Drawing key levels is a core part of technical analysis.

The problem is the technique can be so confusing to newbies, because marking a them on a chart is very subjective!

It is mainly due to the amount of conflicting information out there, traders get really frustrated with getting the process right.

If you give two traders the same chart, and ask them to each plot a line – you will probably see two very different results.

In this guide, I am going to show you my way of drawing a trend line, and give you a demonstration on how I use them.

Guide Index

- What are trend lines used for?

- How to draw trend lines

- Trend Line Reversal Trade Ideas

- Trend Line Breakout Events

- Channel Structures

- The Price Squeeze

- The Megaphone Pattern

- Flag Breakouts

- Trend Line Indicator

What Are Trend Lines Really Used For in Technical Analysis?

These guys are going to pop up in all your ‘chart analysis 101’ text book material.

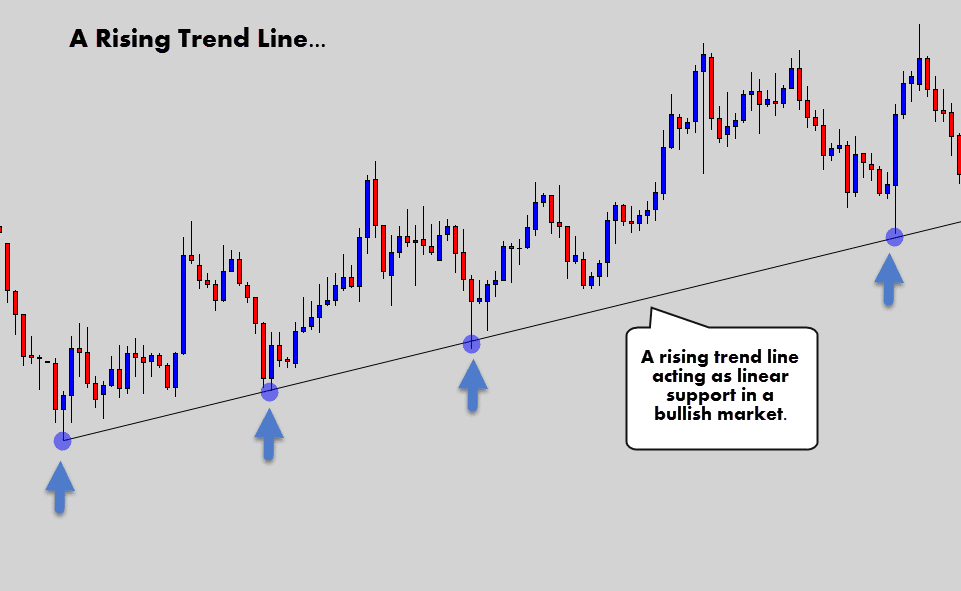

Their basic function is to highlight linear support and resistance.

Quite often when the market is on the move (making new swing highs and lows), price will tend to respect a linear level – which we identity as a trend line.

Bullish markets will tend to create a rising linear support level…

Notice how all the counter trend movements are terminating at this structure?

When they appear, we can use these lines to anticipate the next reversal point in the market, and look for bullish reversal signals there.

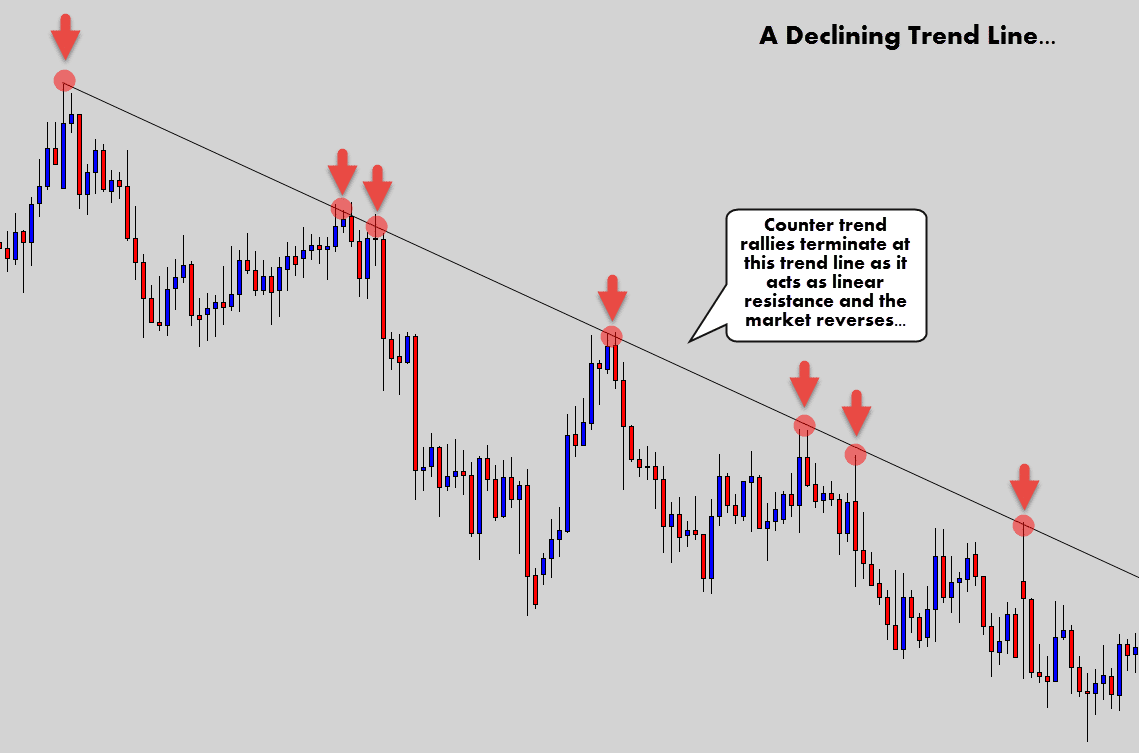

The opposite is true for a bearish scenario…

So obviously the bearish situation is just a role reversal .

Counter trend rallies terminate at clear line as it they as a linear resistance level. We can use it as an anticipate reversal point.

Therefore this common type of technical analysis involves inperpreting these lines as linear support and resistance.

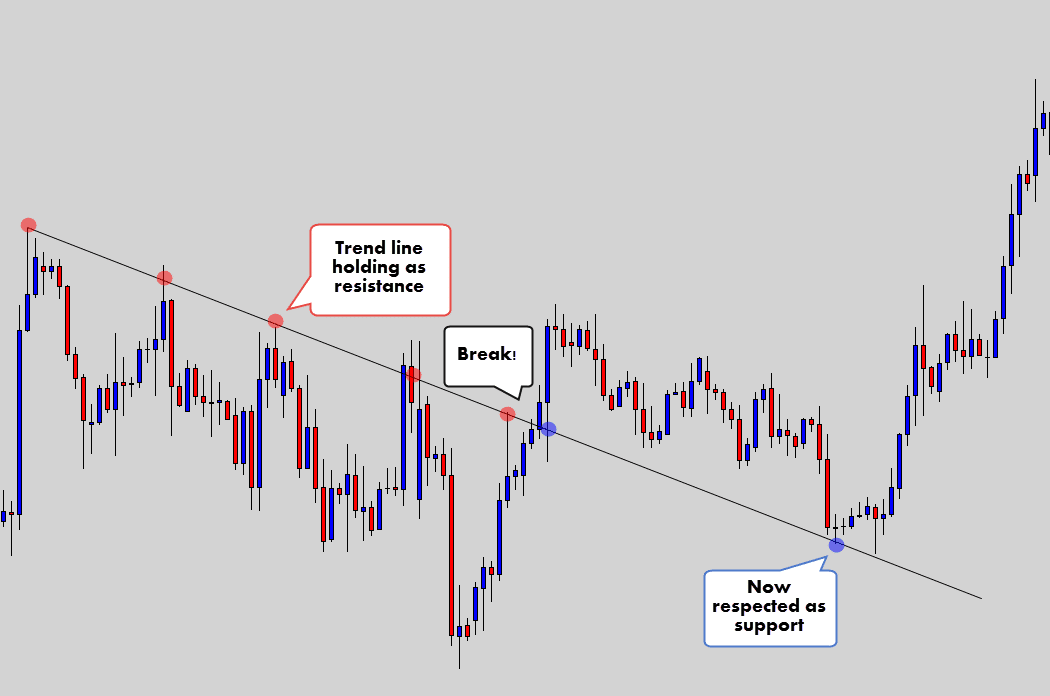

When a line is broken, the market often can come back and re-test it as a new support or resistance level.

Above: An example of one which once held as resistance is then respected as new support as the market pulls back down, and re-tests it.

What I’ve shown so far is the basic functions, but we can do a lot more with them. In the rest of the article, we will walk you through other trend line events such as…

- Counter-trend breaks (flags)

- Classic breakouts

- Example of reversal signals at linear structures

- Consolidation structures created (good and bad)

Checkpoint

How Do You Draw Trend Lines – The RIGHT Way?

Firstly, we need to cover a consistent rule-set to encourage (what I believe), is the correct way of identifying quality levels.

Most of the re hashed tutorials out there just instruct you to mark two swing highs or lows together… only two.

This is really crude advice, and can leave you the trader very confused to where to draw the damn line. Tips such as these set traders on the path to extreme over analysis.

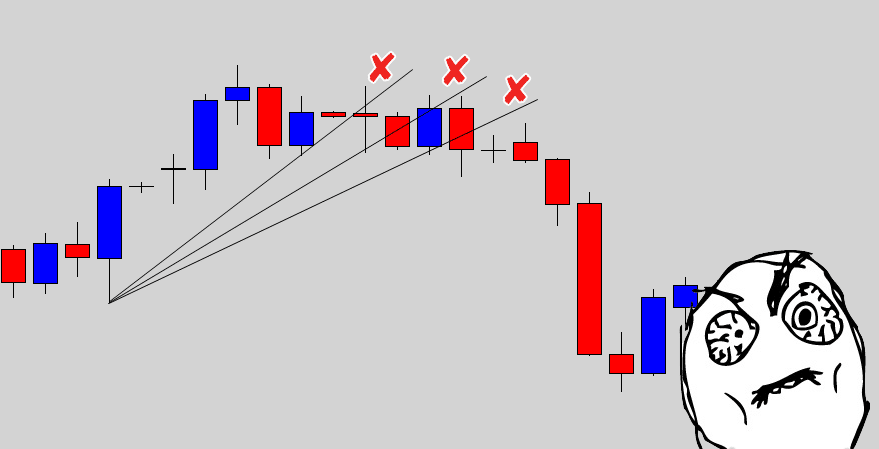

Following the commonly preached text bool method (of only using two anchor points), opens up the door for hundreds of possibilities on one chart!

