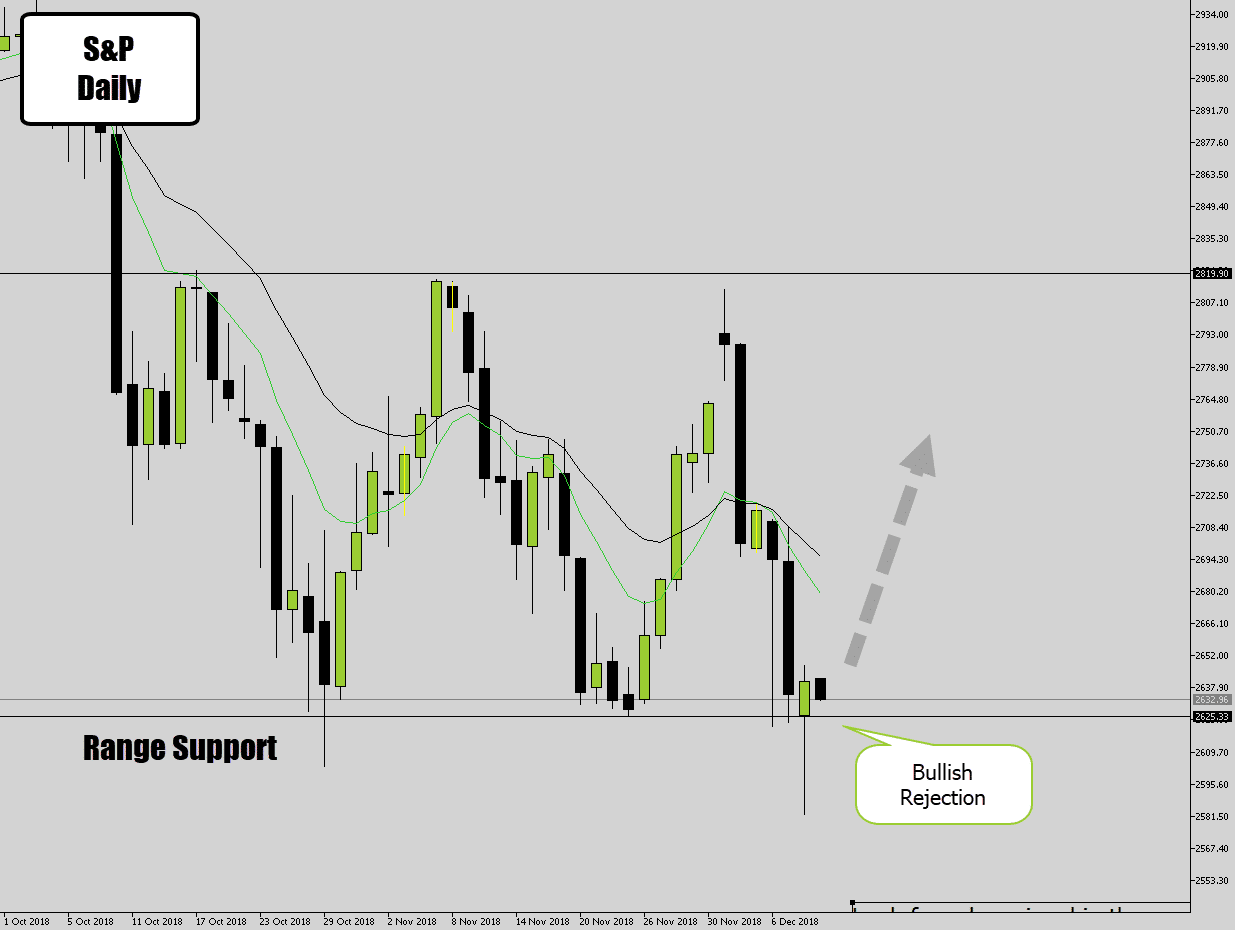

The S&P is printing a class range signal. This market fell into a range after dropping from a big rally.

Now we have the range structure, it’s just buy on bottom, sell on top… and what better evidence do you need than a price action signal.

Last session the S&P printed a large bullish rejection candle off the range bottom.

This is strong evidence that price wants to cycle through another range.

Generally the S&P gets fired up in the US session, so we will see then if this signal is likely to work out or not.

A retracement entry on the signal would be nice here to tighten up the stop loss needed, as it is a large ranged candle.

The long extended lower wick that pokes though the range bottom is a sign of a fake out to the downside… another sign of strength.

Good luck on the charts guys.

Patrick

Good example that the best possible setup can fail.

Patrick

Hi Dale. Is this trial version compatible with Mac versions on MT4/5 too?

Replying to: Patrick

Dale WoodsAuthor

You need to run it in a windows emulator like parallels & win 10. Then it will work.

Sentosa masyhor

I think all trader testing this version