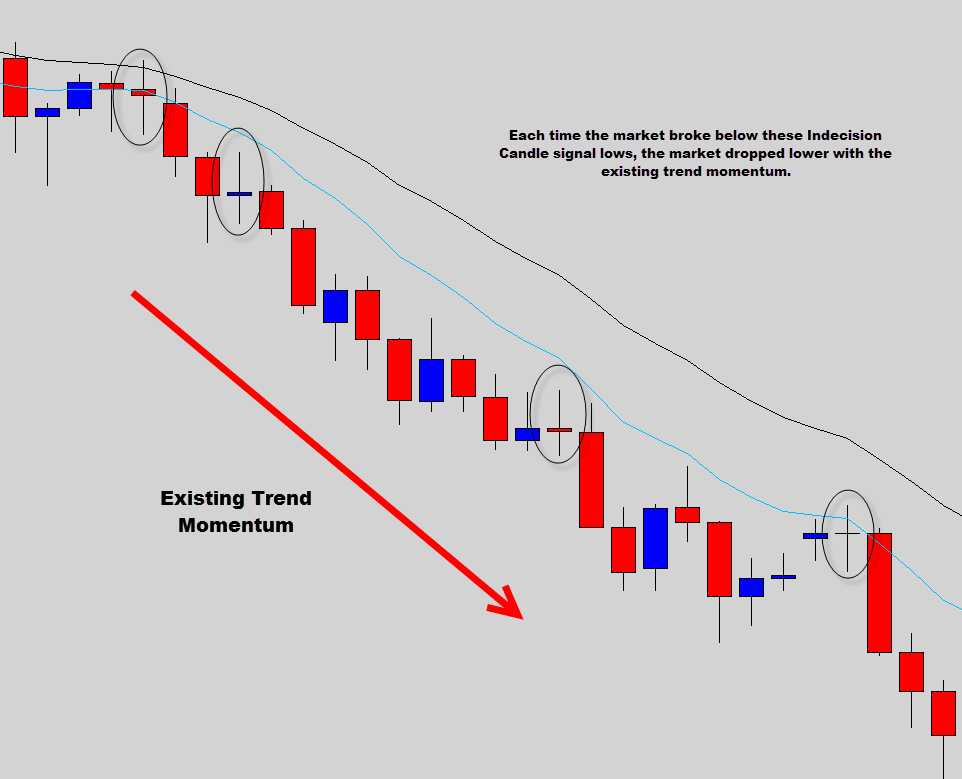

The Indecision Candle

The Indecision Candle is very similar to the Inside Day setup. It is instead a single candlestick formation. They have small bodies which are centered in the candles range with long wicks poking out each of the body.

The Indecision Candle communicates to the chart reader that a period of market Indecision/Consolidation has occurred. The market moves up and down during its open period but closes with neutral bias.

The Breakout Signal

Inside & Indecision candles are not direct trading signals so to speak. It’s unnecessary to take immediate action when they form. Instead they are warning signs of a potential breakout move.

They form the catalysts for powerful breakouts and make up some of the best Forex signals.

The breakout signal actually occurs when price breaches either the high or the low of the Inside or Indecision candle’s range. It’s the high and lows of these signals which make up the price containment that price has previously had trouble penetrating.

When price escapes the containment a ‘breakout’ has occurred and the breakout trade is triggered.

Breakouts from these signals can be very potent, but how do we know we are not going to get caught in a breakout trap? Well we don’t, but we can dramatically improve our edge if we only trade these two breakout signals with existing trend momentum.

You can see how powerful these candlestick signals are when used in combination with an existing trend.

By using these simple, but powerful candlestick formations, you can really start to gain that edge in the market that most traders need to push them from zero to trading hero.

Price action is the most powerful proven trading method and produced the most reliable and best Forex signals. Price action trading is no doubt the most successful, popular trading method used in the markets today.That’s we we use it.

We use the Price Action candlestick signals that are discussed in this chapter every day, why wouldn’t we.

But don’t take our word for it just look back through your Forex historical data, you will see the explosive moves and the consistency that these signals can produce.

Do you like the idea of trading the price action signals discussed in this chapter? If you want to have a better chance of becoming a professional trader by taking advantage of the benefits of price action trading, then we have set up our advanced Price Action Protocol trading course for those serious traders.

In the course we discuss these candlestick setups is much greater detail. The course covers advanced trade entry methods, stop loss placements and how to integrate our positive geared risk reward money management into price action trading plus much more.

This concludes our beginners introduction to price action trading. For more information about trading strategies, money management, or psychology check out our forex trading articles section.

If you would like some live demonstrations on price action trading, stop by our live price action videos area.

All the best with your trading career

Daji

How much moving avarage

david

Thanks because i have discovered that price action is the best trading and successful method

Annastacia Khonyane

Your article is very clear and to the point especially to me the crawling bie, thank you so much.

Tasi Feite

Very informative and easy to read and understand. Thank you.

Brent

Hi Dale. I’m a beginner in trading forex. I’ve been reading your articles and I’m very grateful for sharing your knowledge with us. Since the Breakout Trap and Reverse Trade Trigger can be traded ‘live’, when can I enter a trade? Do I put my entry price after the trap reversed even if the price is still int he previous candle’s range or do I have to wait for the price to pass/break the highest price (for bullish trigger) or lowest price(for bearish trigger) of the previous candle?

Mohamed Badulkadir

My name s Mohamed from Somalia, Africa i have never seen beeter blog this one really i appreiciate your work this blog encourages me to learn more about forex.

Keep doing

Thank uou

Kenneth MABOTE

This I find to be very informative especially for Beginners like myself learning the basics from africa where exposure and knowledge is hard to get.We congradulate you for availing such a web site from which we can learn the Basics.

Todd

What if you have a bullish candle followed by a bearish candle in a couple of periods, what does that mean.

Thanks

Replying to: Todd

Dale WoodsAuthor

It means there was a sell off after a rally.

Keith.

Hi. I like your clear descriptions & also the fact that your charts also show a similar (e)ma setup to mine. About to go live after 6 months of demo so your articles help, confirm & clarify for me that my strategy has an edge, as long as I remain patient, clear & disciplined. Will be back for more. Thanks.

Chooddy

Thank You Very Much..

Ronald

Hi, I read your beginners introduction to price action trading and your Forex Survival Guide with big interest. Although there are things not completely clear to me, I like the way you write your articles.

The question I have is, what would be the next best step to take in order to start trading?

Tom Ngiracha

Incredible