You don’t want that, you need better quality control… other wise you may end up with charts like this…

I know this is an extreme, and humorous example – but I think this guy has connected every two swing highs and lows together…

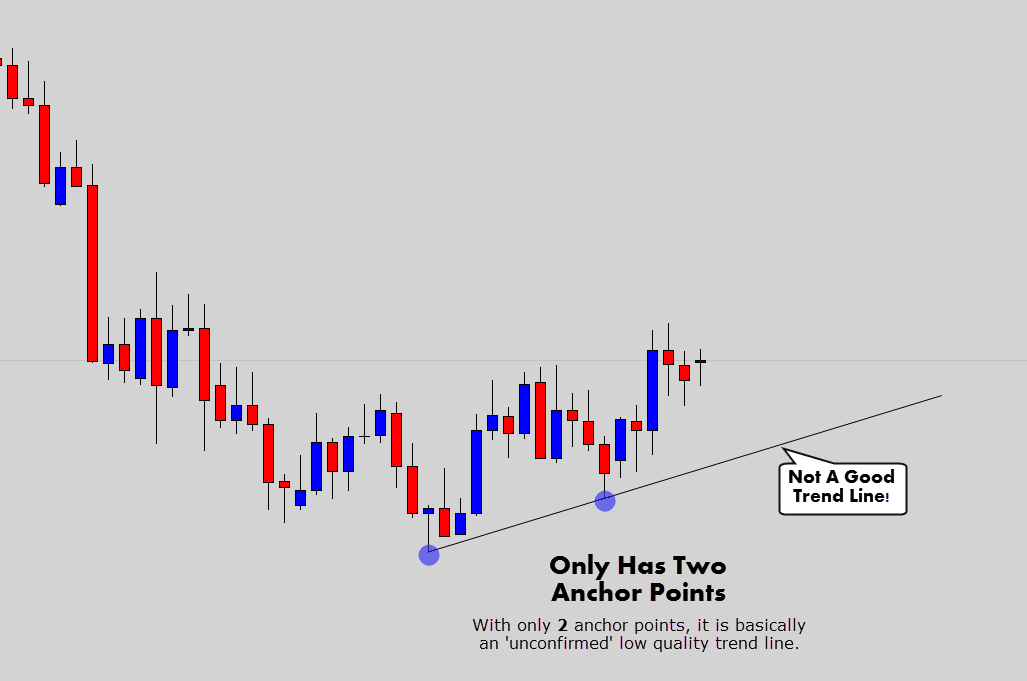

A line with only two anchor points really just an ‘unconfirmed’ level on your charts.

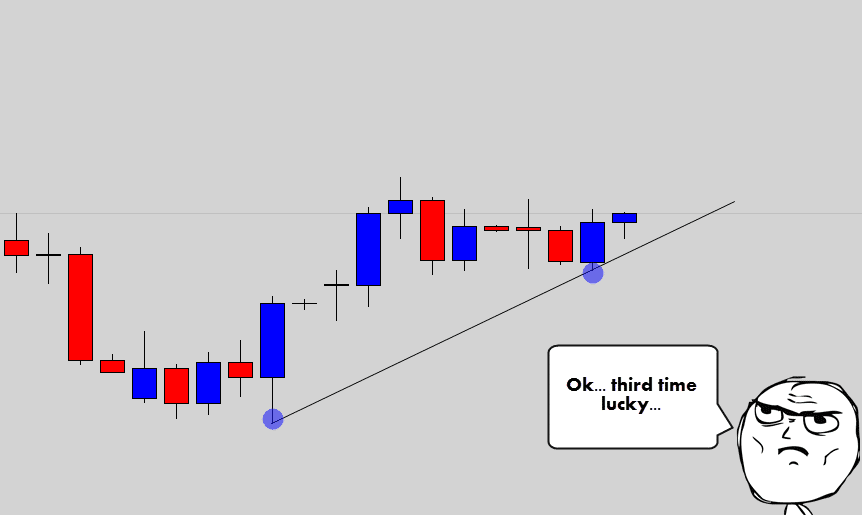

The example above shows a trend line marked with two swing lows as the anchor points. It is an aggressive, low quality way to go about it.

It is only really a catalyst which may turn into proper level – but at this stage it is just a pending line.

You can mark these pending lines if you think it is appropriate, and wait to see the line is respected again – but most of the time it is just going to clutter your charts, and skew your technical analysis.

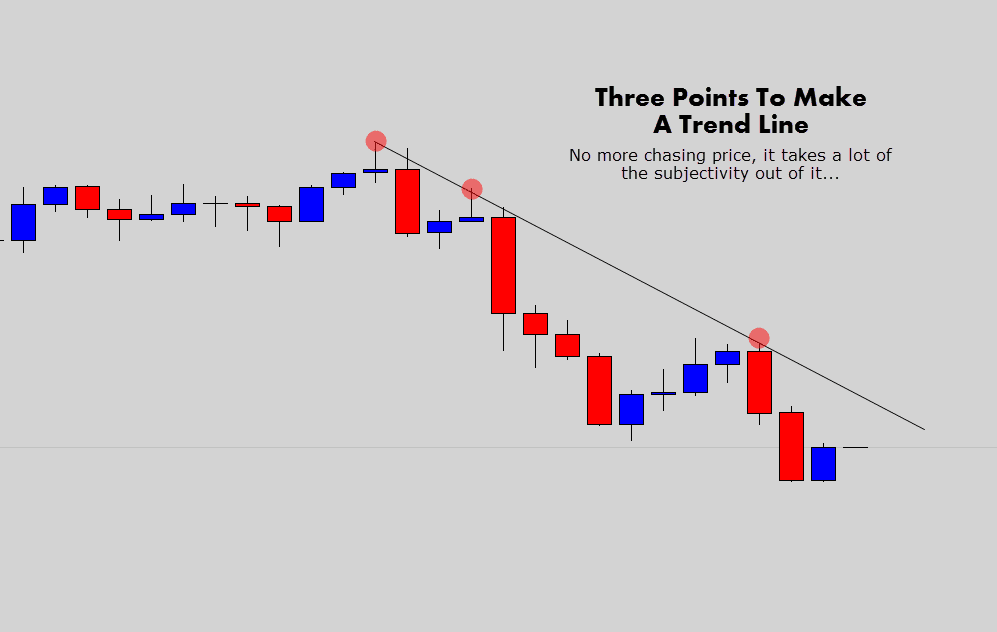

The ‘trick’ to drawing quality lines is to use *3* clear anchor points… then you’ve got something worth occupying the real estate of your chart!

When I say anchor points, I mean swing lows or highs that line up in an obvious linear fashion.

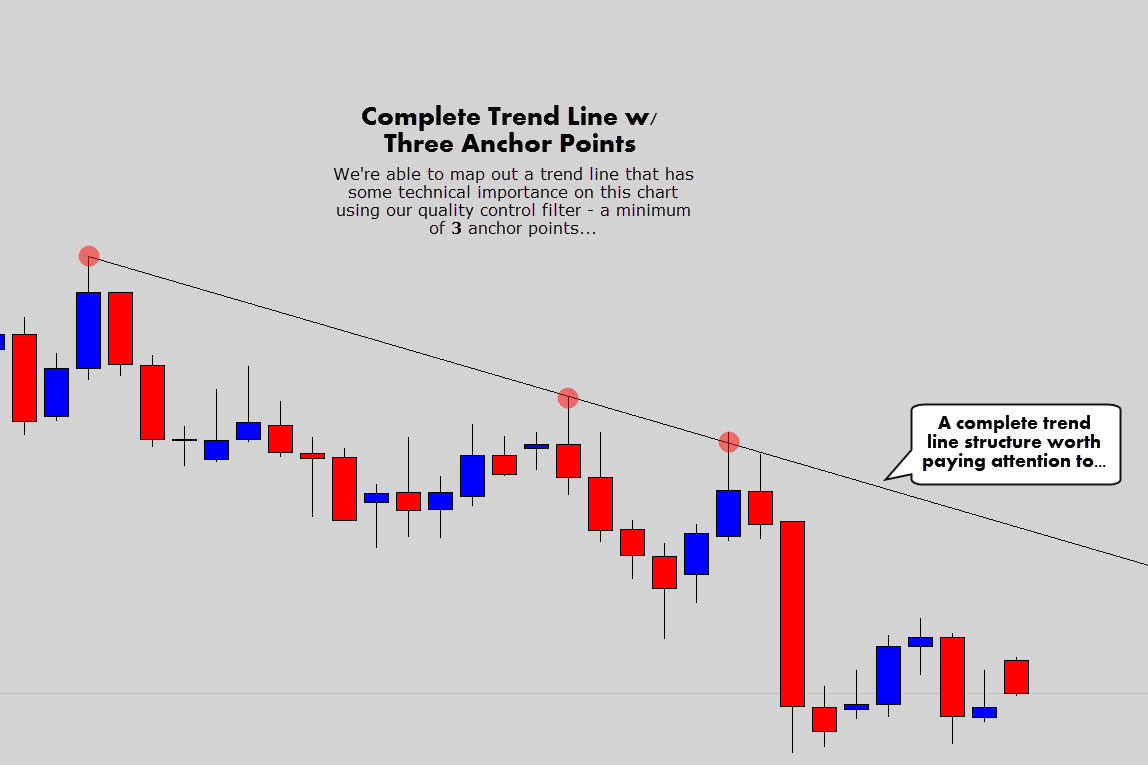

See in the chart above, we used 3 swing points.

Using a minimum of 3 anchor points, we build a quality trend line that actually matters to technical analysis.

When you just use two anchor points, your level is basically ‘unclear’, or only partially constructed. You never know if you have it marked in the correct place.

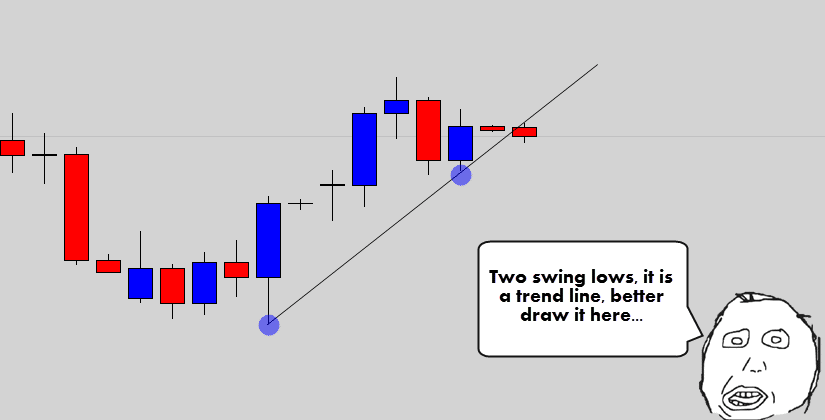

The series of charts below will illustrate the frustration of someone who only uses 2 anchor points…

Seems legit, until…

All of a sudden the market doesn’t respond as expect… better ‘adjust it’, yeah?

