- The Heikin Ashi Candle Anatomy

- Benefits of Heikin Ashi Charts

- How to Read Heikin Ashi Candlesticks

- Warning About Using Heikin Ashi

- How to Trade Heikin Ashi Charts

- Heikin Ashi Charts on MT4

Have you ever been riding a trend, then been spooked out of a position because it seemed like price was going to turn against you – only to see the trend continue another 300 pips?

Maybe you’re having trouble spotting the main trend, or market reversals?

Heikin Ashi candlesticks may be of interest to you, they can help with: trend analysis, pinpointing key reversals, and enhancing your exit strategy.

Heikin Ashi candlesticks are another clever invention from the minds of great Japanese traders. I’ve been a fan of these modified candlesticks for most of my trading career, but I feel they are rarely spoken about or used to their full potential.

They are a lesser known customized form of price action – but building in popularity, providing traders a new insight into technical analysis.

These bad boys can be used with any market on any time frame.

In this guide, I am going to walk you through how Heikin Ashi charts work, and how these customized candlesticks can give you a different unique perspective and perhaps change the way perform your chart analysis…

The Anatomy of a Heikin Ashi Candle

They are the result of applying some average math directly to the candlestick structure.

One main goal of Heikin Ashi candlesticks is to eliminate noise on the chart. This is achieved through the way the Heikin Ashi charts are built through the equation.

The ‘formula’ for their construction is designed to creates a ‘smoothing’ effect – filtering out the irrelevant moves, while maintaining the display of the dominant price action.

Heikin Ashi candlesticks requires data from the previous HA candle, meaning they essentially build off one another. It is this chaining effect that gives a really unique view into the market.

The classic candlestick we’re all used to has a high, low, open, and close price. These figures are taken directly from the raw price action.

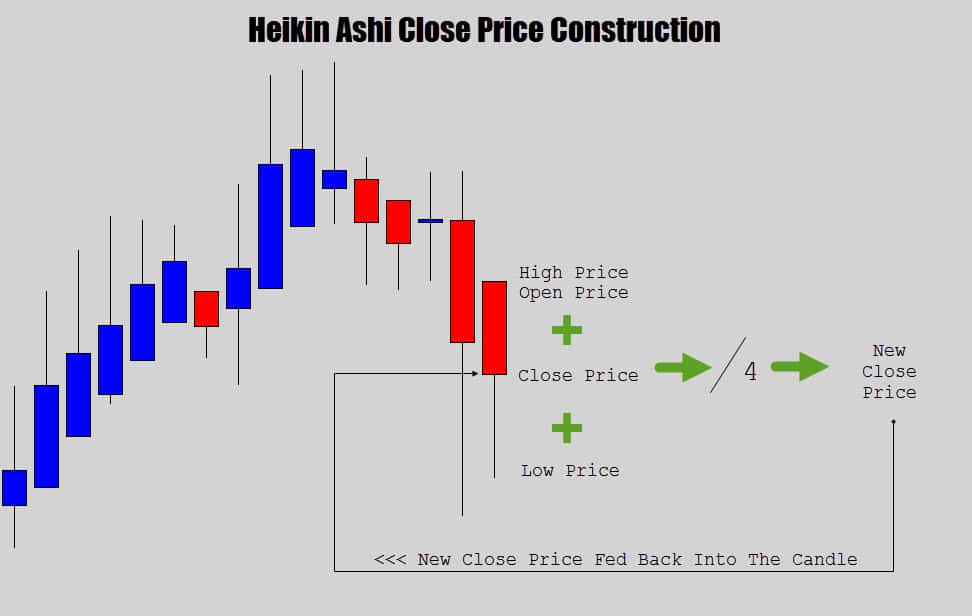

Heikin Ashi candles have the same 4 data points, but they each have some unique math behind them – which is important to understand if you’re going to use them.

- High Price = highest price out of the current candle’s high, open, or close price

- Low Price = lowest price out of the current candles’s low, open, or close price

- Close Price = (open + high + low + close) / 4

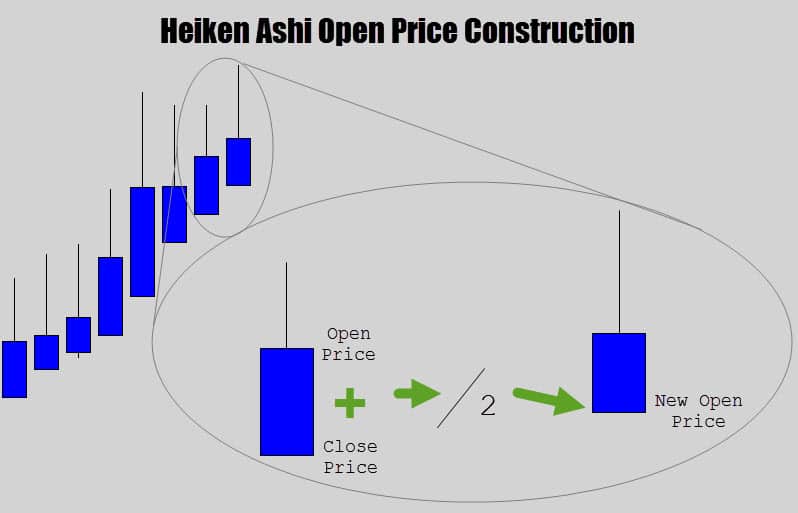

- Open price = previous candle (open + close) / 2

To summarize, the high and low prices are nothing special. The Heikin Ashi candle will just show the highest and lowest data point achieved while it was active.

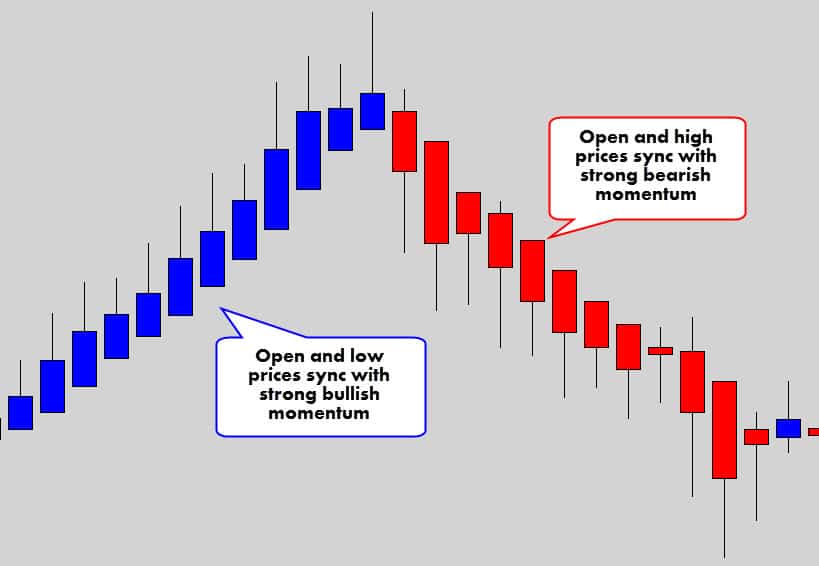

What you will find in strong bullish conditions is that the open and low price are the same, and during bearish momentum, the open and high price are equal.

When the open price syncs up with the high or low, you know you you’ve got some good market momentum.

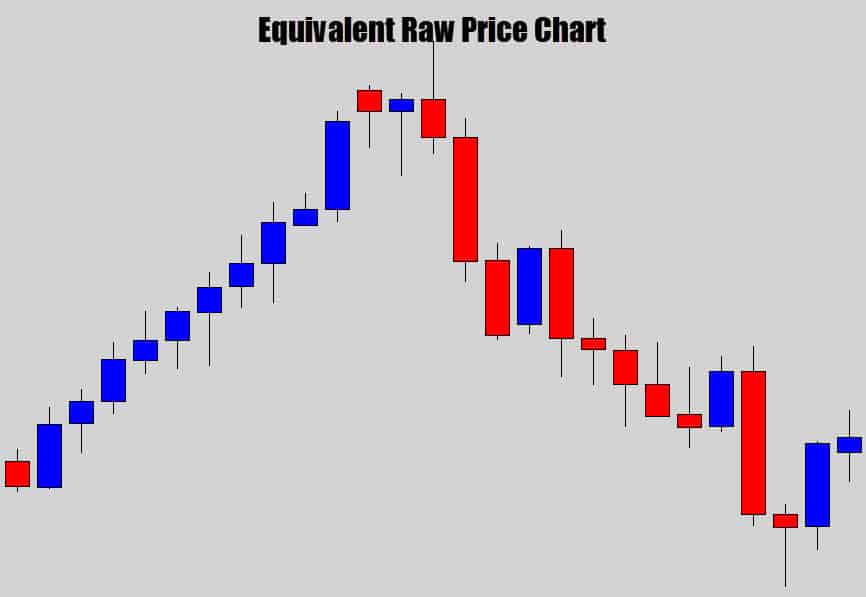

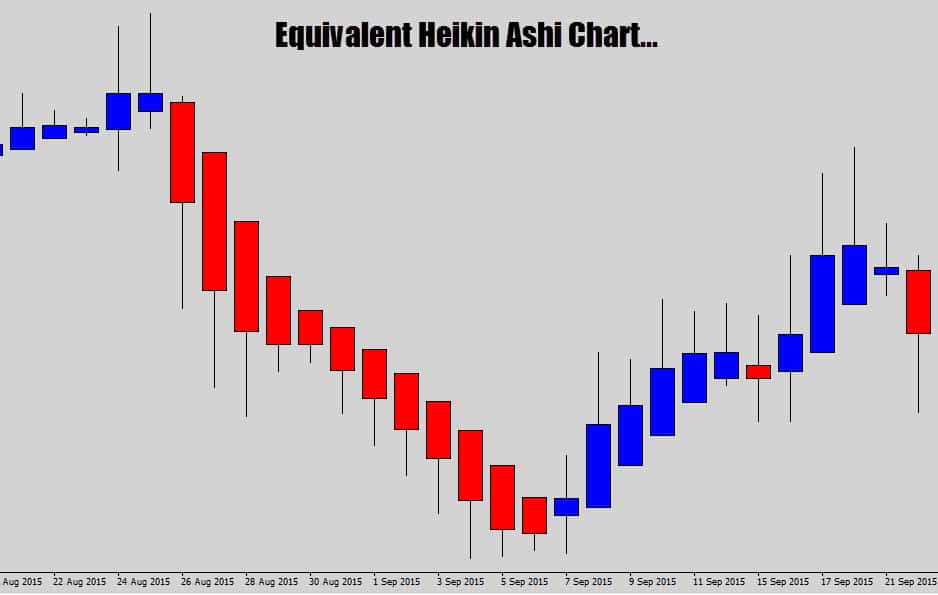

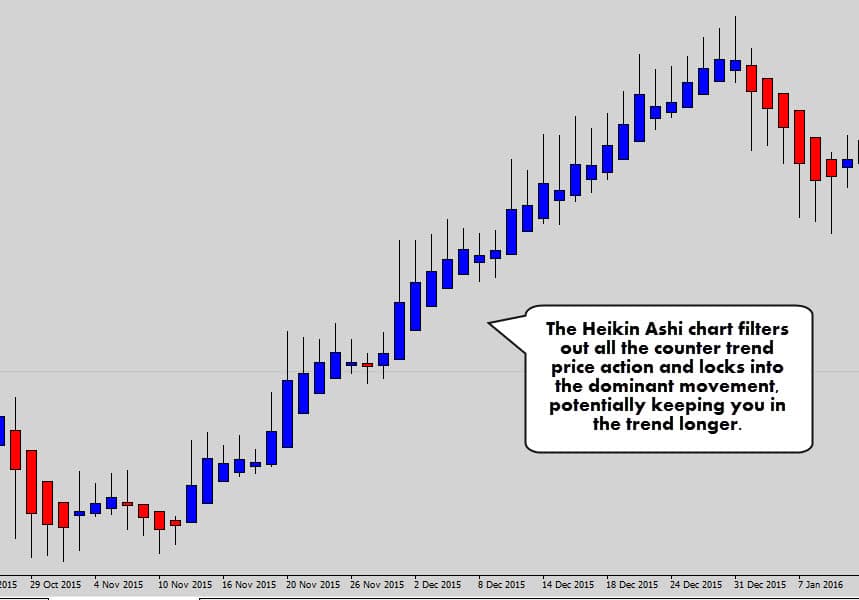

You can see, when you compare the two charts together, how the Heikin Ashi chart helps filter out those counter trend movements and keep the dominant trend in display.

It’s the way open and close prices are calculated that gives this filtering effect.

The open price is derived from the previous candle’s open and close prices.

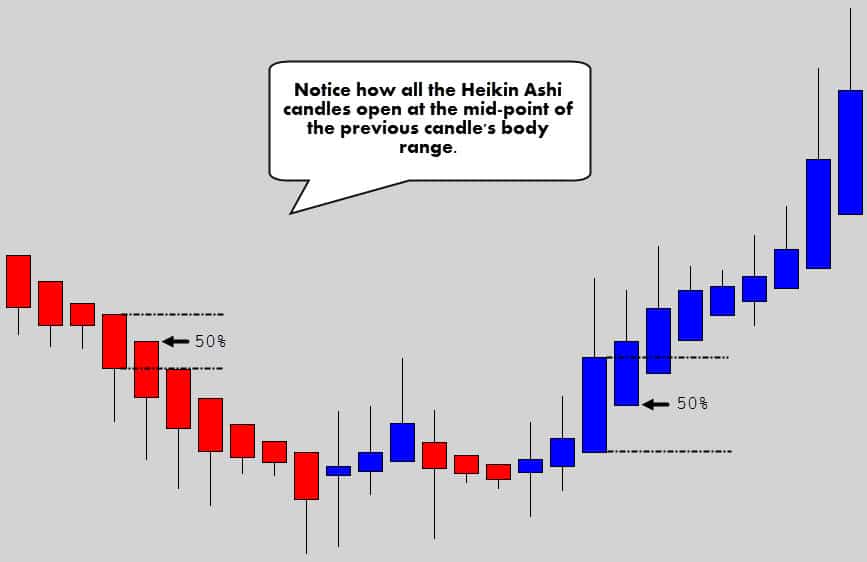

If you look at the formula carefully, it makes each new Heikin Ashi candle open in the middle of the previous candle’s body’s range.

One of the main reasons these charts looks so neat and orderly is the way the open price is being printed.

The close price is the other interesting aspect of the Heikin Ashi candlestick anatomy.

It takes all 4 data points of the candle, adds them together – then divides that figure by four to spit out an average price of all the candle data points.

The close price is basically the average point of all the prices in the candle.

It’s important to understand that the close price also means the current candle price while the candle is active. When the candle closes, the last close price will be cemented in as the final close price.

Every time the market receives a new price tick, the Heikin Ashi formula is executed again, all the prices are recalculated and the candle anatomy is updated appropriately.

Checkpoint

Benefits of Heikin Ashi Charts

There are many benefits a Heikin Ashi chart can provide to your technical analysis.

Obviously, the main purpose of these charts is to clean up the noise and display dominant trend strength.

Notice how the Heikin Ashi charts prints out a lot smoother price action, helping draw out the main market movement.

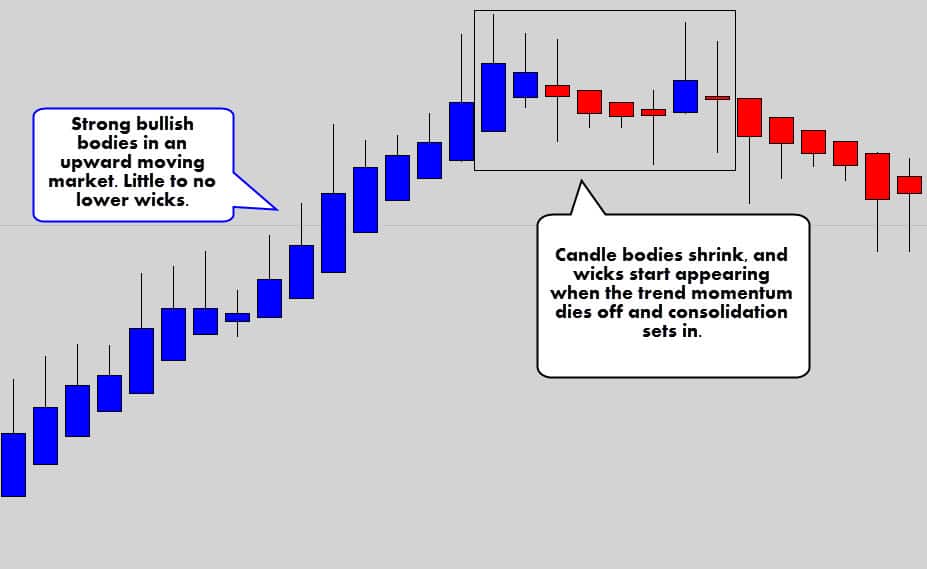

Check out what happens during strong trending markets.