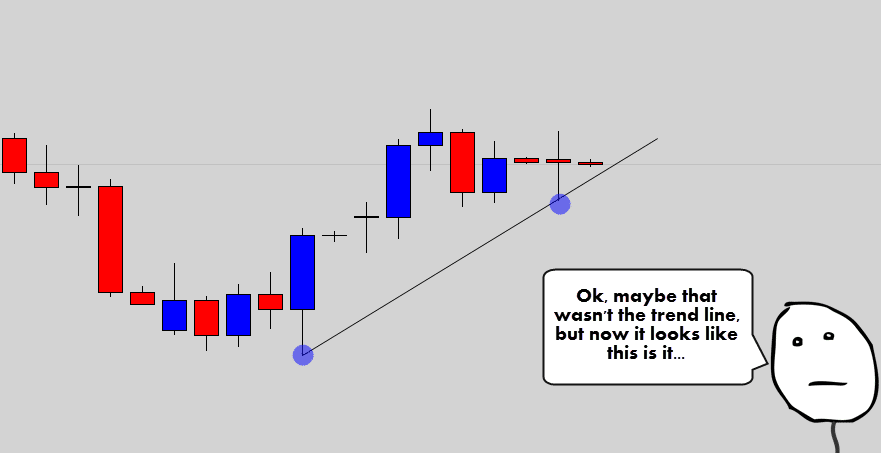

OK, now I think I’ve got it…

The comic shows the trader ‘chasing the line’. Which is frustrating and unproductive analysis.

Don’t waste your energy… use 3 anchor points. It’s much easier, and provides a confirmed trend line in the market.

Don’t chase price, mark what you can clearly see!

Above: Using 3 swing highs rule. No more chasing our tail, three data points line up – we’ve got what we need.

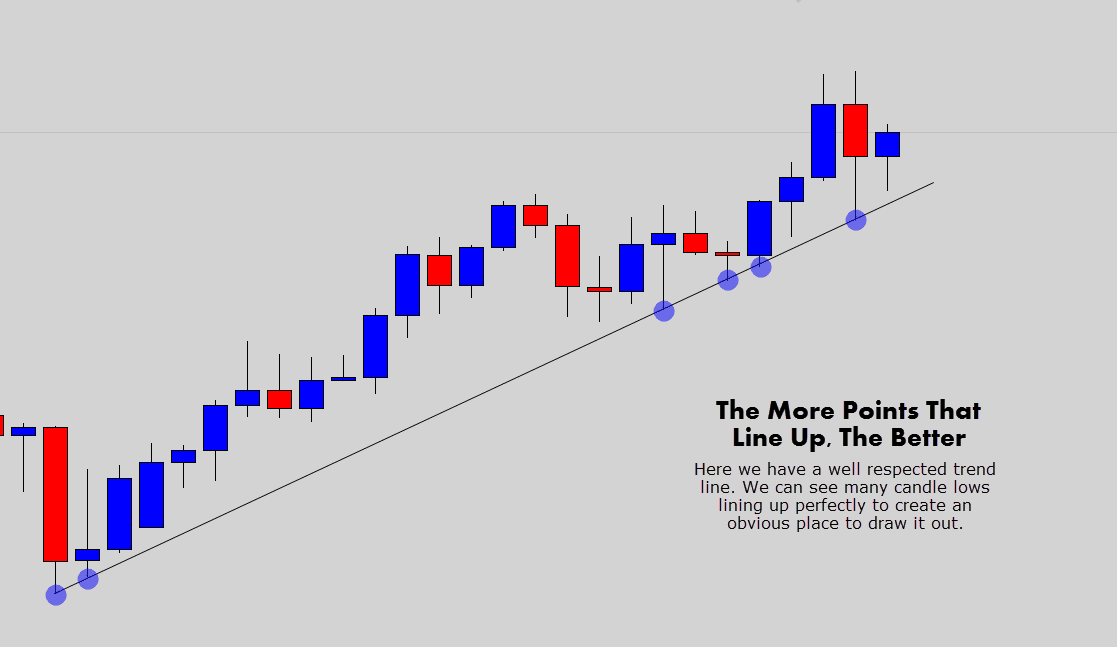

Above: The more anchor points we have to build the line, the better – it just becomes more obvious and makes the trend line more significant!

Checkpoint

Don’t Let Fake Outs Throw You Off

One thing that throws a lot of traders off, are false breakouts.

We won’t always get the perfect text-book scenario for our charting, false breaks do occur often – making a mess of our picture perfect idea of a trend line.

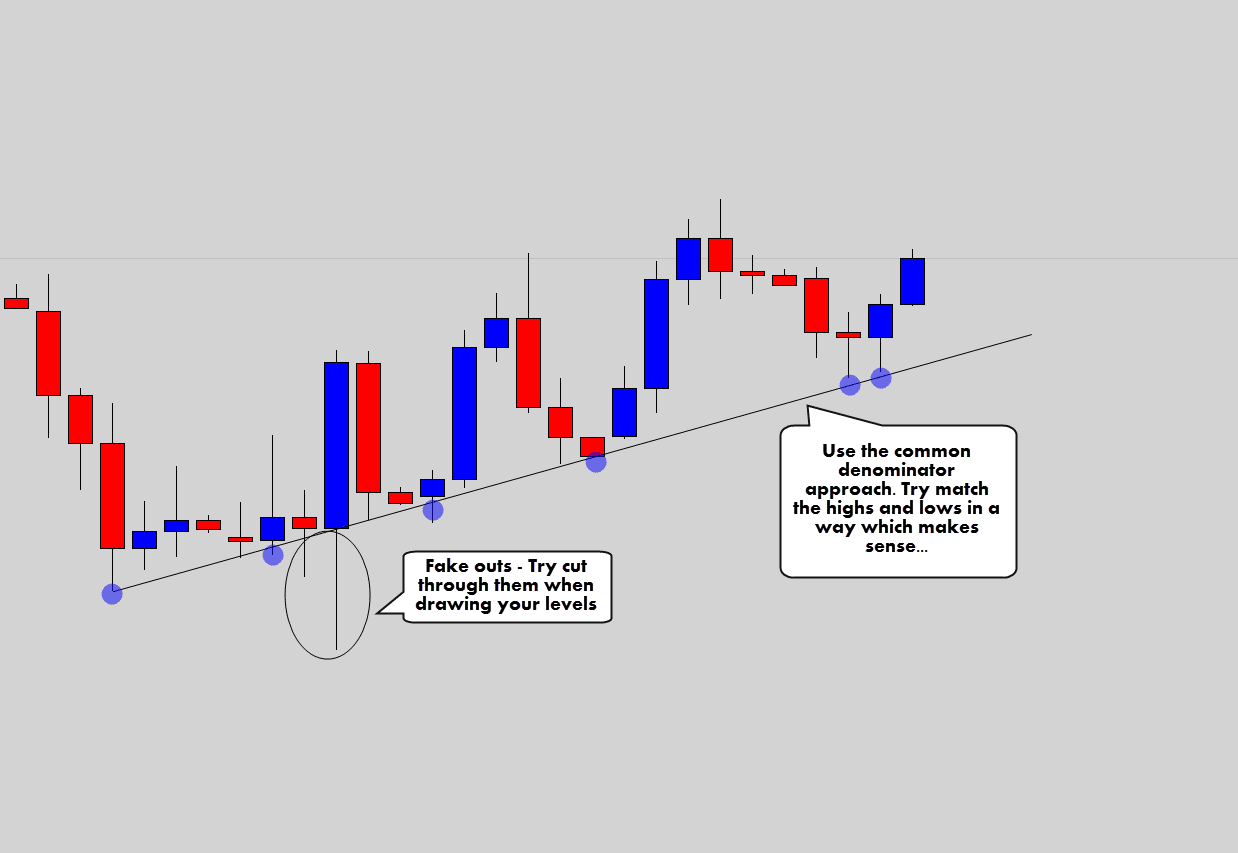

To ‘filter out’ the fake-outs, I use something which I call the common denominator approach.

The goal is to line up the common data points that create some obvious consistency, and just ‘makes sense’. Let me show an example…

Above: We’ve drawn the line that conforms well with the lows here in a consistent manner. We cut through the fake outs by basically ‘connecting the common dots’.

We can see how the level holds as support here well – the fake out creates an inconvenience we need just to slice straight through.

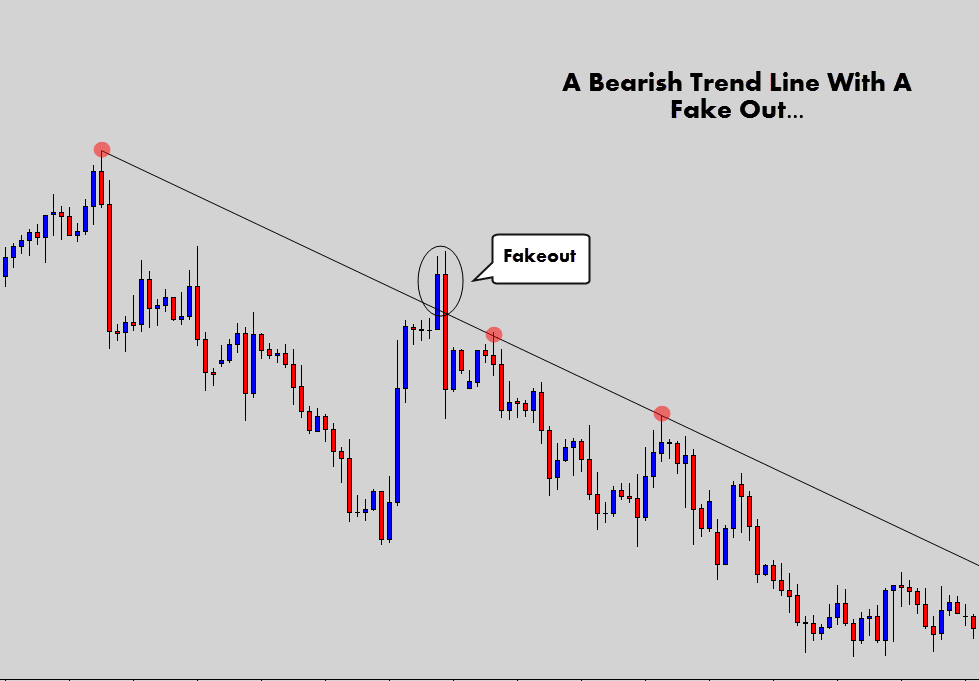

Let’s look at a bearish example…

Lining up the common swing highs here for identification. The fake out becomes obvious when you work with the consistency of the market.