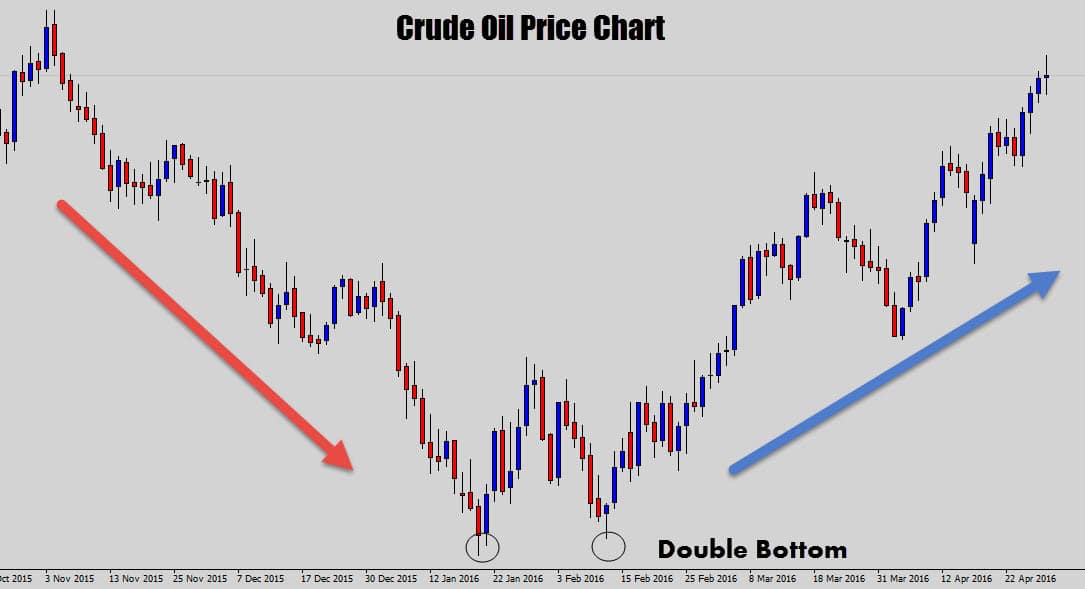

Although the price chart is fairly easy to read, you can’t deny that the Heikin Ashi chart does a very good job at straightening out the market structure.

We can easily see where the core trend movement is and where the counter trend corrections are occurring.

Even the double bottom pattern looks a lot cleaner.

If you’re having trouble determining the trend, these charts could be a good aid for you.

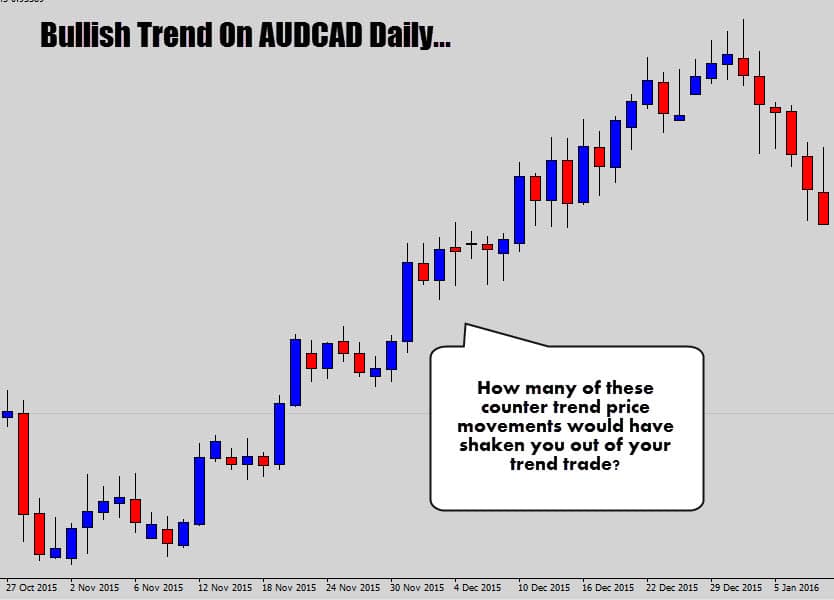

They are also great for keeping you in a trend trade longer. It is common to believe price is moving against you, and find out you got spooked out by a counter trend retracement soon after.

I know there are a lot of traders who ‘cut their profits short’ in these scenarios.

Check out how Heikin Ashi charts may help with the psychological problem of ‘price moving against you’…

This is one of the key advantages of HA candlesticks, the ability to ‘cut the crap’ when the market is trending.

Look how well of a job they did in the AUDCAD example above. You basically only see blue candles until the trend dies out, and then a larger red candle is printed.

Charts like these maybe just the thing you need to stop those early exits.

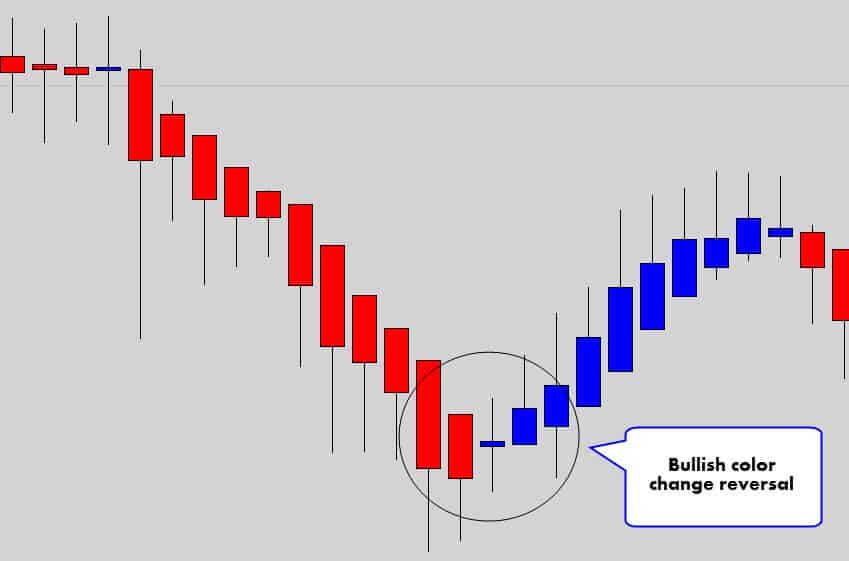

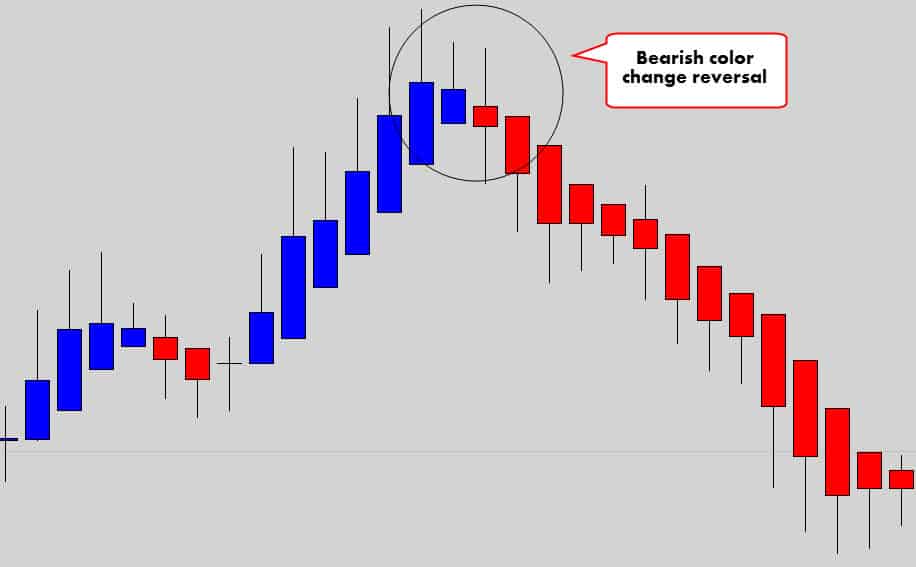

Reversals can be much easier to spot, especially with the classic ‘color change’ in the Heikin Ashi candles…

You can see that when the candles change dramatically from bullish to bearish, there can be a large follow through reversal.