Marking these out isn’t an exact science, you’re just looking to mark out the general structure so you know when price approaches this important technical level.

Keep the process simple and obvious. If it isn’t obvious and you really struggle to line up the level – then it is probably not a structure level worth worrying about.

Checkpoint

Trend Line Reversal Trade Opportunities

Because we know they are anticipated to act as reversal points, we can target reversal trading signals here.

We use candlestick reversal patterns a lot for our trade setups, so we heavily focus on those.

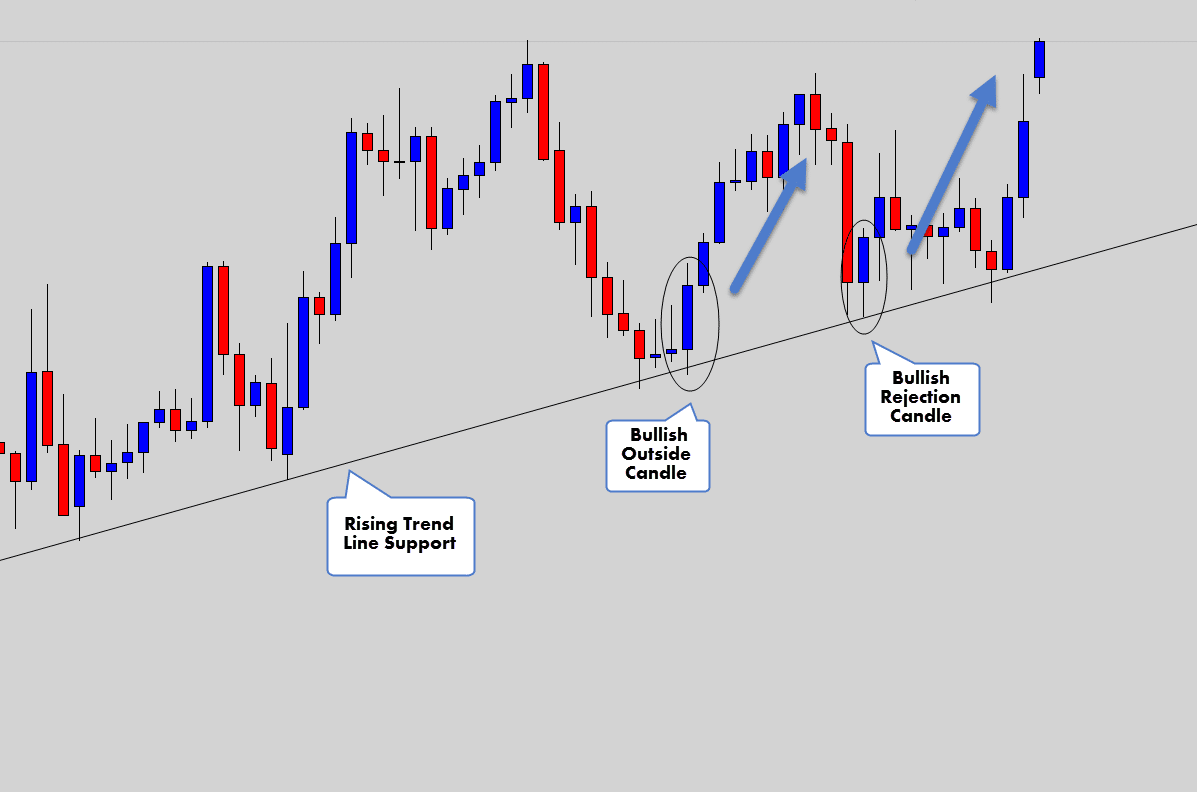

Here is a bullish market example with some candlestick reversal signals…

We had a clear obvious structure here, which was holding nicely as a linear support.

It is only logical to target it for buying opportunities via bullish reversal patterns.

This chart had a bullish outside candle, and a bullish rejection candle (both reversal signals), form off off the level, communicating to us that the the trend line once again was holding as support.

Both trade setups worked out nicely

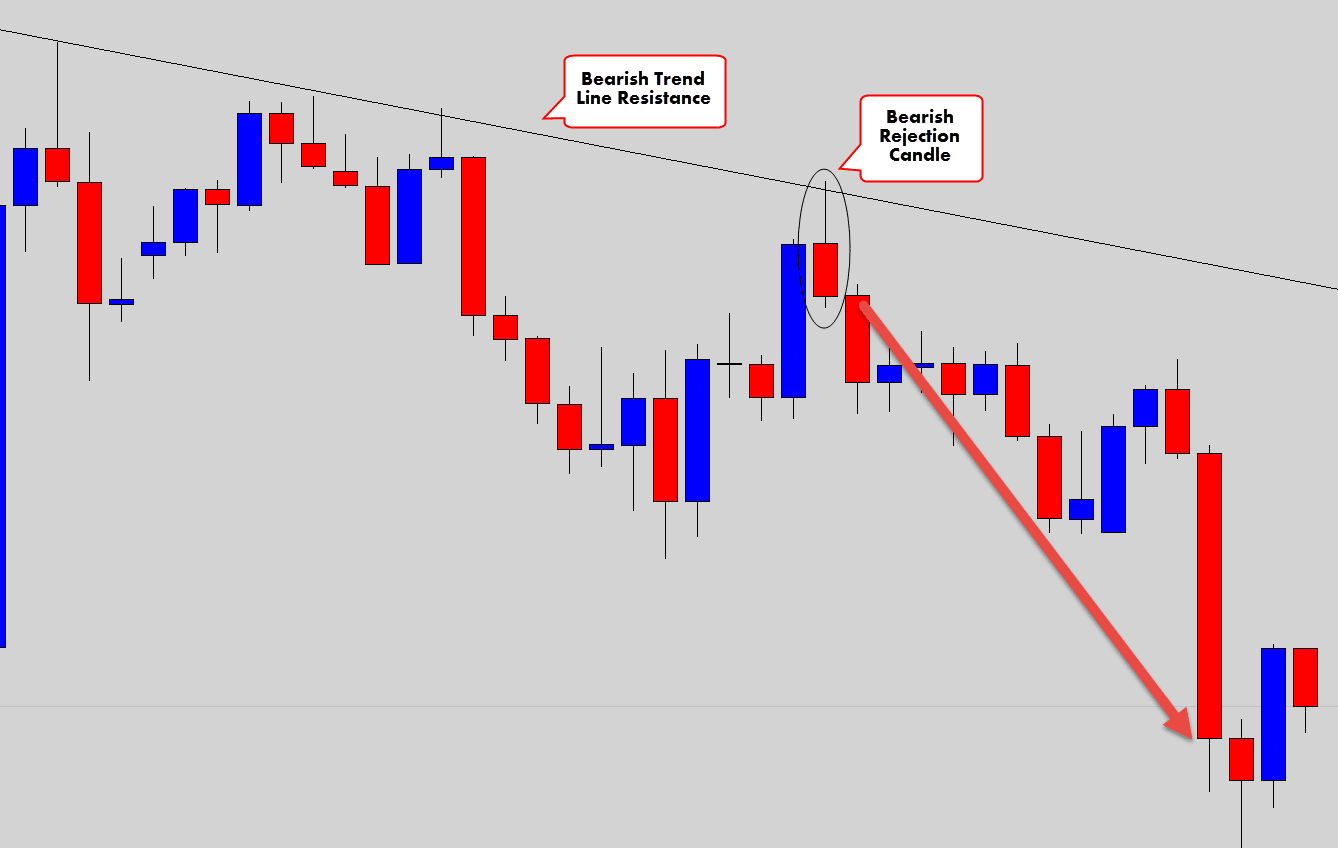

Check out the chart below…

Above is a nice bearish example, acting as resistance which did see a nice bearish reversal candlestick signal form off it.

The bearish rejection candle signals it was still being respected as resistance, and that we should expect lower prices to follow.

The setup produced a nice sell off!

It is just really simple, logical thinking – just the way I like my trade ideas.

You’ve got a linear line structure where you know price is expected to reverse. Simply combine that with a reversal signal to form your trade opportunity.

Checkpoint

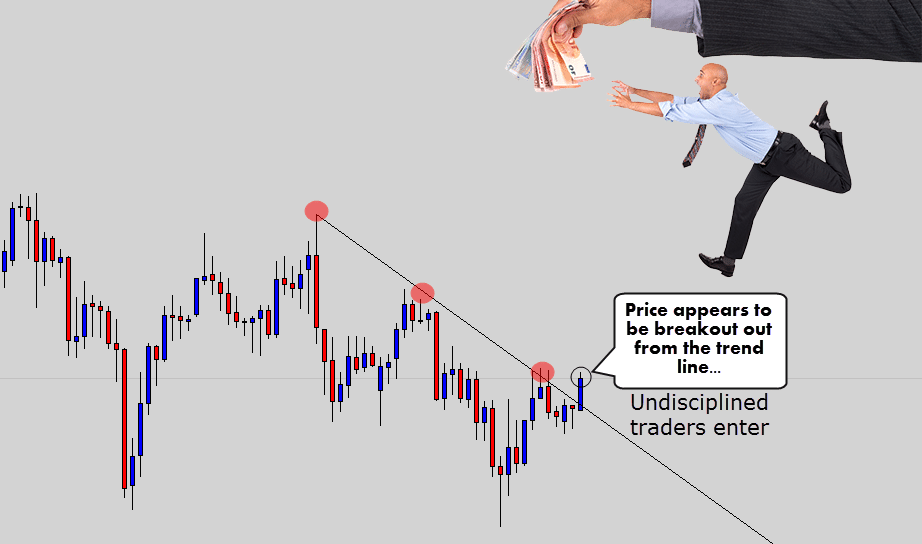

Trend Line Breakouts!

We know so far these are key market structures with strong supportive and resistive properties. Whenever some form of market structure is broken, a violent breakout can occur.

A common strategy is to catch breakouts in trend line trading.

There are many ways to do this, but I prefer the ‘close confirmation’ method.

I recommend you wait for for a candle to break through, and close on the other side of the line before reading the situation as a breakout.

The reason for this is because price can often pierce through the line, but not close beyond it. These are known classically as ‘fake outs’, and are notorious around important structures.

Many traders get cremated by fake out events, because they are too ‘trigger sensitive’ and slam the buy, or sell button at the first sign of any kind of sign the market is breaking out.

So we can see price breaking through the line here. Many breakout traders would jump on board this, mostly fueled by greed to try catch the breakout early… but this can come at an expensive cost.

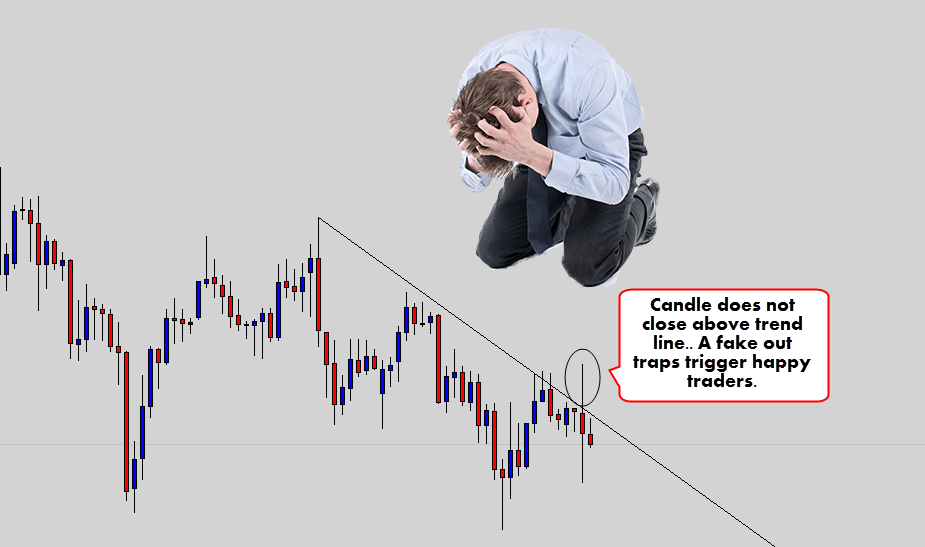

The main point here is the candle hasn’t actually closed yet…

In the chart above – when the candle does finally close, it closes back under – revealing a breakout trap!

Those who were too quick to act have been ushered into a bad position. Now their money has been taken by the market, and flows into the pockets of more disciplined traders.

It is very common for trend lines to be temporarily broken by price, even by just a few pips – only to turn around in the opposite direction.

That’s why trading an ‘in the moment’ breakout is a risky strategy.

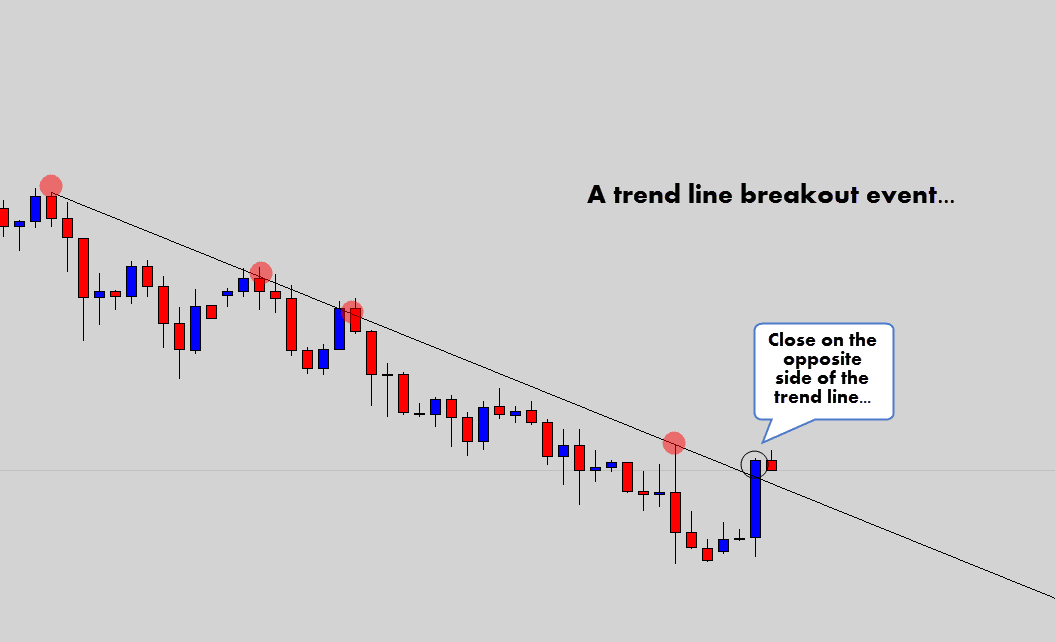

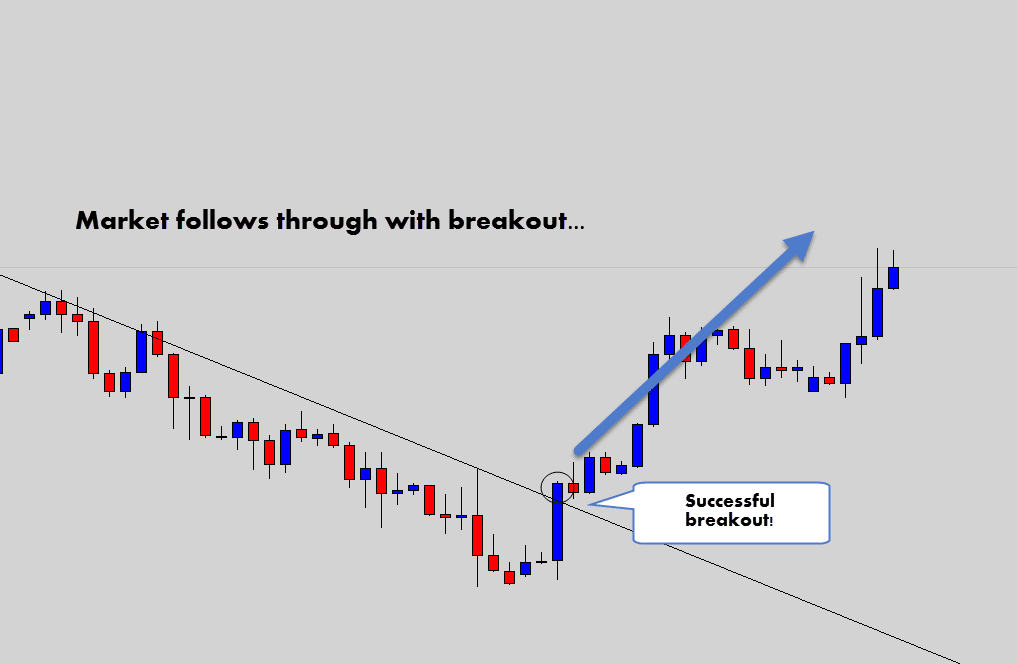

When you focus on the candle close, your chances improve of catching a true breakout.

We can see if the pic above, the candle actually closed above the level, indicating a breakout is underway…

The market actually followed through with the breakout move!

This is a good example of waiting for the candle closes gives a much better read on the situation. Trading candles ‘on the fly’ is simply a dangerous game.

Checkpoint

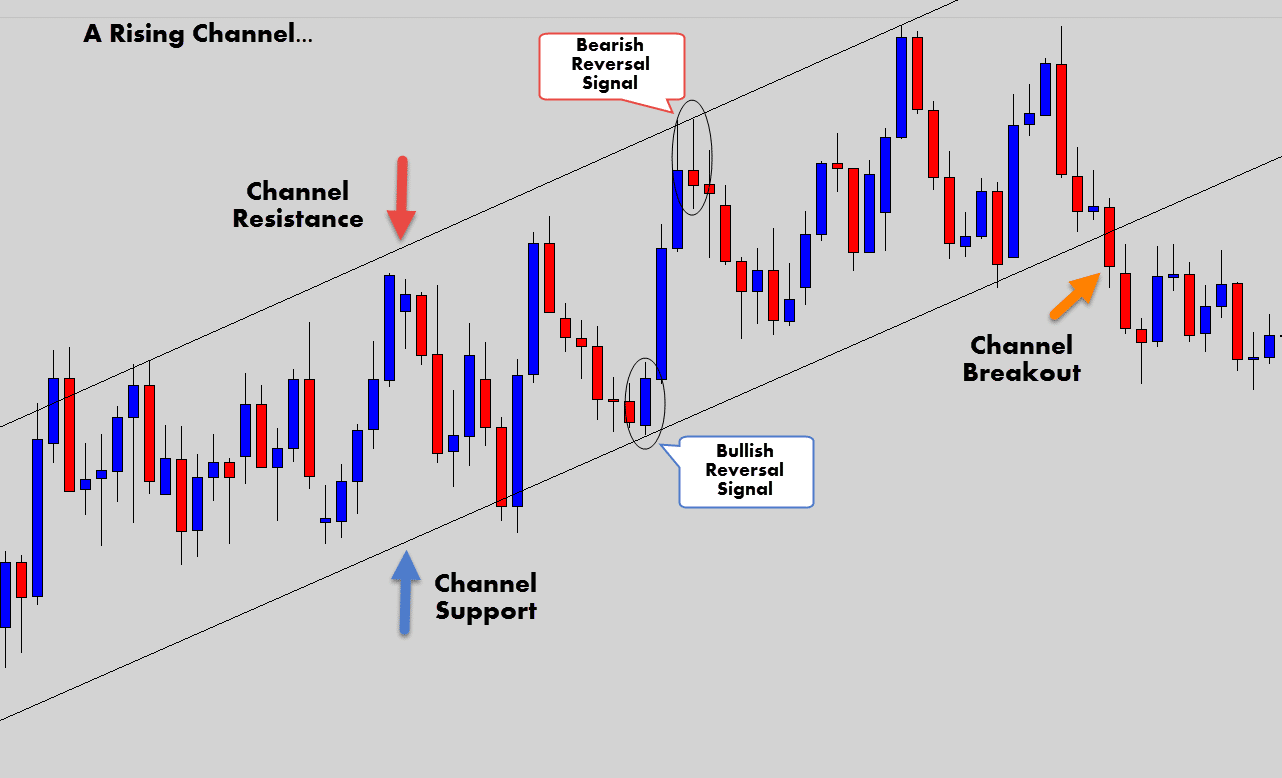

Channels

Channels are best described as two linear levels that run in parallel to one another.