Obviously it wouldn’t be profitable to trade every single color change because when the market falls into consolidation, you will get eaten alive.

These reversals tend to be more potent after a large bullish or bearish move has already occurred before leading into the color change signal.

Checkpoint

How to Read Heikin Ashi Candlesticks

So far, we looked at how the HA candlesticks can help provides a better visual experience for traders, and collectively help with market analysis.

Now lets dive into the individual Heikin Ashi candlesticks and learn how to read the individually.

- If the body of the candle is bullish – it reflects a bullish environment.

- If the body of the candle is bearish – it reflects a bearish environment.

- If the body of the candle is thin, and there is wicks protruding out both ends of the body, the market is indecisive, has stalled, or is consolidating.

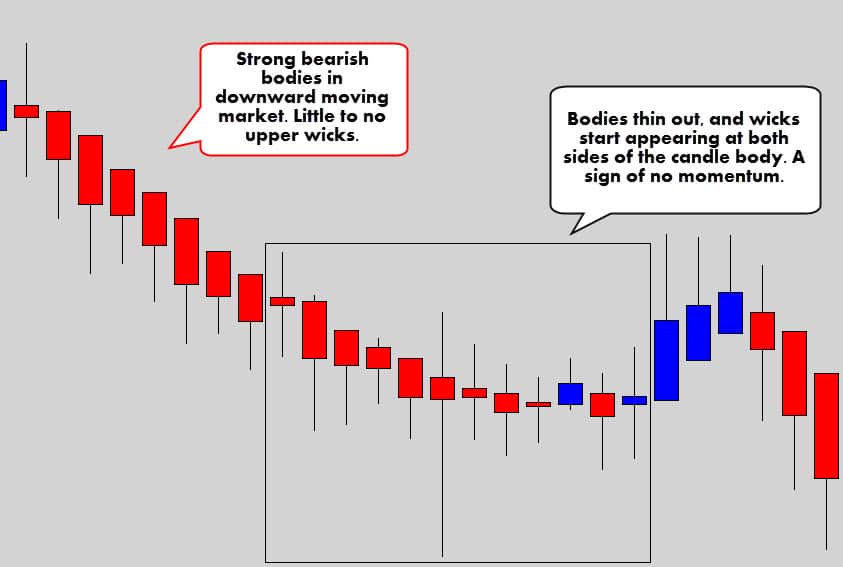

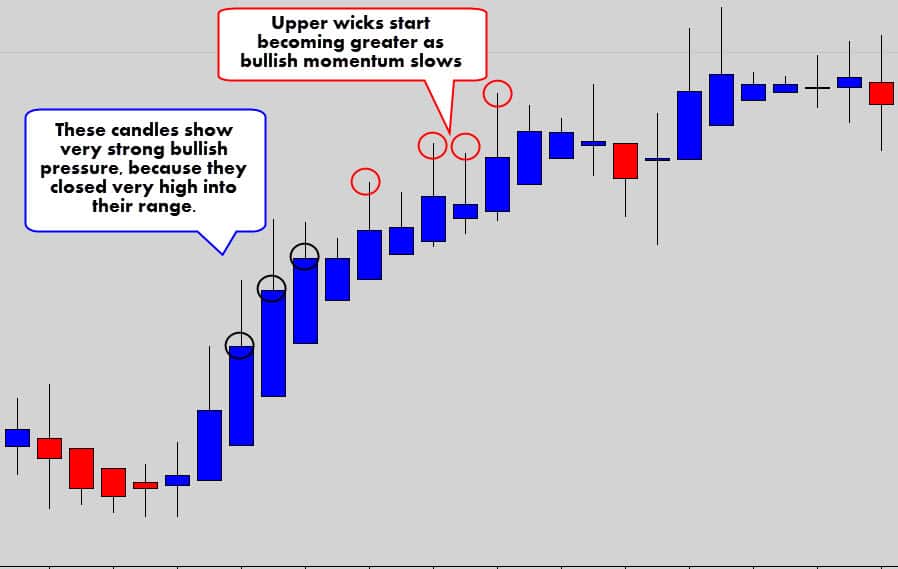

If a strong trend is underway, the candlesticks become a gauge to the current trend strength.

Remember the close price is the average of all the data points in the candle, so if the close price is very high, then you have strong bullish pressure in the market.

Upper wicks will start to appear when the bullish momentum slows down, and more bearish pressure starts to enter the market.

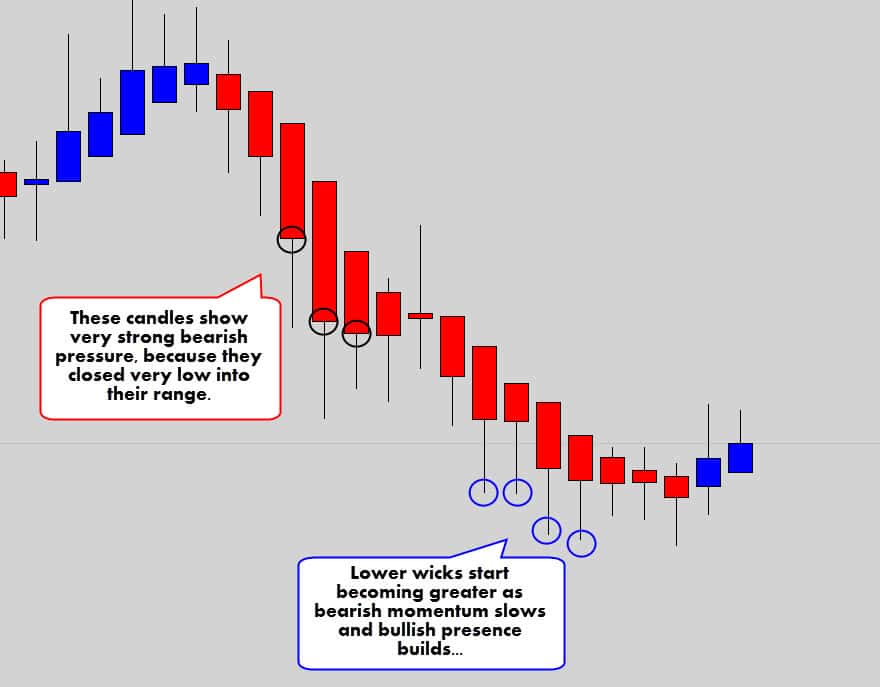

Same obviously applies to bearish conditions. The candles will close lower into the candle range under strong bearish trends.

Remember:

- Big candle range + big candle body = Strong momentum

- Small candle ranges + small candle body = Weak momentum

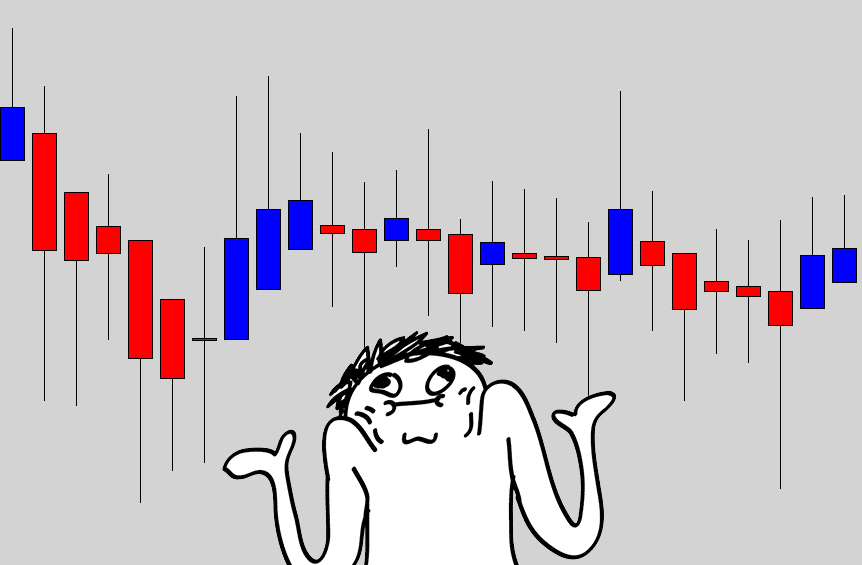

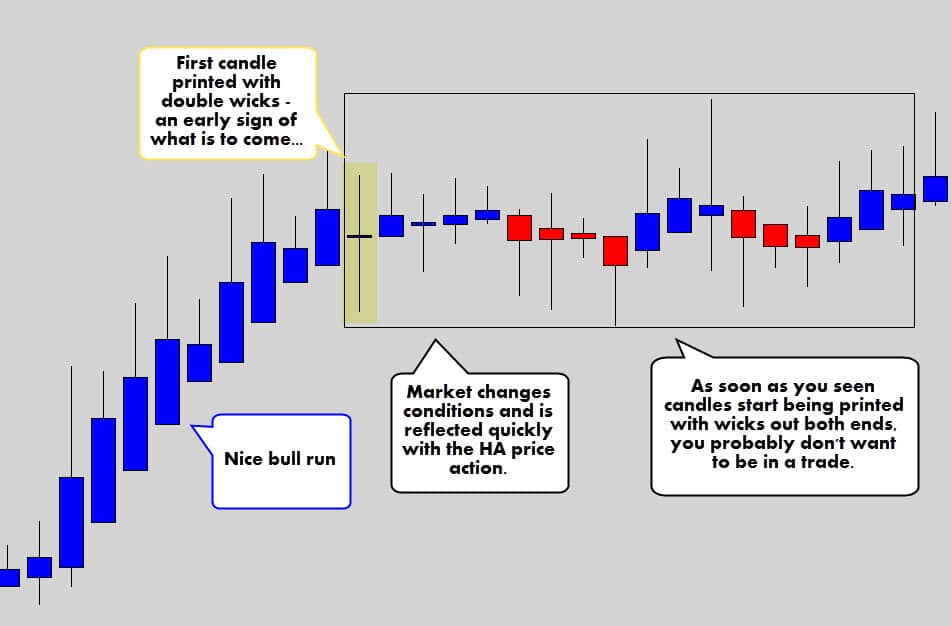

Because these candlesticks change drastically when the market conditions shift, it’s very easy to see when the markets fall into consolidation, when you don’t really want to be in the market.

It’s fairly easy to spot dangerous market conditions with Heikin Ashi price action.

Try to stay out of the market when you start seeing doji like candles, especially large ones.

When these charts go into nasty sideways action, there will be a lot of candles with wicks coming out of both ends of the body – a warning sign to be on the side lines.

I always say, if you can’t make sense of the chart, then simply don’t trade it!

The chart above shows how these charts can do a great job and displaying a the change in market conditions.

One Doji formation – a double wicked candle – was a warning sign of dangerous consolidation to come.

Like normal candlestick chart, Doji patterns are a reflection of indecision, consolidation or unstable volatility. The effects of Doji candles on HA charts are more emphasized.

Checkpoint

Warning: Heikin Ashi Candles Can be Visually Misdirecting

When you look at these charts, you will imminently think it is a gold mine. But we all know there is no free lunch 🙂

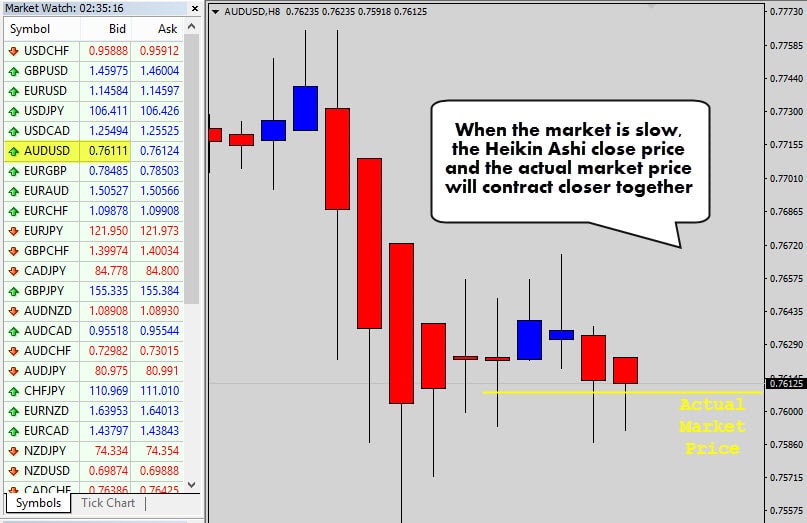

If you remember the calculations we went through before on how a Heikin Ashi is formed… you might have picked up that Heikin Ashi candlesticks don’t always reflect the current prices in the market.

In a normal candlestick, the close price is the current price in the market.

On a Heikin Ashi candlestick, the close price is an average of all the candle data. This means the close price of a Heikin Ashi candle is going to be different to the current market price!

As a trend develops, the Heikin Ashi candles really start to build momentum off one another as price is driven higher or lower – the spread between the actual market price and the HA price will expand dramatically.

I actually like this mathematical outcome because it punishes traders for buying too high and selling too low – which is a common problem for novice trend traders.

When the market settles down, the distance between real price and HA price will contract significantly.

Notice how the prices are fairly aligned in the chart above. The trending conditions have stopped and the market is drifting sideways, allowing the market price to catch up with HA price.

Now when a trading opportunity occurs, you will be able to get in closer to the market bid.

Just remember, when you’re taking a Heikin Ashi trade, to check where the real market price is. This is important because you need the real market price to execute correct risk management calculations.

Checkpoint

How to Trade Heikin Ashi – Some Trade Ideas

Allow me to give you some ‘food for thought’ to get started with trading Heikin Ashi charts.

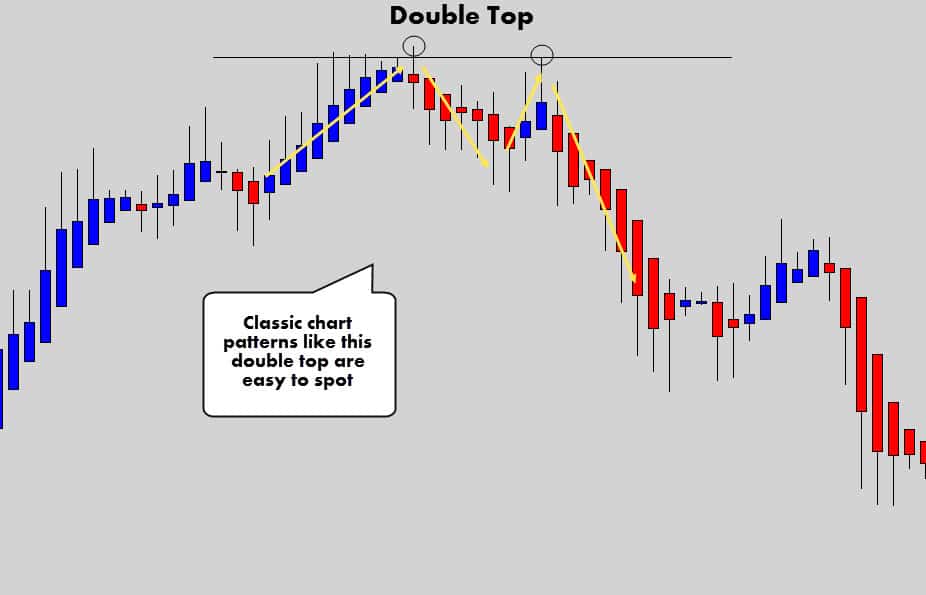

Traditional forms of technical analysis, and your classic chart patterns are still going to be relevant.

We can see above the classic swing level still being relevant. Look how well HA displays the ebb and flow off support and resistance levels.

Classic patterns like the double top, and the head & shoulders patterns can be easily spotted and traded as per your plan.