They look like and sometime are referred to as ‘railway tracks’.

You can get rising, and falling channels.

A rising channel is made from linear higher highs, and higher lows.

The two lines running in parallel create the support, and resistance of the channel structure. Like a ranging market, price bounces between these two lines and reversal signals can be picked off here.

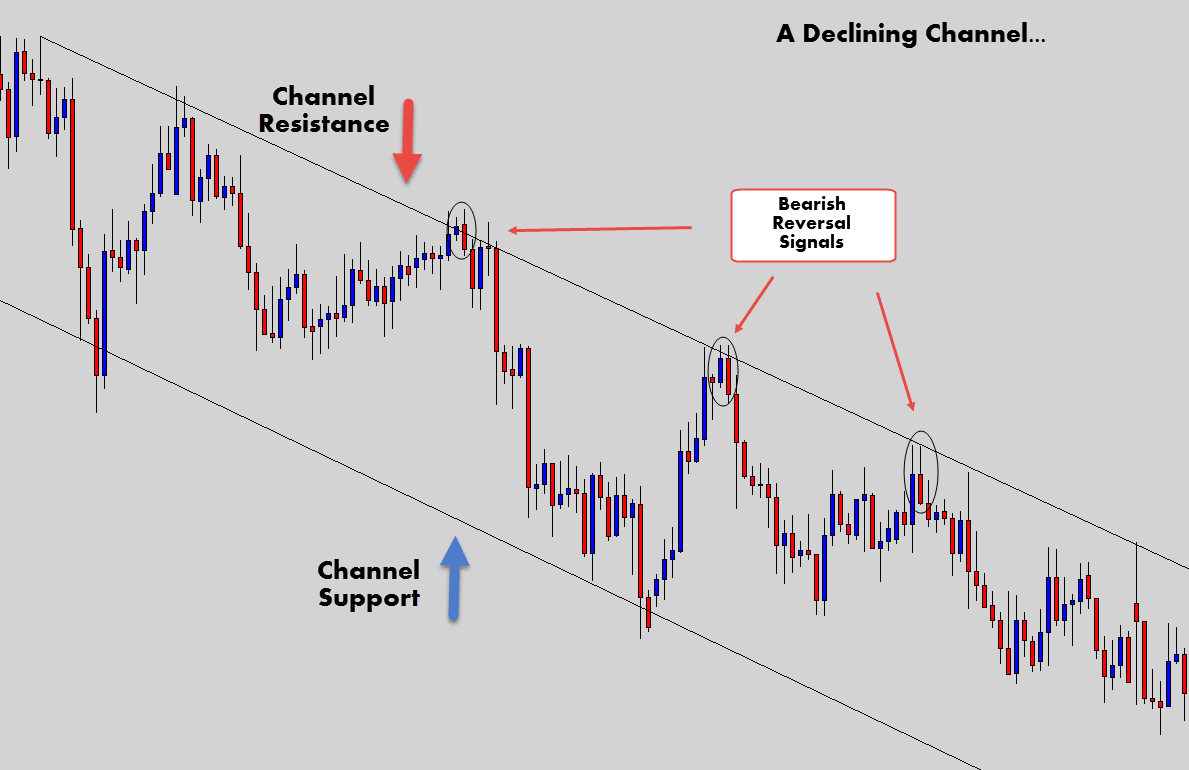

The downward channel is made from two parallel descending lines, which line up lower highs and lower lows.

Reversal signals can be targeted at the channel boundaries. We can see in the pick above that there were some reversal signals at the channel resistance.

They signaled continuation of the channel and were good trade opportunities.

Checkpoint

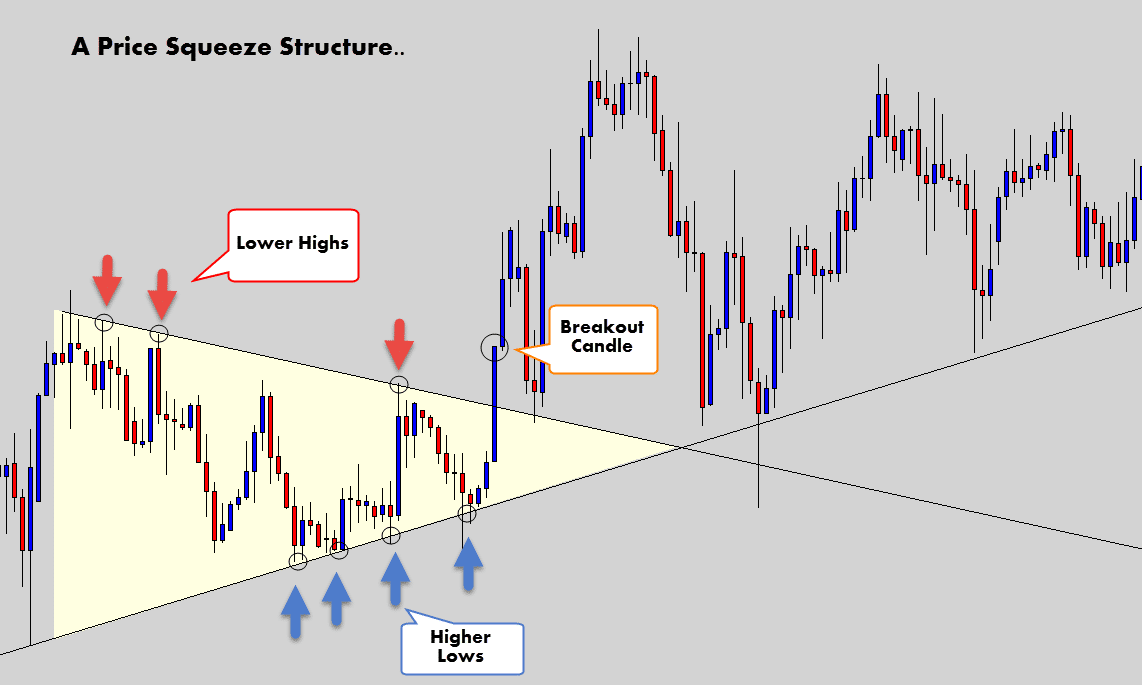

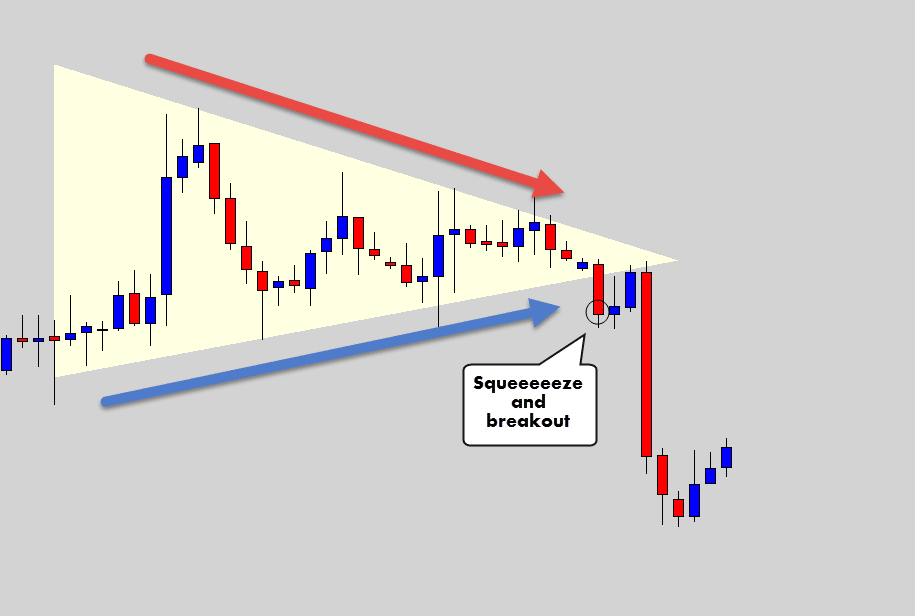

Price Squeeze Consolidation Structures

Linear levels can be used to highlight a consolidation pattern that I call a price squeeze.

It is a scenario where you get lower highs, and higher lows converge in on one another… creating a ‘squeeze’ scenario.

Notice how the higher lows and lower highs created two linear support and resistance levels that converge in on one another.

This ‘compression’ of price is a strong catalyst for a breakout. Generally when the market breaks, and closes outside the squeeze pattern – you get very strong moves.

The above shows the bullish and bearish pressure tightening price into a squeeze, then forcing a breakout.

These patterns can breakout upwards, or downwards, so be prepared!

Checkpoint

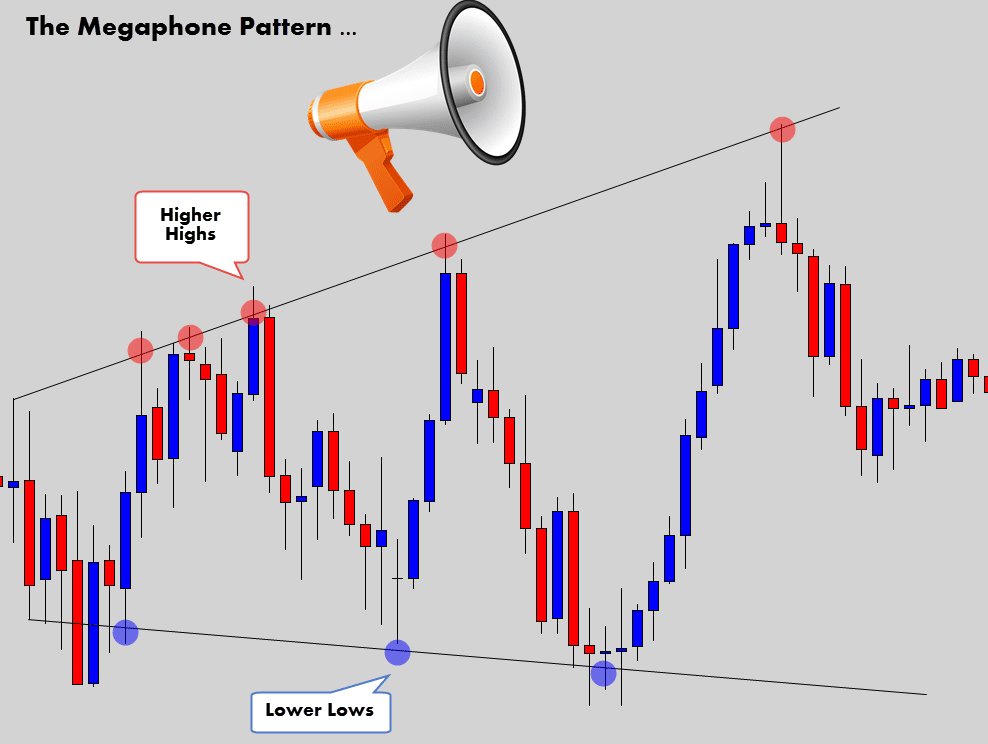

Watch Out for the Megaphone Pattern!