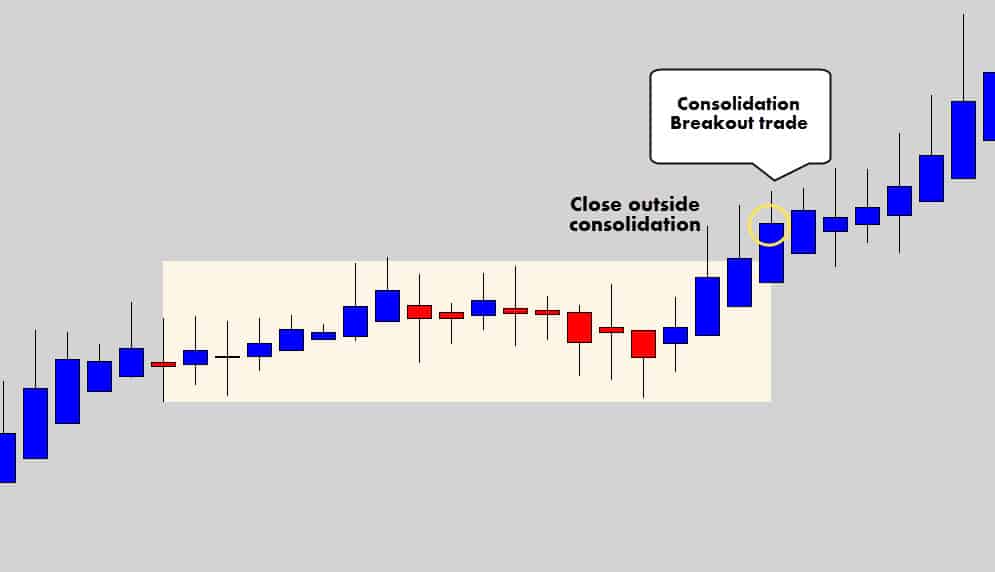

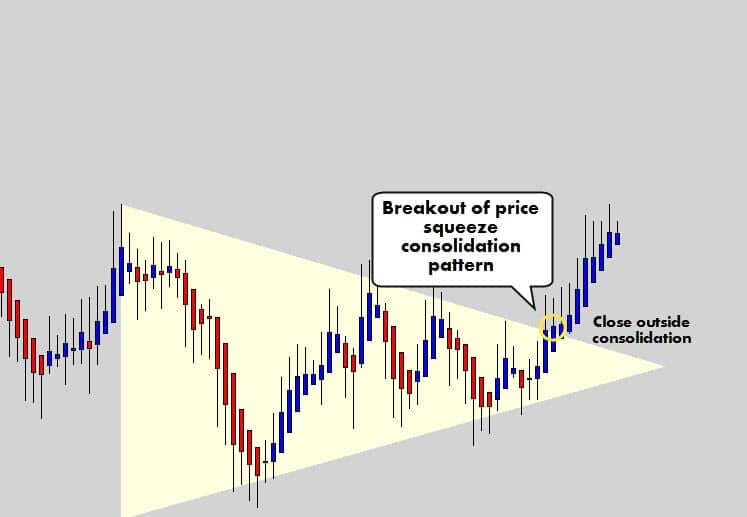

Consolidation breakouts are also easy to spot and work out well.

Whenever a Heikin Ashi candle closes outside of these consolidation structures, it is a good indicator that a breakout is underway.

It may even be beneficial to watch lower swing trade time frames to catch an intra-day HA breakout for an earlier entry – because you’ve always got to keep in mind the spread between the HA price and the real market price.

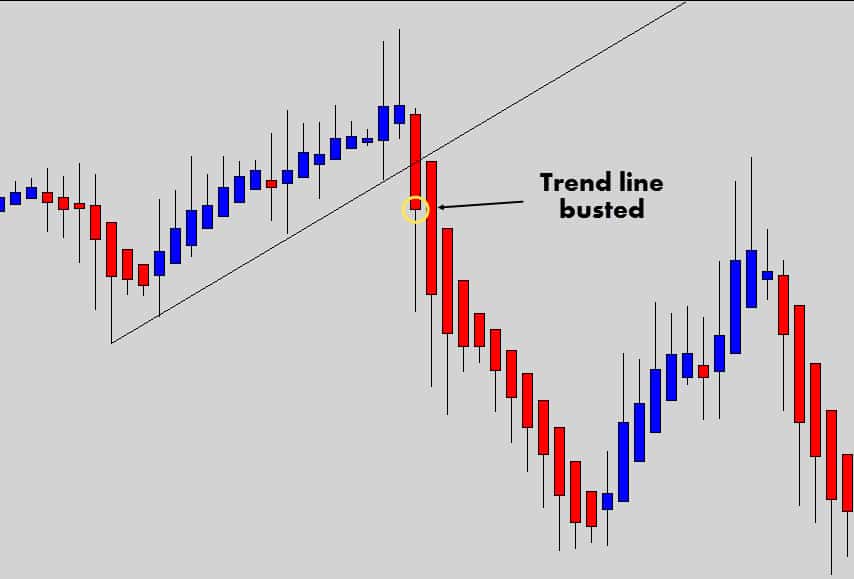

Another example of effective structure breakouts are simple trend line breaks.

Due to the market structure being easy to see with Heikin Ashi charts, trend lines are easier to mark. Watch for the break of obvious trend lines…

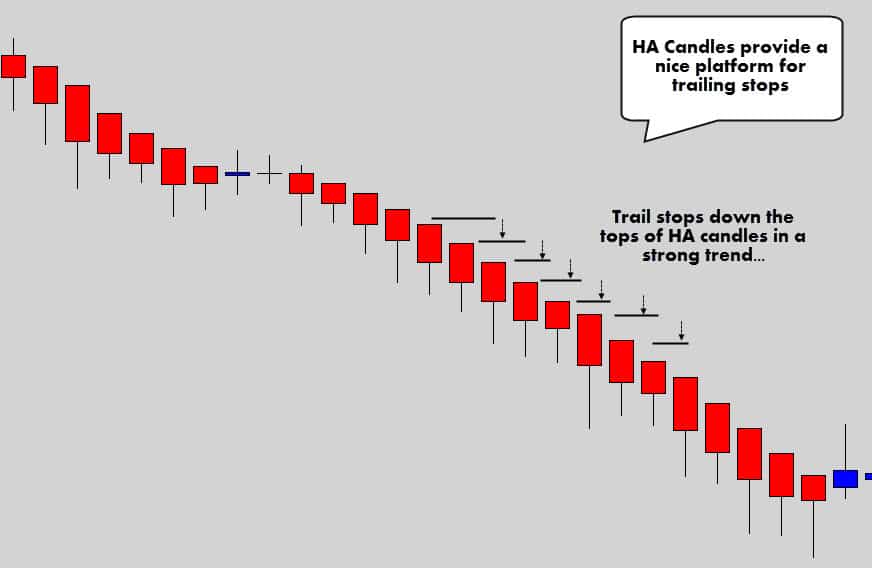

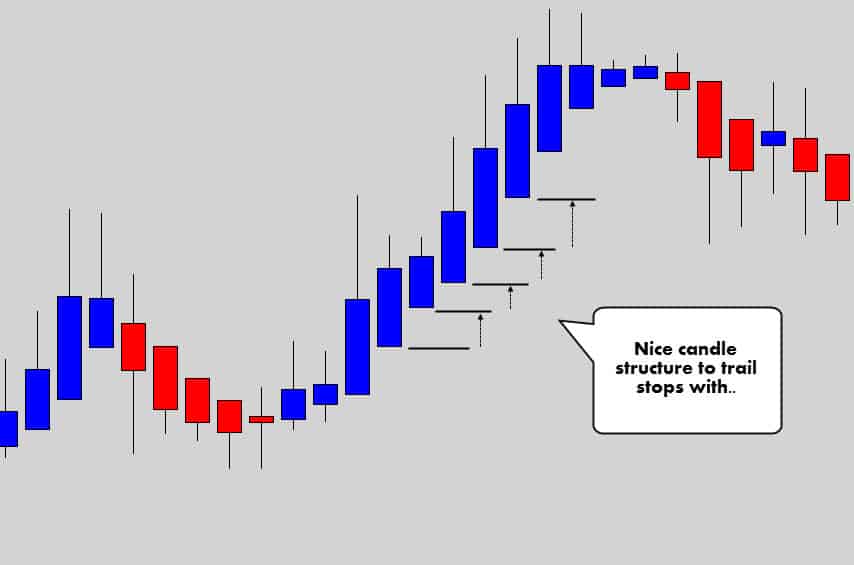

These charts are also an excellent opportunity for trailing stops… especially during strong trends.