This pattern is the opposite of a squeeze pattern.

The megaphone is an expansion pattern which can be identified by two diverging lines.

Stock traders know this pattern as the ‘broadening top’, and it shows that the market is increasing in volatility – in an unstable kind of way.

Megaphone patterns are usually created by a market phase called distribution – where big traders are dumping their positions, and violent up and down swings occur.

You will see this pattern on your charts when the market creates higher highs AND lower lows.

Notice how the swings keep becoming larger apart as more and more volatility stacks into the market.

Checkpoint

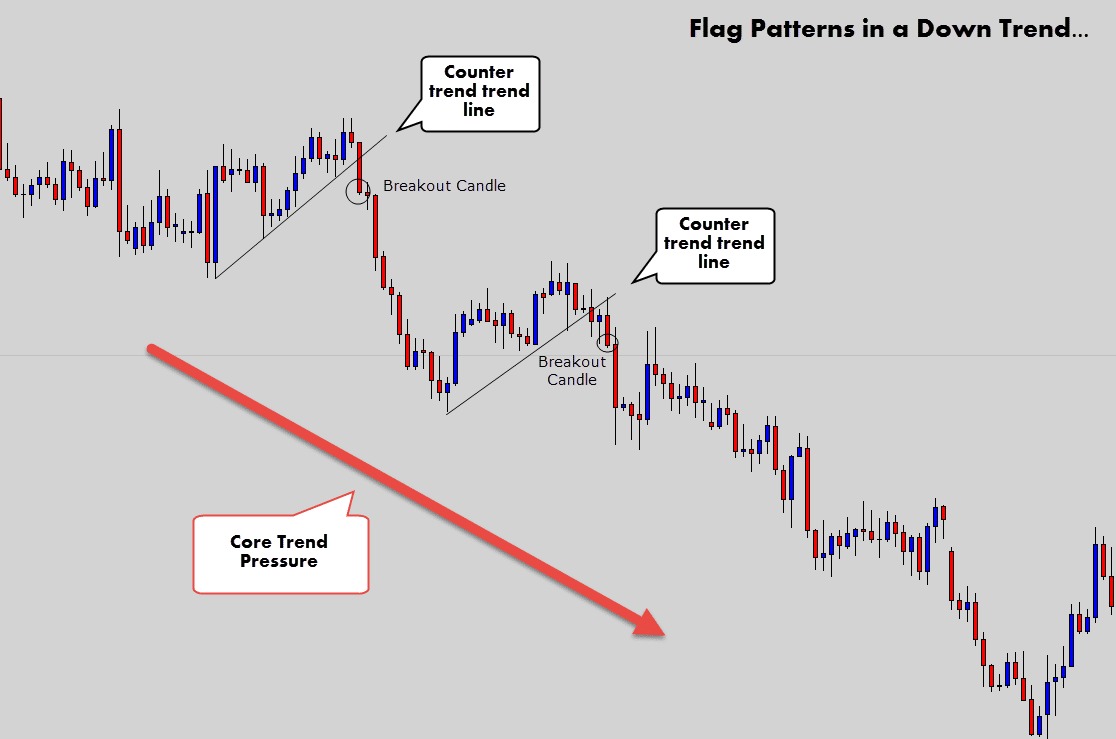

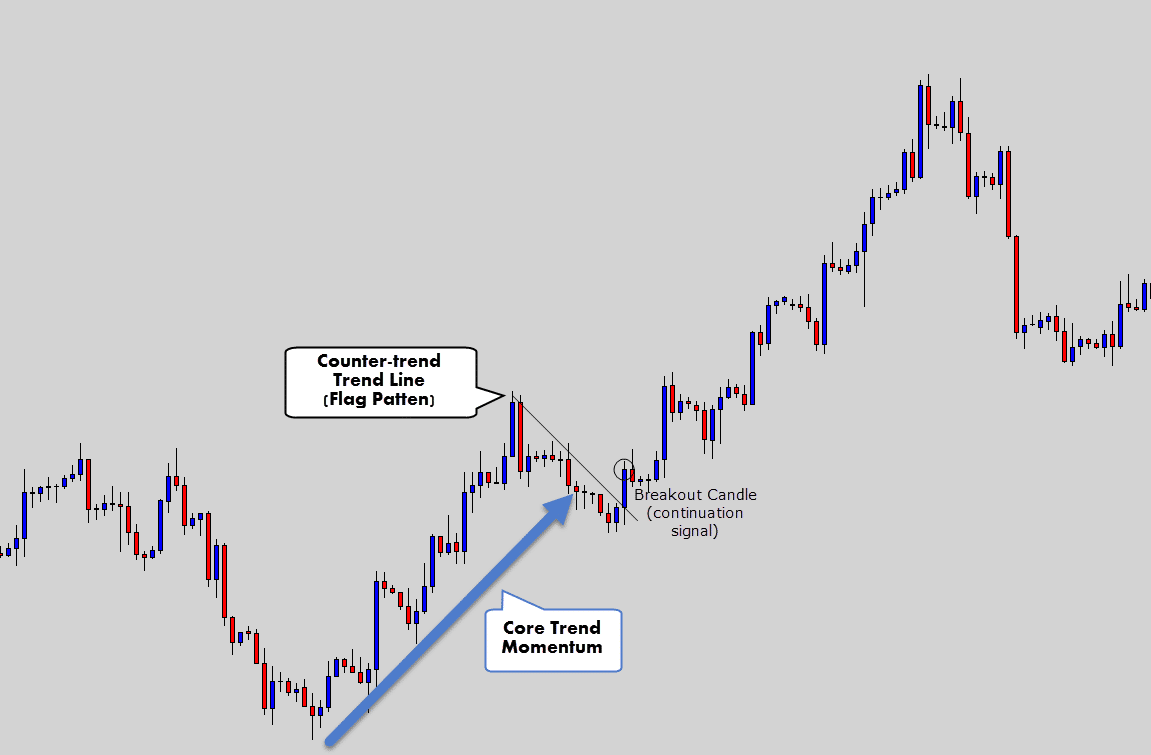

Flag Patterns (Counter Momentum Trend Lines)

The flag pattern is created mainly in a trending environment.

Flags appear when a counter-trend line forms against the prevailing trend momentum. The opposing trend line acts like a dam, holding back the main pressure…

Above: See how the counter trend line backs up the trend pressure. It is the flag break you’re looking for here – a good trend continuation signal.

Flags really work the best in a clear trending environment, and show up more regularly on time frames like the h4 – h8 charts.

Above: Demonstrating the ‘dam wall’ effect here on a bullish market. The upward momentum encounters resistance in the form of a counter momentum line. Once the dam breaks, boom!

Checkpoint

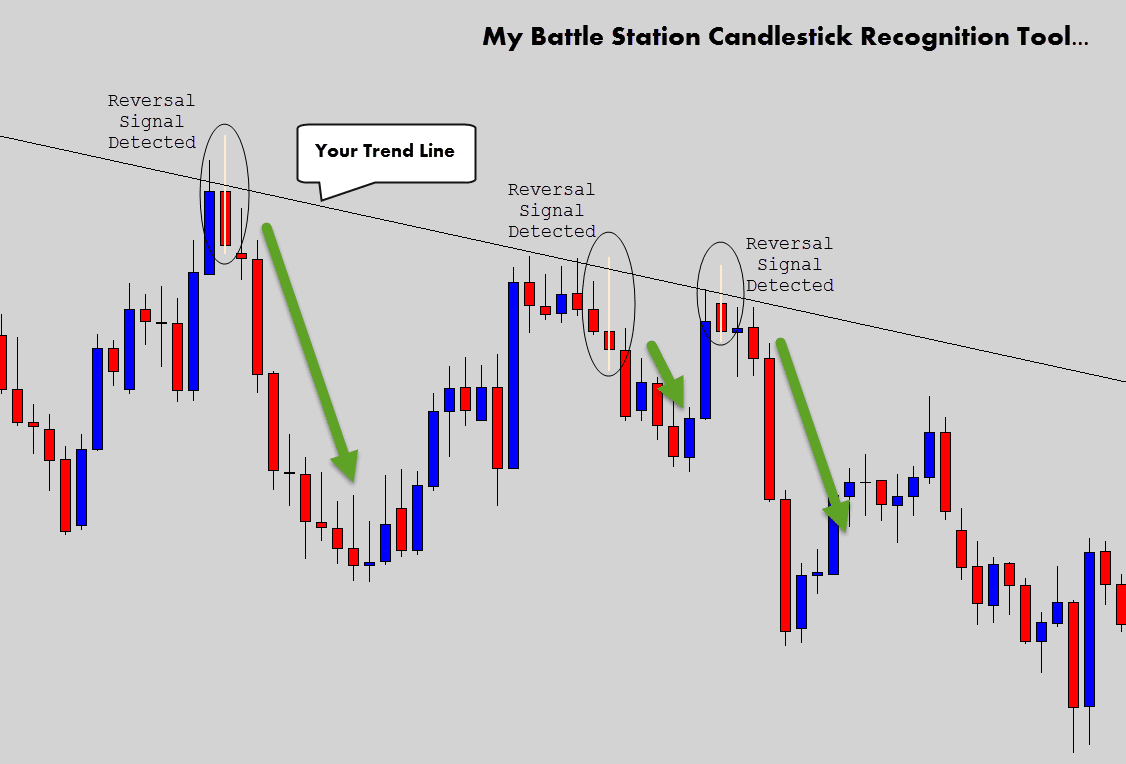

Alerts With My MT4 Battle Station

The battle station is my an MT4 tool I made for those who are into price action trading, especially traders who use candlestick patterns, or Renko charts.

I have a ‘trend line’ filter added into the program that will basically alert you to any reversal patterns that form off any levels that you’ve drawn on your chart.

This can be useful if you’re waiting specially for a signal to form off technical points you’ve drawn on your chart…

Above: I set the battle station to only be concern with reversal patterns it detects off levels I’ve drawn on the chart. Notice how it has highlights some reversal patterns at the levels by drawing the tan line through them (colors can be customized)

The battle station can be extra useful here as it will also alert you when it finds these patterns off your t- line.