When the open price aligns with the high or low of the candle in a trend, this may the opportunity for you to trail your stop if you’re into that.

Trailing a stop behind the previous candle’s low or high may be a little aggressive – consider trailing the stop behind the high or low of two candles ago.

The stacking trend candles may also be used with scale in strategy, adding to your position as the trend develops.

Careful with this though – because the HA / Market price spread is going to increase as the trend develops, making it more difficult to scale in as the trend extends out.

Checkpoint

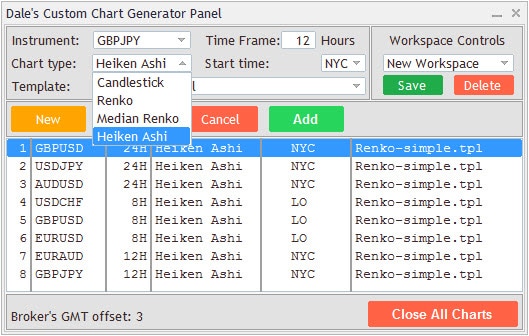

How to Get Heikin Ashi on MT4

Naturally there are free MT4 HA generators out there, but they can be annoying to use – and can be filled with annoying bugs.

Here is a free one if you want to test them out.

If you’re more serious about Heikin Ashi charts, you might be interested in my custom chart generator tool.

This cutting-edge panel allows you to customize your own charts for a unique view on price action – that includes custom tailored HA candles.

You can check out the info on the current chart generator here.

The second version of this panel will support Heikin Ashi, and is almost ready for release, here is a sneak peak…

If you’re on my email list, I will shoot out an email to everyone when this is ready. It is proving to be a very powerful and convenient tool.

I hope this guide was helpful. Please leave me a comment below and let me know if it was, or just leave me your feedback or experiences with Heikin Ashi charts. I always look forward to reading your comments!

Stay safe and profitable out there! Best of luck on the charts this week 🙂

Bert

Great job. On Tradingview, I click on the “+” to compare, add a symbol to the chart.

I add the same symbol as the main chart to superimpose a line chart on the candlestick chart.

Then I can see at a glance the spread between the actual close the HA price.

Balazs

Nice thoughts on trading Heikin-Ashi charts. Pretty detailed and well illustrated article. Keep up the good work!

himanshu.asiwal

How to download to solve problem

Donna

This is the best explanation of HA candles I’ve ever seen. Thank you

Norman Manzon

Great article!

To add a little info, a good way TO DETERMINE TRUE PRICE LEVELS for open, close, high and low when using H-A is to superimpose H-A over bar candles, which clearly show all four levels. Just make sure your H-A candles are not so dark as to block them out! For just true highs or lows, simply consult the H-A highs and lows. They’re true levels. For bid and ask prices, make sure platform shows them both.

Thanks Dale, and happy trading everyone,

Norm

Emmanuel

God bless you my guy

mike shiroi

Really nice article about HA Candles. Clear and concise, which is exactly what I was looking for.

Medeterian

I learned trading on my own, watching for 10,000 hours how those HA candles move and could figure out next move based on all information you have mentioned above. Its the same as kids learn how to speak without reading a book I guess. But thank you for a nice article, I got kind of confirmation of what I know already.

Hank

Your explanation is the most thorough, sensible and easily understood explanation of HA that I have read–and I have read a lot of explanations. Thus, yours is the best explanation for me and what I do in trading. You point to some characteristics to be aware of, some of which I had not noticed, but these are crucial points. And I now see that it might be actually better to draw trend lines on HA charts rather than on my standard charts. I use HA and Standard charts together at the same time. The HA gives me a better visual feel while the Standard keep me of aware of the “real” price at all times. And you are so right, there is no such thing as just follow the color change blindly –that is the path to ruining your account.

Eddier Caicedo

Excellent material…

Somnath

Really great work done by you on heikin ashi strategy. Every one can tread if he fallow your rules on heikin you.

Bill Murray

Really good explanation , have watched them for ages . Now I,m going to try them ! Thank you .

philip m

really informative, insightful, and helpful.

thanks

Gop

Thank you,

Very clear and helpful

Best.

S K

Very well illustrated! Plz keep up the good work.

Swapnali

Hiee… Love the way u explain HA in depth. I always prefer to trade or to understand market movement with HA… So ur article is more n more helpful for me.

Calisto

Fantastic article, content like this on candle behavior is very scarce out there, well done!

Thinking about an interactive “Last Candle Calculator” that would allow you to set the price of one Heiken Ashi candle, then have 4 sliders for you to move and see how the second candle behaves “real time”, would be a cool learning tool.

Chris Brock

I didnt see where it explains Why the HA. Candles Change Color Red to Green OR Green to RED and

how does that happen if is “Open vs. Close”

not NetChange.

THANX

cb

sorry the formulas just dont explain it to me.

Replying to: Chris Brock

Dale WoodsAuthor

That’s just like a normal candlestick.

If close is above open, it’s bullish. Opposite condition for bearish.

Avraham Schwartz

Nice to receives something that will help us trade forex better. Well done. Success and blessings to you and yours.

Avraham Schwartz

Nof HaGalil, Israel

Frederic

Hi

Looking at the trade ideas, ‘food for thought’, would you recommend for high/low break or body of heikin ashi break?

George

Great article and very usefull information.I would like to implement the HA candlestick chart and waiting on your second version of your panel generator!!!

Elan

I needed this. Thank You.

Guesmia issam

thnx bro this the most helpful article about HA Candlesticks cheers bro bless up ????

manzur pasha

very good article please let me what time frame is good for intraday trading

oula philippe

je suis heureux de faire la découverte de votre article sur Heiken Ashi. En effet moi meme je suis fan des bougies HA et je cherchais une formation appropriée et voilà que je suis tombé sur la mine d’or. Merci et à la prochaine. Actuellement je veux coupler HA à l’indicateur ICHIMOKU KINKE HYO que j’apprecie aussi beaucoup. Merci

ANJAN BABU

great article. everything is here. I don’t even have to take notes now, I just bookmarked this page.

cheers!

Sandeep Parekh

Hi

Request you to share where to initiate a trade as the prices seen on the Heiken Ashi chart is not the same in market (open or close – even high or low depends on prev open calculation). Also my experience has been that we need to wait to the closing time to understand the color of the candle esp in breakouts after many dojis or the signal changes often.

Regards

chhotubhai

exellant

Robert

Great article. Very helpful for a newbie like myself

Jeremy

Anything for Android mobile devices?

Thanks!

Robert

Hi Dale;

Thank you for putting together a very informative post about Heikin Ashi candles. How does one enter a trade when the current price is so far away from the closed HA candle? Is it best to switch back and forth to Japanese candlesticks? Your advice is appreciated.

Thanks

Saqi

awesome article…can we download this article in pdf format????

Alan Northam

Enjoyed the tutorial on Heikin Ashi candles.

ken christopher

very informative

rambabu

wonderful guidelines for the freshers.we thank you a billion.

TOny Biasillo

very good explanation

thank you

Horst

Great article, very helpful, cheers Horst

Peter Paul Acholonu

what time frame is recomended for the heikein Ashi charts

Peter Paul Acholonu

Good job but which time Frame do you use all the time for heinkin Ashichart

Zebrasky Mcdonald

I have falling in love with heikin ashi. Now it’s time to master it. My question is what timeframe are the heikin ashi candles best traded on

Yaakov Markos

Very good explanation , I will try to see how it will work. Thanks

DAVID ROBINSON

This is very fascinating indeed.Thanking you for all the effort you have taken to explain all these points to us all.

However i am a little confused regarding entry points,to a degree.

While everything does appear to be much smoother and pleasing on the eye.

I somehow cannot comprehend or grasp a correct entry point at the minute.

Am i to take it that the market price is the true price to enter on a new candle opening being as the previous closed candles highs,lows and closes are averaged and not a true reflection on price.

I am sorry if i do appear to be totally confused,but to be fair i do grasp it and it appears easier to trade.

For some reason it is certainly a better concept but i appear to be totally missing something,it appears far easier and pleasing on the eye yet my mind is a blank figuring entries.

Appreciate your thoughts when you have time.

Many Thanks

Regards

Dave Robinson

Vipul Srivastava

Very Good article.

Explained almost everything about HA chart and all indicators.

Steve Hudson

I found your article most informative. I have only started looking into them after reading a book on trading the S&P 500. The author advised using HAs on the 30 minute time frame to look for entry points. I thought the HA candles looked ‘smoother’ than the regular ones but I didn’t know how to interpret them. The part in your article about the candles with the same open and high/low prices and no wicks was most helpful. Thanx for the info.

Jagdish patel

Nice and very informative Explanation ….. Thanks

Doc

Great, easy to understand, explanation of HA

Rodrigo Reis

Excelente!!

Pankaj Kumar Laskar

Nice article!! Would like to receive a copy if permissible please.

Thanks!!

Paulo

thank you Dale

Richard Sawford IEng MIET MAIPM

Very helpful. I am new to trading so this helps in my steep leaning curve. Thank you

David Caple

Dale, I’m not doubting your citing of the formulae for the HA High and Low but I am confused by them! You (and everybody else) quote them as …

High Price = highest price out of the current candle’s high, open, or close price

Low Price = lowest price out of the current candles’s low, open, or close price

… but in what circumstances with the Open or Close ever be higher than the High or lower than the Low? By definition the High is the highest price and therefore Open and Close can never be higher and Low is the lowest price and Open and Close can never be lower! Am I missing something?

Replying to: David Caple

Dale WoodsAuthor

Well observed, but I am just quoting the original formula. But you’re correct in saying that we really only need to concern ourselves with the high or low prices. There are conditions where the open or close price can be the same as the high or low price also – it’s just a technicality though.

Kuhan

Your write ups are fantastic buddy. Thanks a lot

Lars

Great article,Dale. Very informative. The HA turn trading into a song. I had no idea about the diff in the spread, but that makes sense considering the HA was designed to prevent trading against the trend, and the spread is the fix. Smart. With that as the only “disadvantage” – I will continue trade regular candles and use the HA as an indicator on the same chart. I have come to learn cross-overs from a 14 periods stochastic, D: 7 and K:3 as an added measure for confirming entry/exit.

Maxwell

Nice one Dale. Am new to forex trading and your article is useful. Your explanation is clear and simple. Cheers

Dr SS Sharma

Thank You! I have been trading HA for quite some time. I have been ok with my trades, and this has helped my trading tremendously.

Please, dear friends, be very very reminded of these:

1) HA Candles are Lagging candles

2) Always check with your regular candlestick charts for current price, targets, stop loss

3) HA is only to show if you are able to sustain or stay i the trade

4) DO NOT trade the HA alone in its own context.

Terry Smith

First read through was very interesting, I am sure that as I get a bit more of a grip it will all start to make some really useful sense. Looks very useful, informative and I can’t wait to read it all again!!!

Many thanks.

Terry Smith

Manjit Singh

Brilliant, easy and clear to understand Thanks.

K

Just found your site Dale. Thanks for the great explanation of HA candles. Do you use them? Most of your training deals with normal candlesticks and not HA. When using HA, do you recommend switching back to normal PA to find good entry/exit location/price?

Frederic

Hi, love this guide! So detailed.

Just wanna clear something. So the longer the wick compare to body, the slower the momentum? So does that means a full body show strong momentum?

Kenneth

Thank you for the information and a wonderful site you have here. I am trading with the Genesis Matrix system with uses these candles. I will be visiting your site quite often.

Raju

very easily explained.. thank your very much. i will use these candles in Indian market.

Rgsh

Nice post thnx

Howard

great explanation of HA, thank you Dale

Yan Naing

Thanks for your effort. I would like to know your trading strategy that you are doing now.

Russell Weiss

Russ Weiss May30,2016

Best explanation of HA I’ve come upon. Thanks. Any help on trading HA would be greatly appreciated.

john

Thanks another good article.

stephanus sugama

thank you……

Neville

Very very informative and interesting. Thank you for going to the effort of describing this. I am most grateful.

Douglas

Thank you Dale. VERY INFORMATIVE!!

Jason Roque

Is there Heiki Ashi mt4 on mobile?

Replying to: Jason Roque

Dale WoodsAuthor

I don’t do mobile trading much, and most advanced charting is done on a computer – so it will be hard to find it on mobile.

Replying to: Jason Roque

CalvinJugah

hi Jason.

just wanted to butt in here. I do plenty of mobile trading due to my nature of work.

I use Trade Interceptor , you can get it from Play store for Androids.

Since Trade Interceptor is my charting platform only, I just trade on my MT4 on Android.

Hope this helps.

TREVOR

great food for thought,looks like you have done a lot of work on this DALE.congratulations .and thank you.

Tonino

newbie here. Enjoyed your article Dale.

I have not yet put anything to the test as I am still reading the course.

I want to take my time with your course and learn all the things that you offer us.

And it looks like that these HA candles will have to be given a try.

Thanks Dale.

By the way Dale, if you ever win to much in one day I could do with some. lol

Martin

Excellent article Dale – just a pity there’s no mention of Heikin Ashi Smoothed, which I find another fascination feature of these candles (cuts out even more market noise).

Replying to: Martin

Dale WoodsAuthor

I don’t like them. Heikin Ashi charts are already an averaged candle. Smoothed Heikin Ashi charts are normal HA charts with even more average math pumped through them. Smoothed Heikin Ashi charts are very misleading, as they are printed way off the actual market price. You will probably get just as much out of them as a moving average.

austin

that was excellent i really like it cos it helps one alot in identifying an important moment.

AndyB

2 thumbs up! Thanks for sharing your expertise Dale! 🙂

Warmest Regards

AndyB

Stevko

hi Dale, great! I always appreciate your detailed explanation.

Barry Lang

Anything that can simplfy trading must be a bonus….From ” Dow Theory to Gann Theory and of course Elliot Wave Principals” trading can be complicated and as Gann said, if every trader just knew the 50% rule / theory he would be richer for knowing it… But how simple is this?…I have always wondered about Heinken- Ashi candles’ but i have avoided them because of older trading principles…Thanks’ Dale, as I will in the future employ such principals’ within my trades’….And thanks’ for the MT4 knowledge and the links’ you provided..

Regards

Theo Courtriers

Dale, I signed up for your course at least 6 years ago. I loved what I saw and then I went on a spree of wanting more because enough was not enough and then I stumbled on a heikin ashi course that also included renko trading. That was it for me. I switched and loved every minute of every potential opportunity as advertised. I started seeing every heikin candle color change as an opportunity and started doing crazy things. I lost money galore. I finally came back to your website like the prodical son and started all over again with candlesticks and that is what I am using now with a few indicators. The main indicator being your PABS and I am loving it.

I have placed my expensive heikin ashi course in an archive. My brain is now fully wired to see candlesticks. I am seeing the market clearer and making pips again. I am building my account again and best of all my trading is starting to become boring which means I can now start living the life I dreamed of as a forex trader with lots of time on my hands.

Replying to: Theo Courtriers

Dale WoodsAuthor

Hi Theo, thanks for coming home in the end 🙂 I have scoped out the Heikin Ashi strategies being thrown around out there. Most of them are paired with indicators – which is going to straight away give you a system that lags a lot, because HA candles already are a little slow themselves due to the average math.

I’ve got a few things I would like to test on these charts, but thanks for the feedback!

David

Hi Dale,

Thank you for this really useful article. It fascinates me how many trading tools are Japanese – Renko bricks, Ichimoku clouds and many more – I think “ordinary” candles are derived from rice trading. I agree that some of the standard MT4 HA offerings aren’t the most friendly tools to use. I will try your download.

I am currently back-testing and dummy forward-trading Renko bricks in combination with Ichimoku and it is producing some very good results.

bijan

It looks promising, thanks Dale for this wonderful article and looking forward to the others. Cheers

Alex McCullie

Thanks, Dale. I find Heiken Ashi and, even, Ichimoku, both fascinating and mysterious offerings with potential market insights. I’ll add your article to my collection of forex refernces. Good contribution!

Lord

Hi Dale,

Many thanks for the great work you’ve done.

The stoff was easy and clear to understand.

Well done. Get going.

Lord

.—-.

Karl

Brilliant. Thanks.

osama

A helpful article. cheers Dale.