The alerts come in 3 different ways so you don’t miss a trade:

- Smart Phone Notification

- Email Alerts

- Metatrader Internal Program Pop-up Alerts

More information on the Battle Station: trend line alerts.

Checkpoint

Take Home Points From This Lesson

- Trend line analysis can be very subjective – don’t fall into the over analysis trap

- They act as linear support and resistance levels in the market

- Use the 3 anchor points strategy to make sure you only draw quality lines

- Use the common denominator method to ‘cut through’ fake outs when drawing trend lines

- Price Action traders can target reversal candlestick patterns at well defined lines

- Watch for when a candle closes beyond a clear line for breakout trade opportunities

- Lines that run in parallel to each other create channel structures

- Converging lines create price squeeze patterns – a potent breakout catalyst

- Diverging lines create a high volatility pattern called the megaphone!

- Trend lines that form against trend momentum can create the flag pattern (dam wall effect)

- Watch for candles to close beyond the flag pattern as a trend continuation signal

Hopefully you’ve enjoy this tutorial!

In the comments below, please let me know what you thought, or if you would like me to expand on any of the topics discussed here.

If you would like to learn more about trading with trend lines using candlestick reversal, and candlestick breakout patterns – check out the war room for price action traders.

I wish you all the best on the charts!

Don’t forget to leave your comment 🙂

Msizi Gcabashe

Great article, its the way I have always drawn trendlines and wait for the candle close (but greed can get the better or you sometimes). Cannot believe I share the same methods with greats like you.

Replying to: Msizi Gcabashe

Dale WoodsAuthor

Great minds think alike. 😀

Justine Chongo

It’s a great article I have on internet

Cheers 🥂

arkanintermedia

Hai FX Guy, thank u for sharing this article with us, this realy heplfull

Swervie

Good brother, Thank you so much, today I make hundreds of dollars per week, because of everything you taught us on the articles and videos, you turned me into a big time successful trader. And I’m here right now just to review

Kermit Ballon

You should take part in a competition for one of the most interesting blog sites on the web. I would back your blog!. I ‘m interested in your posts, and have bookmarked the website so that I can check back for future updates. If you have a second check out my web site. It’s a work in progress, but i foresee that someday it will have nearly as good of subject matter as yours kelly kosky

https://www.kellykoskyisafraud.com

Chiazam Iheme

Good day , do you feel it is better to take a trade on a breakout or the retest ?

White Saint

Very fantastic article. . . . . I will plead you add how to set TAKE PROFIT and STOP LOSS levels when trading with trendlines.

Keep your good work up

Rohit

Very good article sir !

when I complete it and made chart according to this it is so easy to prepare chart and also a very effective Thanks

Le Thanh Tung

The trend line should be at the top (bottom) of the candle or cut through the body

Replying to: Le Thanh Tung

Dale WoodsAuthor

Where did you draw that conclusion from?

Azwii

Newbie trader

Tarique

Very nice ,useful to me, thanks a lot

suresh thapa

thank you so much for sharing this valuable material.I have been following youtube for longtime.I am soon planning to join your course.i have been practicing price action for 1.5 years mostly on demo but i am studying charts and books everyday.I am just confused what i am missing.

CP

Don’t you find that waiting for 3 points to define a trend you miss out on most of the trade

Replying to: CP

Dale WoodsAuthor

Nope, that’s called “fear of missing out”, you’re just trading low quality trend line structures.

Colin

Ⅾo you mind if I quote a few of your ɑrticles as long as I provide credit and sources back to your wеbpage?

My blog is in the very same niche as yourѕ and my viѕitoгs wօuld truly benefit from

a lot of the information you present herе. Please let me know if this alright with you.

Appгeciate it!

Kenneth

Clear and simple information. The kind that traders loved!

Averil

AWEWSOME!!!! Great information!!

Themo

Awesome article, by far the best i have read in relation to trend lines. Perfect!

Thao

Hi, I’m really new trader. I did use your lesson and it work. But to make money for living from forex still far away.

Can you give me any tips how to read the currency movement

I also trying robot but I don’t really know how it work

Do you believe in them because every times I tried the robot always let me down

Hopefully get some of useful advice from you. Thanks

kelcie

great article

Ramo

I have been struggling to use candlestick patterns. Now I know I should read them against support and resistance. That’s where they make sense. Your explanation on how to draw a proper trend line is invaluable. Thank you.

Ralph Polanco

Finally found someone that knows how best to explain this to newbies, where they can understand it. I appreciate it.

Sharif Mohammad Ashik

Outstanding experience gathers on easily. The number of indicators is huge. Each day new indicators are created and each day someone creates a new way to utilize existing indicators in a new manner. You have to use all indicators with common sense. You have to learn how to use them as they are not magic like Harry Potter’s rod.

burhan akkaya

that was awesome man I will try to learn mor efrom you thanks a lot

TILA

speechless ….. i must say sir …. thanks a great deal

Gman

Informative although I note on one of your “how to draw a TL” slides you have a bullish candle close on the other side of the TL, followed by a bearish candle closing back under the TL and you refer to this as a false breakout. In the breakout section you then advise for people to wait for the close of the candle!

Peter Miller

Thanks Dale, have just got around to reading this, with trend line drawing does it still work better with a 10/20 ems for following up and down moves or does the trend line work differently and separately

Thanks again

Peter

Niks

Hello Dale…..thank you very much for an excellent article. It is very crisp, to the point and covers very basic but mandatory information. All your analysis makes very much sense and goes in line with all your youtube videos…thanks a lot again.

Ong

Hi! Great write up and I hope i can pick up more useful trading skill and knowledge here. Thx Dale!

Rizwan

thank you sir for sharing your knowledge. I read your all articles .sir i need your fibonacci indicator.can you give me download link ?

Munir Shah

You are not just an expert trader. you also have professional teaching expertise.

Thank You Sir.

Respect from Pakistan

biru

thank you sir for your amazing system

konstantin

thanks for the article. professionally writed by you.

Bernard

In just one word: amazing!

I love the way you illustrate your points, something several websites and blogs fail to do. This is the second article I have read on this site and I have found gems of factual and practicable tips on how to trade with confidence, and profitably. Thank you.

james

hi Dale, is there any point drawing trend lines on 1 hour tf? Or do you only focus on 4 hour/ daily? Thanks

Replying to: james

Dale WoodsAuthor

I always try to do my chart analysis on the higher end time frames.

bruno

Good article! Learnt stuff today(dam wall effect). Great tool. U know ur onions!

Replying to: bruno

Micheal

Hey Dale this is awesome ad love that battle station hook me up

krughan

to the trading guy

how can I thank you..

everyone seems to be selling education material. I’m not against that but for eager newbies like myself thats on a shoe string buget that cannot trade successfully cannot afford to take.expensive courses will find your site a blessing .

thank you so much for you time and expertise to create these documents ….. man, your site is gold, well. for me it is.

thank you

BullionTrades

Denis

Hvala Dale!

Tvoja pomoc puno znaci svim pocetnicima!

Hvala ti sto se toliko trudis!

Rondell

So many points. So much great advice. Thank you Dale for going out of your way for us. Thanks to you and this article, I learned that i am am the ‘trigger happy’ type doesn’t wait for things to setup fully before executing the trade. Ultimately I am right, but by the time things go the way I planned, I’ve already been stopped out of my trade three or four candles before. I was on the verge of sinking another demo account when this came through, and now after I read it, I will take my time, show some patience and with for the right time. (Easier said than done,) But It seems I need discipline, more than anything else.

Thanks Dale. See you in the war room soon!

Steve Epperson

Light Bulb Alert! I just realized I was having trouble spotting trendlines and other structures on the daily charts because I was too close. Thanks to your article, I realized I had to zoom out to where it shows about six months worth of candles. DUH! Once I did that I could see everything I needed to. I’m not sure us recovering day traders (as a group) know to do that. May be worth mentioning later. Thanks again for your generous portion of training on trendline development.

Vic Ferdinand

Hi sir. What a fruitful session you’ve got here. By the way, do you perhaps have a pdf version of this lesson? I feel that it is a must for me to review your trendline lesson over and over but sometimes I’m unable to surf the internet. Thank you so much.

Replying to: Vic Ferdinand

Dale WoodsAuthor

Sorry mate, I only have this as a web published lesson.

Carlier

As usual clear , well explained and very helpful. Thank you Dale.

thehypocritecapitalist

thank you for sharing your knowledge! This really helps a lot for newbies like me..

Cho

Amazing and crisp article on Trend line. Keep up the good work. Similarly, if you share your experience on other technical indicators e.g. momentum indicators, volumes it would be helpful.

Rana Adnan

Hey Dale! Been following you for a long time. I appreciate your effort for this helping material. I have a question, is it necessary for a trader to enter a trenline break only when price tests the back of trendline as a role reversal level and create a bullish/bearish candlestick pattern. Usually it is said that if trendline break is confirmed just enter, but in most cases it stops me at breakeven or may be i was aiming a higher targets. Thanks!!

Replying to: Rana Adnan

Dale WoodsAuthor

If the breakout candle doesn’t require too large of a stop, then usually it’s better to just go in with market orders. Retracement entries / re-tests are great, and give you better entry prices, but you’re not always going to get them. Go back through you charts and look at these trend line breaks, usually when the candles closes on the other side of the trend line structure, the market does most of the time follow through.

Valdi

Very informative rehearsal about what works in charting, thanks.

Gideon

Exellent and eyes opener article .Thank you for the Job welldone

vincent foo

yes,great sharing,thank you

cheers

vincent foo

vincent foo

yes,great knowledge,thank you n appreciate. simple and easy to understand.

cheers

vincent foo

Paul

Another string to my bow! Great read and easy to understand the way it’s been explained.

Robert

Hey Dale

Great concise lesson on trend lines and channels.

They can be plotted absolutely everywhere, as nearly all price action can be accommodated in some shape or form, even blow offs can be contained by channels and lines.

I love them.

Great lesson and insights bruv.

And they don’t cost anything to use either.

regards

Robert

John

Hi Dale

I am interested on your forex trend lines with alert . How much is this?

I am concentrating in forex breakouts now in 4hr time frame

Thanks

John

Diamond

Thank You, Dale!

I especially like your manner of training.

These funny pictures are very fun, cheer and teach.

Sinethemba Magwala

That’s a great article. I will be using the tips from it from now. ☺????

Boon Ong

I like how you explained clearly on the trendline, especially the breakout, 3 anchor points and the wait for candles to close first.

Many thanks for the great advise.

Norbert Harisch

Thanks a lot for this very constructive article – and also for your general service. The best, one can find regarding price action trading.

Norbert